Credit cards may be an excellent tool for teaching youngsters about money management. Although the concept of placing a large sum of money in the hands of an emotional adolescent may cause some fear, a credit card may teach youngsters a lot about financial security.

Anyone above the age of 15 (the minimum age varies by bank) in the UAE can use a supplemental or add-on credit card linked to a primary account, such as a parent's or guardian's. The credit limit on such auxiliary cards is usually shared with the principal cardholder. In other words, any obligations owed on the add-on card must be paid by the principal cardholder.

Thus in this blog we will discuss about all the intrinsic details, that is it wise to give a Credit Card to the Teenager in UAE. So without any further ado, let’s learn!

Money lessons in Supervised Environment

Credit cards provide an opportunity for teenagers to learn about finance under the supervision of a responsible adult in a controlled atmosphere. Setting a few ground rules in advance, such as where the card can be used, what expenses can be charged, and the limits on each, can be beneficial for parents.

With the UAE's high-octane lifestyle on full show, temptation seemed to lurk around every corner and on every social media platform. It's easy to overspend in the UAE, with easy access to designer brands, pricey restaurants, and other attractions.

An open discussion about the usage of the card on a frequent basis – perhaps each time a statement becomes available – can help build confidence, prevent misuse, and make it simpler for the teen to ask for support or guidance, just as it can with other parts of parenting. Credit cards, like everything else in life, have advantages and disadvantages, and recognizing both is essential for healthy financial management.

Pros of Teenagers having Credit Cards in United Arab Emirates

For teenagers in the UAE, using a credit card in this type of supervised atmosphere has various advantages.

Assistance in Emergency

The most significant justification for providing teens a credit card in the UAE – or anywhere else for that matter – is that they will always have money in case of an emergency. A credit card can help youngsters pay for unexpected bills, whether it's a car repair, a last-minute tuition payment, or an uninsured medical visit.

Monitor your Financial Expenses

Giving a teenager a credit card allows parents to keep track on their child's expenditures. A simple glance at the monthly statement reveals a teen's goals, allowing parents to intervene and prevent what may otherwise become a big issue. Knowing that their parents are watching over their finances serves as a deterrent to spending money on prohibited products for the youngster.

Experience Based Learning

According to research, learning lessons from personal experience is more beneficial than simply receiving information or guidance. To put it another way, we learn by doing. Having a credit card instills in youngsters a sense of financial responsibility. They will learn how to pay their payments on time, stay out of debt, and maintain a solid credit score.

Create A Credit History

Individual credit ratings, which assist lenders estimate a person's creditworthiness, have recently been tracked in the UAE. Teenagers are encouraged to keep a strong credit history by being given a credit card. This will assist them in the future when applying for loans, paying rent, and so on.

Receive Rewards for your Spending

The primary account holder may also benefit from spending benefits in the form of cash back or possibly air trip vouchers, depending on the credit card. Any purchases made by your adolescent may boost your points balance.

Cons of Teenagers having Credit Cards in United Arab Emirates

Credit cards aren't for everyone, and some kids may find them to be a liability. A debit card may be more appropriate in some instances.

Manipulated Value of Money

One of the most common criticisms of credit cards is that they encourage immediate satisfaction. Teenagers who can pay for everything they want with a tap may be unaware of the effort required to earn the money to make that buy. Perhaps a young person isn't ready for a credit card if they don't comprehend how work affects their purchasing capacity.

Accumulation of Debt

With a large credit card limit, it's easy to rack up a lot of debt. Large debts, in addition to being difficult to repay, may have an impact on the credit score of both the adolescent and the primary cardholder. Again, setting strict boundaries can be beneficial.

Impulse Control Issues

Teenagers are at a point in their lives when they are still sorting out their feelings and learning about the world around them. Those with excessive expectations and a hazy understanding of the repercussions may require a strict credit limit to prevent having to cope with the consequences of impulsive and costly decisions on a frequent basis.

It is Simple to Procrastinate

You don't have to pay your bills till the end of the month thanks to the ease of a credit card. As a result, establishing a reminder may aid in remembering to pay your payments on time.

In the United Arab Emirates, how should teenagers be prepared for Credit Cards?

