Saving is an essential part of financial planning. A bank savings account is undoubtedly one of the most convenient and secure ways to save. Even if multiple banks in the UAE offer various types of savings accounts to their customers, choosing a specific bank is always a challenge. This can be clarified once you are definite about the features and benefits you require and have appropriately compared them. When choosing a savings account, various factors must be considered when comparing one or more banks. Dhanguard is going to give you the advisable knowledge of choosing a bank to open a Saving Account. So, let’s have a look below.

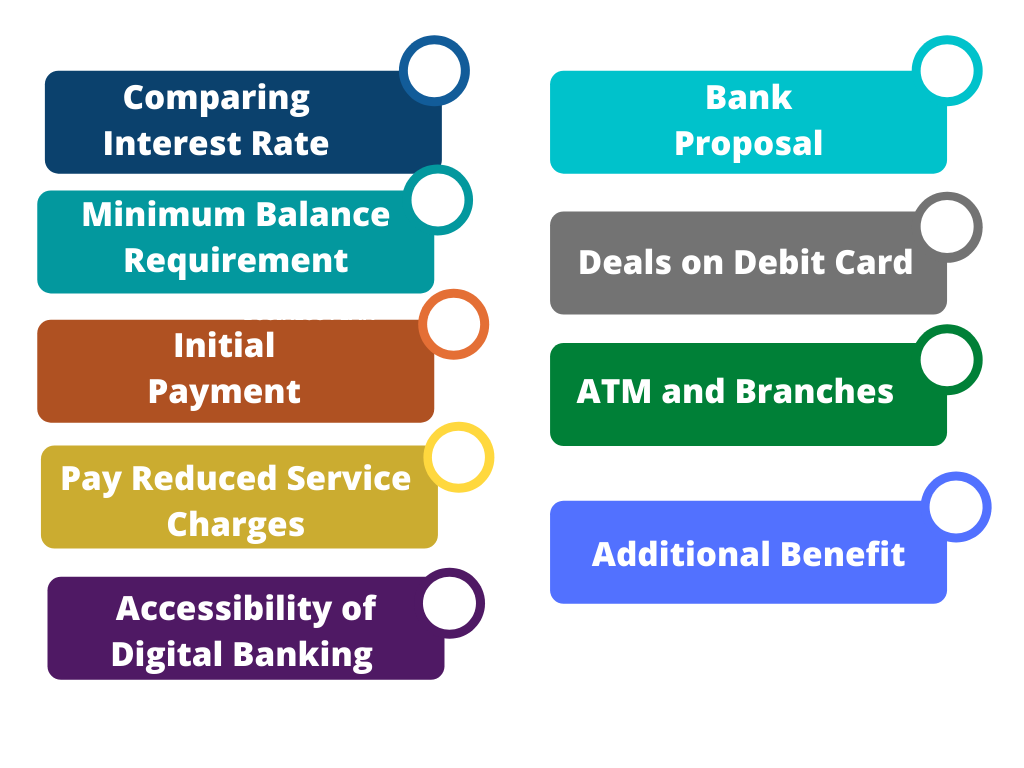

Factors to Contemplate while Opening a Saving Account

Considerable factors to open a Saving Account are mentioned below

Comparing Interest Rate

Even if the interest rates on savings accounts are relatively low, selecting a bank that offers the best interest rates to maximise your profits is advantageous. Customers in the UAE have several alternatives for opening a bank account. Each bank provides numerous Savings Bank Accounts with varying interest rates. These interest rates vary not only by the bank but also by the type of Savings Account and the balance.

As a result, as a knowledgeable investor, you should look for the best bank account with the highest interest rate. Usually, interest rates are up to 4%; however, due to COVID-19, several banks have revised their interest rates.

Minimum Balance Requirement

Several banks allow customers to keep their Savings Bank Account balance at zero. This gives the possibility to borrow the amount without regard for the minimum balance. However, many banks may want you to keep a minimum amount, and failing to do so may result in monthly fines. These monthly penalties differ from one bank to the next. As a customer, you must be aware of two factors. First, which bank has the lowest minimum balance, and second, which has the lowest penalty.

The latter is essential because it allows you to pay a lower monthly penalty if you cannot keep the required amount. Using your savings account strategically can help you profit more from your savings account.

Initial Payment

When opening an account, the account holder must make an initial deposit. The initial deposit can range from AED 0 to AED 3000 or even more at some banks. Before opening an account, check with the banks.

Pay Reduced Service Charges

Many of us ignore the terms and conditions when filling out the form for a Savings Account, which describes the service charges applied by the bank for various services such as cheque-books, e-statements, debit cards, fees for messages on each transaction, the total number of free transactions per month, and charges on additional transactions in a month.

These facts may appear insignificant when applying for a savings bank account, but you will soon learn that they are critical details that could save your money. For example, certain banks will charge you for e-statements, but others provide free e-statements.

It is strongly advised that you compare the service charges of each bank and carefully read the terms and conditions to ensure that the bank does not apply any hidden charges. These modest efforts will go a long way toward helping you save money each month.

Accessibility of Digital Banking

Online banking is vital since it saves both time and effort. The aspect of banking has significantly changed, especially during the epidemic, with digital banking replacing old financial techniques. However, how frequently do you need to perform a transaction, but your account is inaccessible because digital banking does not come with the bank's facilities? In such circumstances, customers pay the bank more for a necessary banking service. Furthermore, many banks suffer server issues from time to time, which restricts the smooth transaction procedure and results in irritation. As a result, you should see if your bank offers a decent Digital Banking platform to improve your banking experience.

Bank Proposals

Customers can benefit from monthly plans offered by many banks in the UAE. Customers are rewarded through monthly contests. Some banks even offer their customers a huge reward of AED 1 million or a new car. Check whether your bank runs monthly Contents and how you may join. Your Savings Account could be your route to the lottery and even greater riches.

Read more :-Multiple Bank Account-Tips for their Successful Management

Deals on Debit Card

There was a period when debit cards were exclusively used for ATM transactions. However, the online platform has vastly increased the use of debit cards today. Numerous banks collaborate with online service providers and e-commerce sites to deliver the finest deals on debit cards, including additional incentives and significant discounts. Ensure that your bank's debit card provides you with these perks before signing the final documents.

ATMs and Branches

Even though the world is becoming more digital, some payments must still be made in cash. During a pandemic or a hectic schedule, the last thing you want to do is look for an ATM or stand in a long line. Check to see if your bank has enough branches or ATMs near you so that you can save time for more important things.

Additional Benefits

Apart from the interest rate, several banks offer a variety of other incentives with their savings accounts. You can get a free debit card and a chequebook on the account. Banks also provide benefits such as a limited number of free external remittances, withdrawals, and so on, free phone banking, online banking, and so on. Furthermore, some banks allow their customers to open accounts in other currencies, i.e., they are not limited to UAE dirhams.

Conclusion

The main objective of a savings account is to save. So make sure you keep it correctly and use the account's features. Choose a bank and an understanding that is appropriate for your needs. Selecting the right bank for a savings account ensures that you do not receive less interest rate on your account or end up paying for additional services.