Credit cards are short-term loans with additional features. Bill payment is an advantage in addition to the numerous credit card offers and bonuses. Financial institutions provide up to a 15-day grace period for paying your credit card statement, and cardholders can pay at least 5% of the balance. This grace period and minimum bill payment option can be both beneficial and detrimental.

Your credit card bill, which is nothing more than your account statement, will be generated every 30 days. Most financial institutions provide you a grace period of 10-20 days to pay your credit card before the due date. The majority of them pay their credit card payments on time, and some even pay them before the due date. However, not everyone knows when the optimal moment is to pay with a credit card.

Payment of the bill prior to the account statement's expiration date

You can pay off your credit card bill in part or in whole even before receiving an account statement. If you've only partially paid your bill, the outstanding amount will be updated on your account statement along with the amount paid for that month. Clearing your credit card bill before the end of the monthly cycle will improve your credit score. Having a high credit card amount during the billing cycle indicates heavy credit utilisation, which can negatively affect your credit report.

After the statement's closing date

The cardholder will be issued a due date, i.e., a grace period of 10-20 days, once the credit card account statement is sent. Even though there will be no late payment charges if the credit card bill is paid during the grace period, bills paid after the account statement is generated, i.e., before the due date, will have an impact on the credit report, which displays credit utilisation, and banks will check a person's credit utilisation before approving a new loan or credit card application.

After the deadline has passed

It is not a good idea to pay your credit card bill after the due date. Banks levy late fees in addition to interest rates. The late payment cost will be 1% to 2% of the outstanding bill amount, with an interest rate starting at 1.95 percent. Banks have different late payment fees and interest rates.

Why Should your Credit Card Due Dates be Changed?

When choosing a new credit card, keep in mind the billing date as well as the payment due date, since these are two of the most crucial factors to consider. The billing date, often known as the statement date, is the day on which the credit card company creates the latest billing cycle's credit card statement. The lender will then send the statement to the email address you provided. The due date, on the other hand, is the deadline for paying your outstanding credit card payments for that billing cycle.

A variety of events, including job loss, new marital status, employment change, and any type of financial emergency, might disrupt your cash flow timetable, making it impossible to make payments by the due date. Not only that, but with many credit cards, it can be tough to keep track of payment due dates, and the risks of missing credit card payments are considerable.

Did you know that you have the option to adjust your credit card's due date?

Yes, you read that correctly. Though you won't have the option to set your billing cycle at first, you can do it later by contacting your lender. The ability to adjust your due date gives you complete control and flexibility, allowing you to pay off your credit card balance whenever it is convenient for you. This is just one of many reasons.

