You don't have to wait or second-guess yourself when it comes to getting your hands on that sleek, gorgeous ride. Getting a new car is now easier and quicker than it used to be, thanks to the concept of car loans. Furthermore, given the current market conditions, getting financed with a car loan rather than paying cash is a better option. Almost all major banks now offer auto loans in the UAE, with attractive interest rates, flexible payback terms, and a variety of other advantages. Given that you are a well-informed buyer, obtaining car finance in UAE is a simple and painless process in today's world.

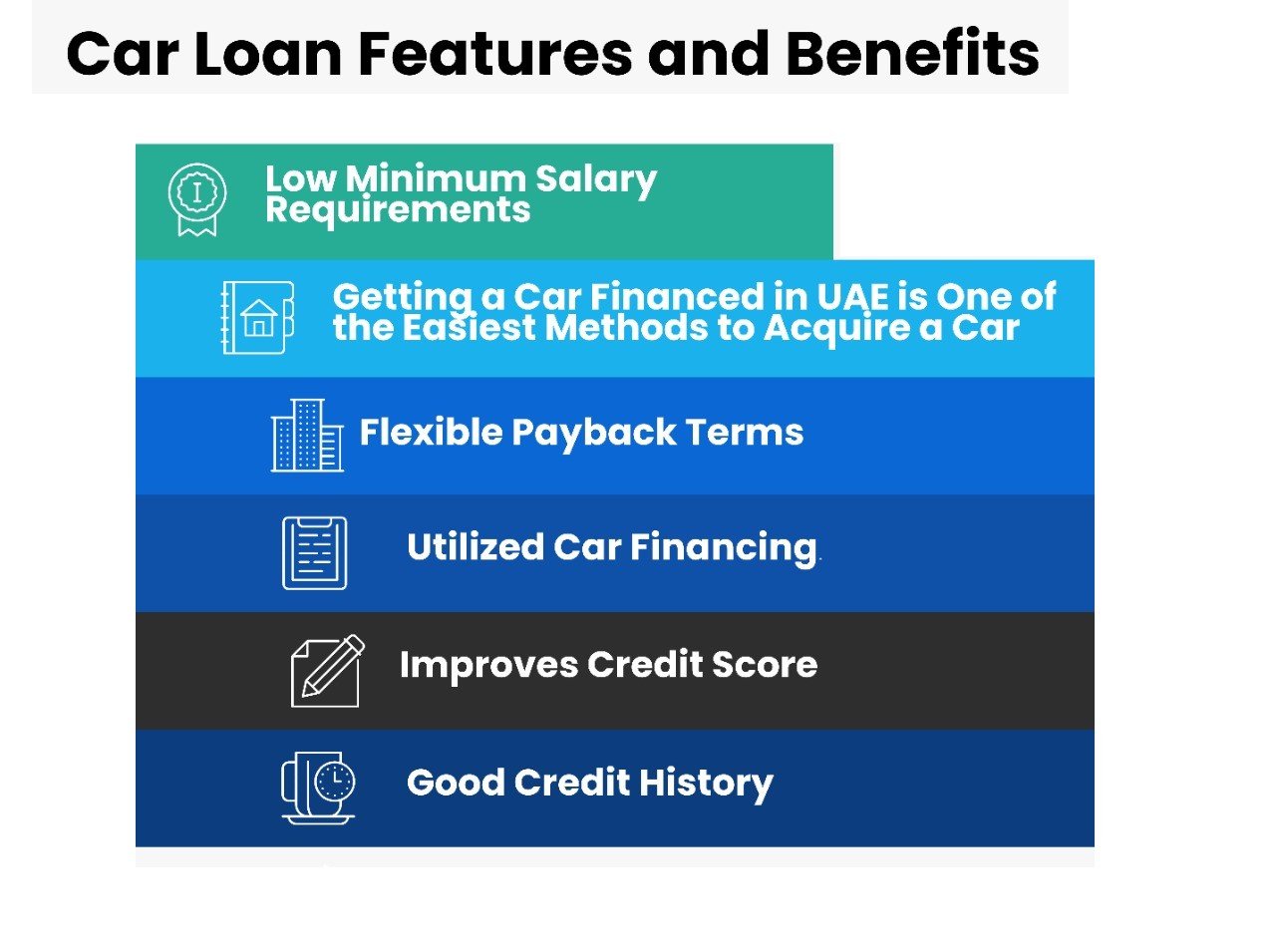

Car Loans in the UAE: Features and Benefits

Here's a rundown of the advantages and appealing characteristics of receiving a car loan in the UAE.

