It is a comfort offered by the issuing bank to the beneficiary in whose favor the guarantee is issued to cover damages if the principal debtor fails to comply with the agreement's conditions. In general, it is provided when one or both parties require significant business commitment and assurances that the other will fulfill the contract's contractual duties. In any foreign business, it is the most regularly used collateral.

Because the UAE is the most popular destination for overseas investors, bank guarantees are widely used. The Commercial Lawyers in Dubai have discussed the different features of bank guarantees as well as the UAE law that governs them.

Under Article 411 of Federal Law number 18 of 1992 on Commercial Transactions Law, a bank guarantee is defined as "an undertaking issued by the bank to settle the customer's debt to a third party in accordance with the conditions agreed upon and mentioned in the guarantee, which may be any given point in time or unlimited."

Thus in this blog we will cover all the intrinsic details pertaining to the Bank Guarantee in UAE which you should be familiar with. So without any further ado, let’s learn!

Parties to the Bank Guarantee

BENEFICIARY

The natural or legal person (client) who submits a payment request to the bank and gets the payment amount

PRINCIPAL

The person who initiates the bank guarantee (the borrower)

GUARANTOR

A financial organization (bank, insurance company) that agrees to make a payment to the individual named in the agreement as soon as a payment request is received.

Bank guarantees are advantageous not just to business owners, but also to banks. They do not demand immediate monetary coverage, unlike a Loan Furthermore, such payments on guarantees may be postponed for a period of time or become unnecessary altogether. A commission fee is payable mandatorily and in full for the supply of such guarantees.

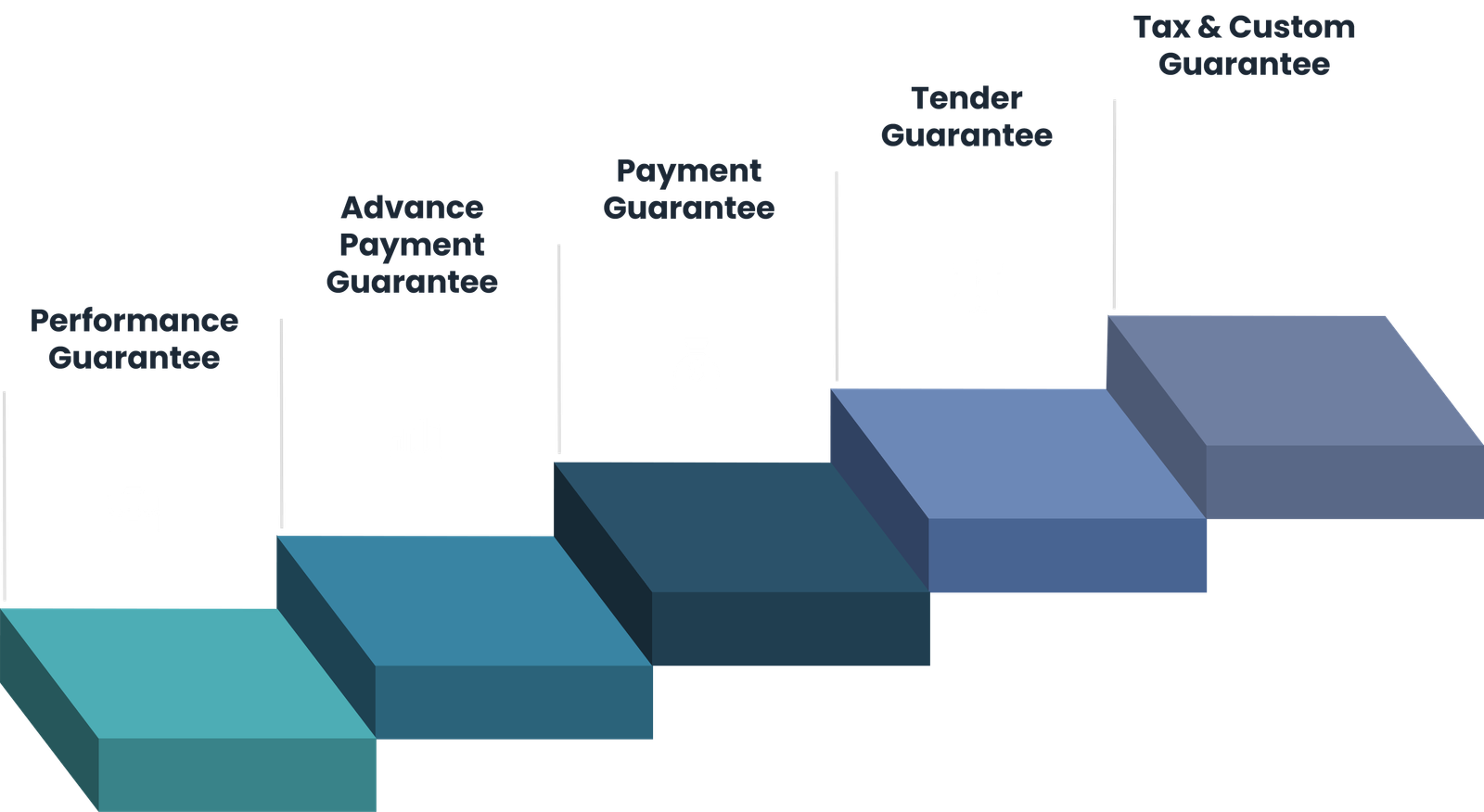

What are the different types of Bank Guarantees available in the UAE?

