When is the last time you paid your credit card bill? Some people pay off their credit card balances in full each month on the due date stated on their statements. Others carry a balance from month to month but make the required minimum payment before the deadline. So, when is the optimum moment to pay with a credit card? Before we get into that, let's take a look at why you should at the very least pay your account before the due date.

Why is paying bills on time so important?

The FICO scoring mechanism is used by the majority of lenders to determine credit ratings. Your payment history accounts for 35% of your credit score under that scoring mechanism. If you have a history of late credit card payments, this can affect your credit score.

- There's another reason why paying off your credit cards should be a top priority for you. A revolving credit account, such as a credit card, is a sort of revolving credit account. Revolving credit accounts, unlike instalment credit accounts like mortgages and student loans, allow you to borrow money whenever you need it up to a set limit (your credit line). There is no set monthly payment, and if you don't pay your account in full each month, you can carry a balance from month to month.

- Revolving debt often carries more weight in your FICO credit score than instalment debt. While paying a loan after its due date can harm your credit, late credit card payments can be even worse.

- Your FICO credit score is 30 percent determined by the amount of debt you owe. The credit usage ratio (the amount of credit you've utilized compared to your credit line) linked with your revolving credit accounts is an important aspect of that variable. If you miss your credit card payment deadlines and have utilized a considerable amount of your available credit line, your credit score could suffer significantly.

Thus, in today’s blog, we will intrinsically focus on when is the best time for you to make payment of your Credit Card Dues so that you may be exempted from unnecessary fines and late charges. So, without any further ado, let’s learn!

So, when exactly is the best time to make payment of the Credit Card Dues?

When it comes to credit card payments, the adage "time is everything" is certainly true. Late payments have a slew of negative effects that you should avoid if at all feasible. If you pay beyond the due date, not only will you be charged late penalties, but you also risk harming your credit and having your interest rate raised to the highest penalty rate.

Even if you pay on time, the timing of your credit card payment might affect the amount of interest you pay while you carry a balance. Paying your bills earlier in the billing cycle might help you save money on interest and, in some situations, improve your credit score. Here are some recommendations to help you decide when the best time is to pay your credit card bill.

Prior to the Due Date

Making at least the minimum payment before the due date's cutoff time will help you maintain good credit and avoid late payment penalties. If you miss your credit card payment by even a few minutes, you will be charged a late fee. If your account is 60 days past due, you may be charged a penalty rate.

That is, if you fail to make two consecutive payments. Late payments may result in the loss of a promotional interest rate as well as the forfeiture of any incentives you've earned. If you need to make a last-minute credit card payment, you can do it online or over the phone as long as you pay before the deadline.

In the early stages of the billing cycle

Although your due date may be later in the billing cycle, paying your credit card early in the billing cycle might help you save money on interest, especially if you don't make any other purchases. This is because your credit card issuer most likely calculates your finance fee using either the daily balance or average daily balance approach. In both circumstances, a lesser balance over a longer period of time will result in a reduced finance fee. On your credit card statement, you'll discover the closure date of your account statement as well as the number of days in your credit card's monthly cycle.

Prior to making a Major Purchase

Using your credit card to make a large purchase when you already have a balance might increase your credit use and lower your credit score. Before making large purchases, pay down your debt to avoid a spike in your credit use and a drop in your credit score.

When your direct deposit hits

Making your credit card payment as soon as you get paid assures that you can afford the payment and decreases the risk of a returned payment, which can result in a fine. You can send your payment even if it isn't due for a few days to have peace of mind that it will be covered. Check your other bills before sending your payment to be sure you're not trying to pay too much with one paycheck. You may be able to defer some credit card payments until your next paycheck if you're paid weekly or bi-monthly.

Prior to the closing date of the Account Statement

Make your credit card payment before the account statement closure date to ensure a reduced credit card balance is reported to the credit bureaus in the current month. A high credit card balance on your credit report can increase your credit use and lower your credit score by a few points. If you plan to apply for a big loan, such as a mortgage or a vehicle loan, before your next account statement closing date, having the finest credit score possible is critical. Otherwise, by paying off your credit card first, you can assure that a lower balance is recorded to the credit bureaus. After you've reduced your balance, don't make any additional credit card purchases until your next statement closes.

