Previously, the term "offshore" was used to identify locations that were excellent for tax evasion and money laundering, but the definition has evolved through time. The name "offshore" was first applied to the Channel Islands since they were located off the coast of the United Kingdom. While the majority of offshore banks are located on islands, the term is now used metaphorically, and having an offshore bank account signifies that the account is located outside of the client's home country. An offshore account is fully legal, anyone may open one, and it is a very valuable tool for personal money management.

Thus in this blog we will discuss in length, the benefits of having an Offshore Bank Account as well as how can you open one for yourself if you want. So without any further ado, let’s learn!

What are the Benefits of having an Offshore Account in United Arab Emirates?

Offshore accounts are typically advantageous to someone who is a frequent traveler, lives outside of his home country, frequently moves between countries or intends to purchase property, plans to retire there, needs to make international payments such as fees for children studying in a foreign country, or has accounts in multiple currencies.

Because of its great strategic location on the world map, Dubai is rapidly advancing to become a worldwide offshore hub, integrating the nations of Asia, Europe, America, and Africa. People from all over the world come to Dubai to build their own businesses because of the government's profitable policies for overseas investors.

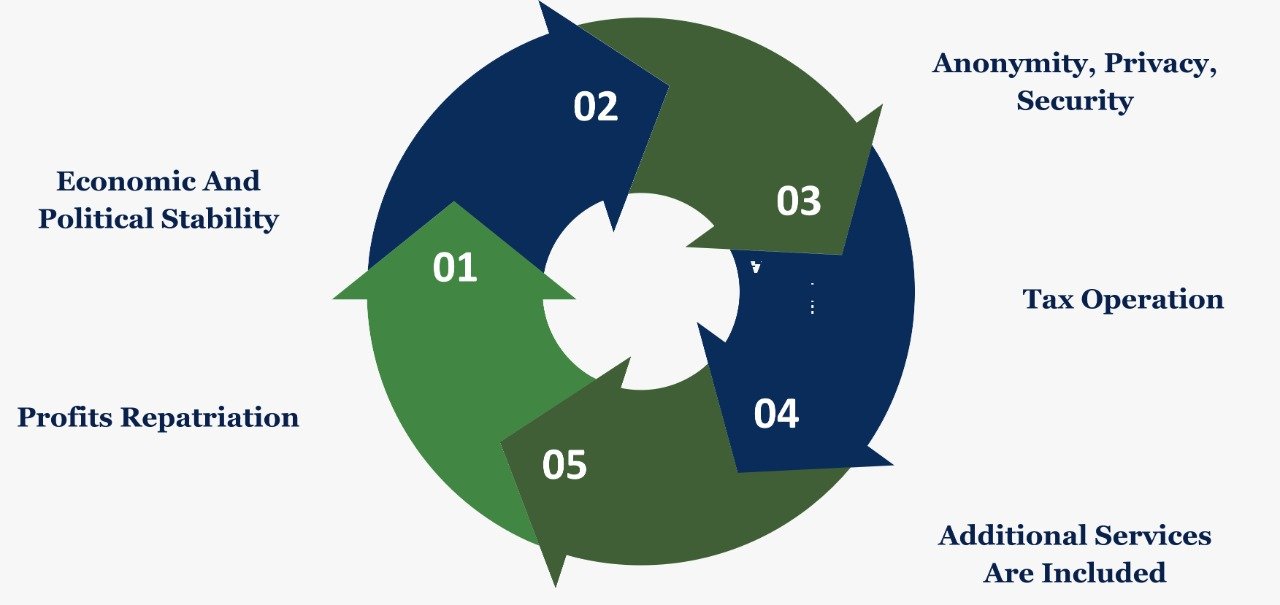

PROFITS REPATRIATION-

One of the major advantages of having an offshore account in Dubai is the total repatriation of profits, as expatriates living and working in Dubai will remit their earnings back to their home country to support their families. Offshore accounts eliminate the need for the time-consuming process of opening foreign bank accounts.

ECONOMIC AND POLITICAL STABILITY-

Dubai offshore accounts are safe and secure. Dubai offers a politically and economically stable environment. This is advantageous for expats living in countries where political unrest is a significant danger, and they are concerned about the seizure, disappearance, or freezing of local accounts and assets in their home country.