Interest Rates that are Low and Negotiable

In the United Arab Emirates, car loan interest rates start at 2%. Most banks provide consumers with both fixed and lowering auto loan interest rates, giving them more repayment options.

Easy Processing

Thanks to the UAE's top banks' flexible operations, your auto loan in the UAE is handled swiftly. This simply implies you won't have to waste hours or days obtaining approvals, realigning, or reassigning procedures to purchase your new vehicle.

Low Minimum Salary Requirements

Depending on the bank you choose, the minimum salary required to obtain a car loan in the UAE might be as low as AED 5000, making private vehicles accessible to all working folks.

Getting a Car Financed in UAE is One of the Easiest Methods to Acquire a Car

Getting a car financed in UAE is one of the simplest ways to own a car. You have the option of choosing a simple, low-interest monthly payment and becoming a car owner virtually immediately. Car financing in UAE bridges the months, if not years, between starting to save for a car and finally being able to buy one.

Flexible Payback Terms

All the UAE's main banks provide flexible vehicle loan repayment terms. Customers can design their repayment strategy and select the EMI tenure and amount that is most convenient for them.

Utilized Car Financing

Car loans in the UAE can be used to purchase old and used cars in UAE. Most banks in the UAE provide used automobile financing at a slightly higher interest rate. Through an inspection, the banks assess the vehicle's maximum age and condition.

While the more typical concept of vehicle loan in UAE is to go 80-20 on financing and down payment, this is not the case in UAE. In the United Arab Emirates, many banks provide 100 percent financing for auto loans.

Improves Credit Score

Getting a car loan in UAE and paying it off according to the EMI of your plan can significantly enhance your credit score, giving you more options and a better bank reputation.

Good Credit History

One of the finest ways to improve your credit history in the UAE is to take out a car loan. This assures that future loan applications with the bank will go more smoothly and quickly.

Top Car Loan Providers in the United Arab Emirates

The following are the leading auto loan providers in the UAE, along with their respective interest rates and loan highlights:

Car Loan from ADCB Bank

- Car Loan Interest Rates: Fixed 1.99 percent per annum and lowering 3.65 percent per annum

- Maximum Repayment Tenure: 60 months

- Minimum Salary Required: AED 5000

- Finance to Down Payment Percentage: 80 percent -20 percent

- Additional Benefits: 50 Touchpoints earned for every AED 1000 loan amount

Car Loan from ADIB Bank

- AED 500,000 is the maximum amount you can borrow for a car loan.

- Fixed 2.75 percent - 4.49 percent p.a. and Reducing 4.75 percent - 8.25 percent p.a. Car Loan Interest Rates: Fixed 2.75 percent - 4.49 percent p.a. and Reducing 4.75 percent - 8.25 percent p.a.

- AED 5000 is the minimum salary need.

- Additional Benefits: One-year instalment deferment and a 90-day grace period for the first instalment.

- Finance to Down Payment Ratio: 80% - 20%

Car Loan from Emirates NBD

- AED 500,000 is the maximum amount you can borrow for a car loan.

- Fixed 1.99 percent p.a. car loan interest rates

- Maximum Repayment Tenure: 60 months

- Required Minimum Salary: AED 4000 to AED 15000 (case basis)

- Additional Advantages: A free credit card is available.

- Finance to Down Payment Ratio: 80 percent to 20% for individual loans, 75 percent to 25% for sports cars, 90 percent to 10% for businesses

First Abu Dhabi Bank (FAB) Car Loan

- Maximum Car Loan Amount: AED 1.5 million from First Abu Dhabi Bank (FAB)

- Fixed 1.99 percent p.a. for UAE nationals and 2.15 percent p.a. for ex-pats on car loans (salaried employees). For self-employed people, the rate is 2.99 percent p.a. unchanged and 5.62 percent p.a. decreasing.