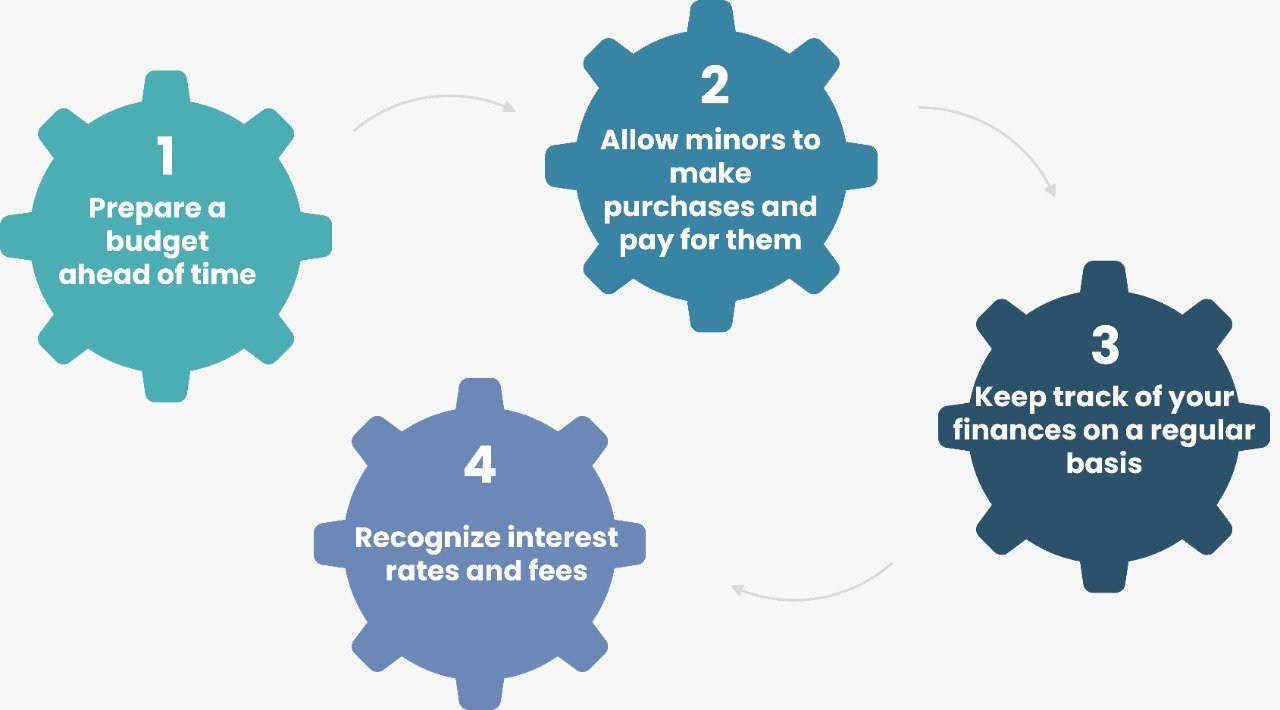

As we've seen, there are various advantages to using a credit card properly. As a parent, you can help your child successfully navigate this transition into adulthood by following these steps:

Prepare a budget ahead of time

Sit down with your child and help them construct an itemized budget that includes both necessities and enjoyable expenses like cafés, concerts, or clothes. Assist them in comprehending how to spread out major expenditures over time and the impact of any interest. Establishing a predetermined personal profit and loss account teaches financial management, enhances decision-making, and detects issues before they arise.

Allow minors to make purchases and pay for them

Allow your teenager to pay their own credit card bills from their allowance, and if required, cover the interest if they are unable to pay off their purchases in full. Providing for their own needs might be a useful financial lesson.

Keep track of your finances on a regular basis

Regularly assessing a teenager's credit card spending can serve as a financial education and assist them in managing their finances in the future. Parents can also take use of this chance to explain the concept of value, giving their children a better understanding of the importance of money. Credit card statements provide an opportunity to conduct regular financial discussions.

Recognize interest rates and fees

Various credit cards have varying interest rates and fees. The impact of differing rates on purchases provides a realistic picture of how much credit might cost over time while also educating people how to evaluate alternative financial options.

Conclusion

Credit cards can give a firm foundation in financial management for teenagers in the UAE, while also teaching them the value of money when handled responsibly. These are life lessons that they will benefit from throughout their lives. Thus we hope this blog provided you with incite full information. The article has been carefully devised by our Experts at Dhanguard to give you the optimum information. For more information on other related aspects, feel free to check out our Website as well.