ANONIMITY, PRIVACY, SECURITY-

Because client information is not divulged, offshore accounts in Dubai provide privacy, security, and anonymity for the protection of their clients. Money transactions can also be performed via the internet from anywhere in the globe with the help of internet banking.

TAX OPERATION-

In terms of tax optimization, having an offshore account is also possible. Interest, investment income and capital gains, as well as inheritance, are not subject to personal or corporation taxation. Also, because there is no currency controls in force, gains can be gained by taking advantage of worldwide investment opportunities in Dubai.

ADDITIONAL SERVICES ARE INCLUDED-

In addition to the fundamental advantages, offshore banks in Dubai offer a wide range of services, including all of the advantages of a local bank account plus the anonymity of an offshore account. These services include liquids storage, money transportation, currency exchange, credit, investment, trade finance, corporate administration, and fund management, among others.

How to open an Offshore Bank Account in UAE-

The best method to achieve it is to start up a business in the United Arab Emirates. In this situation, opening a bank account will be simpler, faster, and less expensive. The cheapest option to start a business in Dubai is to register an offshore corporation. If you establish a RAK offshore business, you will be able to open an account with one of the following local banks:

- Mashreq bank

- RAK BANK

- NOOR bank

- Emirates Islamic Bank

If you choose to open a business in one of the UAE's free zones, your banking options will be much more extensive:

- Emirates NBD

- First Abu Dhabi Bank

- Mashreq bank

- RAK BANK

- NOOR bank

- Emirates Islamic Bank

- ADIB

The UAE mainland company is the quickest in terms of opening a bank account, but it is more expensive in terms of annual maintenance and requires a local citizen as a sponsor with 51 percent of the shares or a service agency with 0% of the shares.

Documents for Additional Verification

Opening an account with an offshore bank frequently comes with a slew of additional regulations. These rules are in place to prevent money laundering, tax fraud, and other illicit acts that are frequently linked with offshore banking.

To begin, offshore banks may need financial reference documentation from your existing bank, such as average balances and a positive relationship.

Bank statements from the previous six to twelve months are usually used to satisfy this requirement.

Second, many offshore banks may inquire about the type of transactions that will be conducted through the account. This may appear overbearing, but offshore banking centres are increasingly being pressured to curb unlawful activity. Many offshore banks require additional documents for this purpose, indicating the source of monies you are depositing in the bank.

What are the Documents required for an Offshore Bank Account in United Arab Emirates?

If you've set up a UAE company and are getting ready to apply for a bank account, we recommend applying to at least two different banks.

Prepare the following documents and information:

- Personal bank statement - this will show you where you got your money from.

- Prepare a corporate statement and ownership documentation if you have another firm. If you already have a business outside of the UAE, that is always a bonus.

- Proof of residency: a recent utility bill or any other document from the municipality showing your address is acceptable.

- CV with relevant work experience

- A business description is a short document that explains the nature of your company and how you want to run it.

- Estimation of annual revenue and initial deposit into the new account

- Names of possible clients and suppliers, as well as the countries in which the business will take place

We propose contacting business setup consultants in Dubai to assist you in evaluating your situation and identifying the banks where you are most likely to be successful in creating an account.

Maintenance of Offshore Bank Account-

To "activate" your account once it has been opened, you must first deposit a minimum balance. When you meet with your bank account opening officer for the first time, the amount of your minimum balance is always addressed. This is something that most business consultants in the UAE are aware of.

It's possible that your account balance will drop below the minimal minimum. The bank will charge you monthly account maintenance fees in this instance. Depending on the bank and the type of account, it could range from $10 to $100.

After sending funds to your account, we do not recommend leaving it idle. Because there are no transactions, banks frequently "freeze" passive accounts.

Opening a Bank Account on your own or with the help of consultants?

You can certainly gather all of your paperwork and apply for an account at any branch of the bank that you like. However, your chances of success are little to none: either the bank's minimum balance requirements are too high, or the bank refuses to issue accounts for your sort of business, or your business activity is just considered "high risk." Thus we suggest you to consider the valuable opinion of our experts at Dhanguard.

Conclusion

Thus we can conclude with the fact the benefits of Offshore Bank Accounts are worthwhile and the process of opening an Offshore Bank Account is an easy task! We hope this blog provided you with incite full information. For more information on other related aspects, feel free to check out our Website as well.