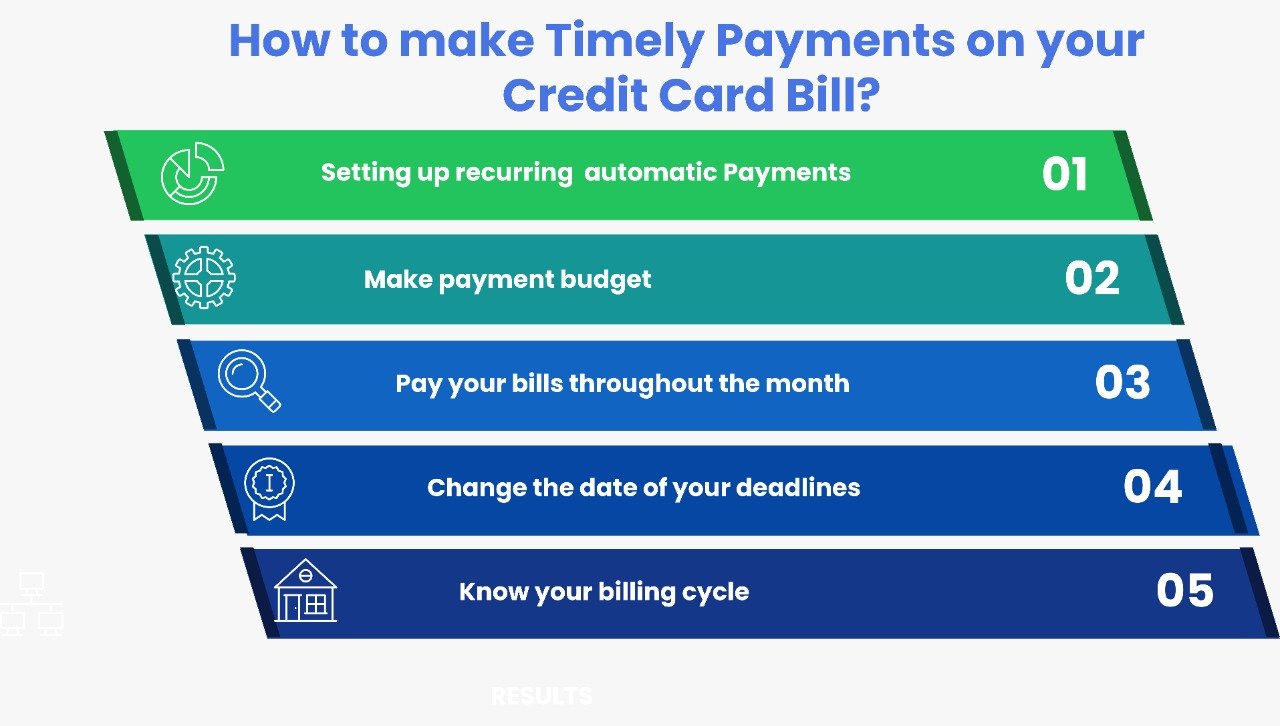

How to make timely payments on your Credit Card Bill?

If you want to make sure you always pay your credit card account on time, here are a few tips to help:

Set up recurring or automatic payments

Setting up automatic payments is one approach to ensure that your credit card account is paid on time each month. When you set up automatic payments, monies will be automatically deducted from your bank account when your bill is due, allowing you to pay with your credit card. You have the option of paying the whole amount owing, the minimum amount due, or a predetermined amount. Just remember to make sure you have enough money in your bank account to cover the automatic payment.

Make a payment budget

It's critical to develop a budget that includes these payments to ensure you have enough money to pay your credit card bill. Consider how much money you have each month to put toward your credit card debts and how often you wish to make credit card payments. It's easier to pay credit card bills on time if you plan ahead and have a strategy in place.

Pay your bills throughout the month

You can make extra credit card payments each month to help you pay off large credit card payments faster and lower your amount and monthly interest costs. Interest on credit cards compounds, so making extra payments now might save you a lot of money in the long run.

Change the date of your deadline

You may be able to pick when to pay your credit card in some instances. Many credit card companies allow you to adjust the due date of your credit card statement to a date that is more convenient for you. For example, you could wish to adjust your due date to coincide with your salary or to avoid clashing with other bills.

Know your Billing Cycle

- The inaccuracy in mentioning that your payment due date is about 21 days before your payment due date stems from a difference in billing cycles and payment dates. The law demands that you pay your account on the same day each month, and while the number of days in each month varies, the number of days in each credit billing cycle remains consistent. Cycles range from 28 to 31 days depending on the card issuer.

- The duration of your card's billing cycle can be found in your cardholder agreement, or you can simply compute the number of days between the start and end dates for the billing period indicated on your card statement. No matter when your next payment is due, the next statement closure date will be that many days from the billing period end date.

- Most credit cards have a grace period for payments, which means you won't be charged interest if you pay the entire amount due each month on your account statement. If you can afford it, paying your debt in full before your monthly statement closing date ensures that no outstanding card balance is recorded to the credit bureaus, which can help you improve your credit scores.

Conclusion

We hope we were able to explain the relevancy of making the payments of your Credit Card Bills on time. For more information on other related aspects, feel free to check out our website as well.