When the time comes to buy your dream car and you realize that the only thing stopping you from having the car of your dreams is a lack of finances, it's time to apply for a car loan. A car loan assures that you can pursue your dreams in a method that allows you to enjoy the vehicle today while paying for it tomorrow. Some of companies may make repayments even easier by offering deals like "take the car now and the EMI will start in 3 to 6 months," so you don't have too much financial hardship in the first few months of ownership.

When it comes to making good decisions, comparison is crucial. Visiting a reputable financial services aggregator website like Dhanguard is the best approach to compare vehicle loans offered by various banks and providers. We've compiled a comprehensive list of all the information you'll need to choose the best vehicle loan company for your impending purchase. We also have comparison tools that can help you compare two or more services.

When Evaluating Vehicle Loan Providers, Keep the following in Mind.

- Loan for a car the provider's interest rates are both stable and decreasing.

- The maximum loan amount available - would it be sufficient for the vehicle you require?

- If you want to buy a sports car or another luxury vehicle, you can get a loan for it.

- The loan's maximum payback period

- Ratio/percentage of down payment

- Any additional customized services that are available

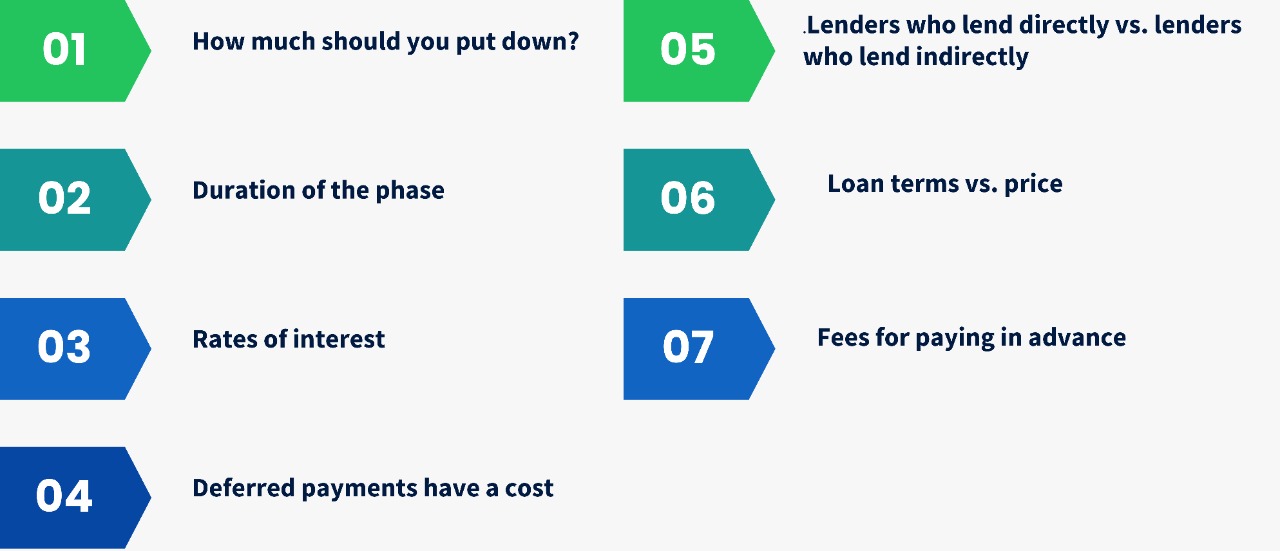

A Comprehensive guide to Comparing a Car Loan

The following questions should be kept in Mind while comparing Car Loan-

1.How much should you put down?

Building a savings account and putting down a large down payment will save you money over time because you will be paying interest on a lesser loan. Furthermore, because brand new cars depreciate swiftly as soon as you drive them off the lot, if you don't put down a down payment, you will most likely owe more than the car is worth for a long time. That means that if your automobile is totaled in an accident or stolen, the insurance payment you get may not be sufficient to cover the entire loan sum.

2.Duration of the phase

The length of auto loan terms has been increasing. This translates to a smaller monthly clearing but higher interest costs. Long loans for used cars should be avoided because they are more likely to have a shorter usable life. You don't want the loan to last longer than the vehicle.

3.Rates of interest

Because car loan interest rates fluctuate, it's important to shop around before committing to a loan. Longer loans often have higher interest rates, so this is another reason to choose a shorter one.

4.Deferred payments have a cost.

"There will be no payments for six months!" You've certainly heard that pitch before, but if you believe it means you get to drive your brand-new automobile for free for six months, think again. The loan terms are probably such that you'll be paying interest the entire time. Because you won't be paying down principal at first, you'll be paying interest on the full loan sum for an additional six months.

5.Lenders who lend directly vs. lenders who lend indirectly

Your loan might be obtained directly from a financial institution or indirectly through a car dealer. As convenient as it may be to have the seller arrange financing, keep in mind that they may earn interest rate mark-ups or other financial incentives in the future, which could raise the loan's cost. If you don't have separate loan offers to compare, don't settle for dealer financing terms.

6.Loan terms vs. price

Using dealer-arranged financing may have an impact on the car's price or the incentives available. Tell the merchant you haven't decided on financing yet while discussing costs. You want to know how much it will cost with and without financing. This will assist you in determining the exact cost of dealer financing.

7.Fees for paying in advance

Before you sign up, think about any fees that might be incurred if the advance is repaid early. This could have a variety of consequences for you. You'd have to pay off the existing loan early if you wanted to trade in the car for a newer or different model. This would raise the price of the trade-in.

Advantages of Car Loan in UAE

If you're still unsure whether a car loan in UAE is the right solution for you, consider the following advantages:

- You don't have to put up any collateral to get a vehicle loan. This is since the car is used as collateral.

- Car loan repayments might really enhance your credit score if you keep up with payment deadlines.

- Banks offer flexible payment packages to make it easier for borrowers to finance their loans which gives them full control over how much they spend in monthly instalments.

Unlike home loans, car loan amounts can be negotiated with lenders provided

Top Car loan Provider in UAE

- ADCB Bank Car Loan

- ADIB Bank Car Loan

- Emirates NBD Car Loan

- First Abu Dhabi Bank (FAB) Car Loan

- Mashreq Bank Car Loan

- RAKBANK Car Loan

- Emirates Islamic Bank Car Loan

- HSBC Car Loan

Conclusion

Obtaining a car loan in Dubai is not difficult if you are eligible and have all the required documentation. Because Dhanguard have relationships with bank personnel, they can assist you in obtaining the loan that best suits your needs.