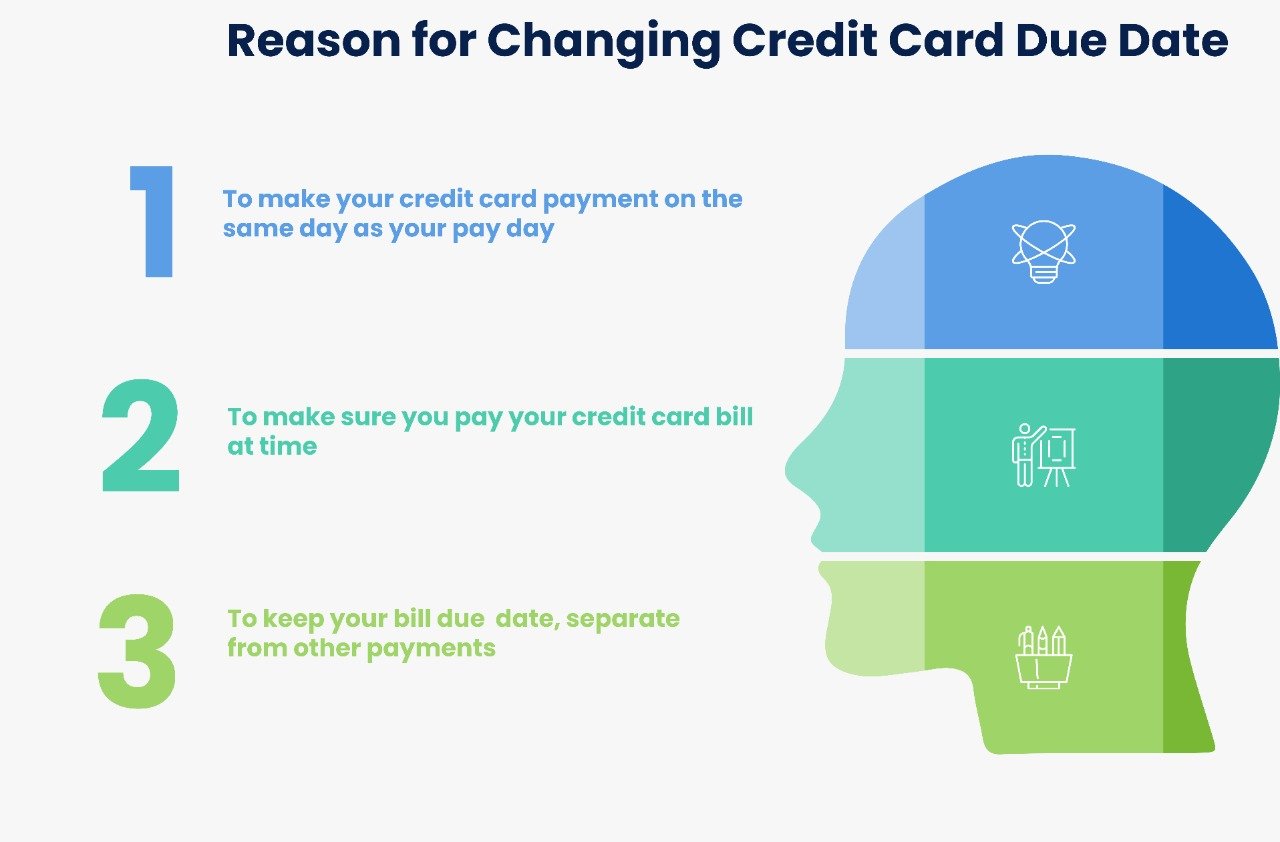

Reason for Changing Credit Card Due Date

Keep reading this article to learn more about the reasons for changing the due date.

To Make Your Credit Card Payment on the Same Day as Your Pay Day

Let's face it, we all have a lot of bills to pay throughout the month. It might be your rent, loan repayment, monthly instalments, or any other debts due before the end of the month. With so many bills to pay, the money we have in hand doesn't last long once the wage is deposited into our bank account.

So, if your salary arrives on the final working day of the month and your credit card payments are due around the 15th, paying off your credit card debt can be challenging, especially if you are not excellent at budgeting or spend more than you make. Late fees and other financing charges will apply if you don't pay your credit card bill on time. In such cases, it is preferable to adjust your billing cycle such that the payment due date comes around the beginning of the month.

To Make Sure You Pay Your Credit Card Bill on Time

You, on the other hand, are the only one who knows about your payment cycles and cash inflow. To get the most out of your salary, you should organise your expenses around the time you receive it. Furthermore, the primary goal of changing due dates is to ensure that you never miss a payment and always pay your account on time, as late payments have a negative impact on your credit score.

To keep your bill due date separate from other payments

On the contrary of the preceding statement, some people just prefer to keep the due date separate from other invoices. Receiving many bills on the same day can be inconvenient for some people. Furthermore, because the full month will be in front of you and you will have several costs for which you must save money, you may end up paying only the minimal due amount. In this case, you may want to explore adjusting your credit card due date to suit your needs.

Conclusion

There are several compelling reasons to consider changing your credit card due date. Just keep in mind that modifying the due date is mostly for the purpose of making a credit card payment on time. So, make your decision according to your convenience and pay your bills on time to avoid late fees and preserve a good credit score. For any of your banking needs, get in touch with the Dhanguard Team.