Depending on the characteristics of a transaction, the following types of bank guarantees are distinguished-

PERFORMANCE GUARANTEE

Serves as a guarantee that all services, jobs, or goods deliveries will be completed completely and on schedule.

ADVANCE PAYMENT GUARANTEE

Ensures that the advance payment is refunded if the transaction's terms are not met in terms of time or volume.

PAYMENT GUARANTEE

Ensures that the delivered items or rendered services are paid on time

TENDER GUARANTEE (TENDER BOND)

Ensures payment requirements are met if a subsequent tenderer refuses to cooperate (cancels an application, fails to sign a contract, etc.)

TAX AND CUSTOMS GUARANTEE

Ensure that commitments to the tax and customs authorities are met.

Bank Guarantee Amount and Time Limit

Under UAE legislation, a Bank Guarantee cannot be for an unspecified sum and must state the specific amount for which the Bank Guarantee is being granted. The provision of a time limit in the Bank Guarantee is not required under UAE law. However, if a Bank Guarantee is included, it will automatically expire when the limit is reached.

The Guarantor shall be discharged from liability vis-à-vis the Beneficiary upon the expiration of the validity period of the Bank Guarantee unless it has been expressly agreed to renew the said term of the Bank Guarantee prior to its expiry and provided no request for payment has been received from Beneficiary during the validity period of the Bank Guarantee.

If the Bank Guarantee does not include a time limit, the normal limitation periods (time bars) imposed by UAE law will apply. Because UAE law does not provide for a specific limitation time for Bank Guarantees, the standard limitation period of ten (10) years will apply to Bank Guarantees.

Structure of Bank Guarantee

A bank guarantee must be in a specific format and include the following information, according to the Commercial Transactions Law:

- It must be of a certain size and quantity. A bank guarantee without a precise sum or a vague number is not enforceable; the time restriction on the guarantee is not need to be mentioned.

- It is important to note, however, that if the guarantee has a time limit; it will be considered expired when that period has passed. This is in accordance with Article 418 of the Law, which states that unless the guarantor expressly agrees to renew the guarantee prior to its expiration and the beneficiary requests payment, the guarantor should be allowed to discharge its liability to the beneficiary after the bank guarantee has expired.

- Because the time limit is ostensibly not stated on the guarantee, it will be regarded expired in line with UAE law, which is 10 years from the date of issue.

The Commercial Transactions Law confirms that the Beneficiary is not permitted to assign his rights under the bank guarantee to any third party without the guarantor's prior written consent. Alternatively, while finishing the bank guarantee, the beneficiary might be provided the right of assignment, requiring the guarantor's prior consent to allow the beneficiary to transfer the bank guarantee's rights.

What happens when the Bank Guarantee is invoked?

- Despite the fact that the issuance of a Bank Guarantee creates joint and several liabilities for the Guarantor and the Principal Debtor, the Guarantor is only liable to pay the Beneficiary upon the Beneficiary's invocation of the Bank Guarantee, not upon the Principal Debtor's default, act, or oversight.

- A Bank Guarantee should, in general, be unlimited; however, if it is subject to any requirements, such as the beneficiary's submission of documents, such conditions should be clearly stated in the bank guarantee. Except if such conditions are not met or the appropriate documents are not submitted, the Beneficiary will not be able to activate the Bank Guarantee. It is the Guarantor's responsibility to show that the Bank Guarantee is subject to such requirements.

- If the beneficiary invokes the guarantee in line with the terms of the guarantee, the guarantor is obligated to make the payment unless the guarantor is prohibited by a court order.

- It is important to note, however, that the guarantor has no time limit to make payments after the bank guarantee is invoked. This is generally stipulated in the concerned document and agreed upon by the parties. The law has offered freedom to the parties to decide the time within which the guarantor will make the payments post the invocation of the bank guarantee at the time of issuance or signing the guarantee.

- Regardless of the preceding, if the guarantor fails to comply with the conditions of the guarantee and fails to make the payment, it will be considered a breach of the Bank guarantee, giving the beneficiary the right to start civil proceedings against the guarantor to repair the breach.

- Importantly, because the guarantor has a different responsibility from the original debtor, the beneficiary cannot file a claim against the principle debtor before pursuing the guarantor. As a result, the beneficiary has the right to sue the principal debtor for the money. However, when the guarantor's complaint was filed,

Conclusion

Thus we can conclude with the fact that being well informed about the Bank Guarantee can be extremely beneficial for you if you are a Business owner or a Salaried Employee residing in UAE. We hope this blog provided you with incite full information. For more information on other related aspects, feel free to check out our Website as well.