- Maximum Term of Repayment: 60 Months

- Minimum Salary: AED 8000 for salaried employees and AED 25,000 for self-employed individuals

- Finance to Down Payment Ratio: 80% - 20%

Mashreq Bank Car Loan

- Maximum Car Loan Amount: AED 500,000

- Car Loan Interest Rates: 3.45 percent per annum fixed rate and 6.31 percent per annum decreasing rate

- Maximum Repayment Tenure: 60 months

- Minimum Salary Required: AED 5000

- Finance to Down Payment Ratio: 80% - 20%

- Additional Benefit: Free credit card for life

RAKBANK Automobile Loan

- Minimum Salary Required: AED 5000

- Car Loan Interest Rates: 1.99 percent p.a. flat rate for salaried candidates

- Maximum Repayment Tenure: 60 months

- Finance to Down Payment Ratio: 80% - 20%

Car Loan from the Emirates Islamic Bank

- Car Loan Interest Rates: 1.80% p.a. fixed rate and 2.95 p.a. decreasing rate

- Maximum Repayment Tenure: 60 months

- Minimum Salary Required: AED 8000

- Finance to Down Payment Ratio: 80% - 20%

- Additional Benefit: Free Emirates Islamic current account

Car Loan from HSBC

- Additional Benefit: 0.15 percent discount on flat interest rates for hybrid vehicles and 0.25 percent discount on flat interest rates for full electric vehicles

- Maximum Car Loan Amount: AED 600,000

- Minimum Salary Required: AED 10,000

- Additional Benefit: 0.15 percent discount on flat interest rates for hybrid vehicles and 0.25 percent discount on flat interest rates for full electric vehicles

- Flat-rate car loan interest rates starting at 1.99 percent p.a.

- Special flat interest rate of 1.74 percent for TESLA

- Lower monthly EMIs with easy Balloon repayment options

Interest Rates Offered by Top Car Loan Providers in UAE

|

Banks |

Interest Rate (p.a.) |

|

ADCB Bank Car Loan |

Flat: 1.99%, Reducing: 3.65% |

|

ADIB Bank Car Loan |

Flat: 2.75% - 4.49%, Reducing: 4.75% - 8.25% |

|

Emirates NBD Car Loan |

Flat: 1.99% |

|

First Abu Dhabi Bank (FAB) Car Loan |

Flat: 1.99% - 2.99%, Reducing: 2.80% -5.62% |

|

Mashreq Bank Car Loan |

Flat: 3.45%, Reducing: 6.31% |

|

RAKBANK Car Loan |

Flat: 1.99% |

|

Emirates Islamic Bank Car Loan |

Flat: 1.18% |

EMI Calculator for Car Loans

The simplest approach to determine the amount to be repaid to the bank each month based on your loan amount, interest rate, and car loan period is to use a car loan EMI calculator. It's quite easy to use a vehicle loan calculator. Simply enter your information and press the "calculate" button at the bottom of the auto loan calculator. To compute and present the EMI break up for your car loan, you must enter the principle amount, interest rate, and number of months in the loan period in the designated slots on the car loan calculator in UAE. Most EMI calculators will also display the loan's amortization schedule, which will show the total amount owed as well as the interest due during the term, which will be displayed separately from the principal amount.

The formula used in the process of EMI calculation by EMI calculators is [P x R x (1+R)^N]/[(1+R)^N-1] where,

P = Principal amount

R = Rate of Interest

N = Number of Months in the Loan Tenure

Conclusion

When it comes to making good decisions, comparison is crucial. Visiting a reputable financial services aggregator website like Dhanguard is the best approach to compare vehicle loans offered by various banks and providers. We've compiled a comprehensive list of all the information you'll need to choose the best vehicle loan company for your impending purchase. We also have comparison tools that can help you compare two or more services.