Those looking for business prospects in this prosperous region of the world seek UAE company registration. In addition, the United Arab Emirates provides registration in the Dubai Free Zone, which is quite popular. It provides tax-free business options for foreigners in some parts of this rich emirate. The following sections contain background information about the United Arab Emirates (UAE) as well as a full discussion of company formation in the region.

The UAE is always at the forefront of recruiting foreign ex-pats and entrepreneurs who want to work, settle, and create a business in the most convenient way possible.

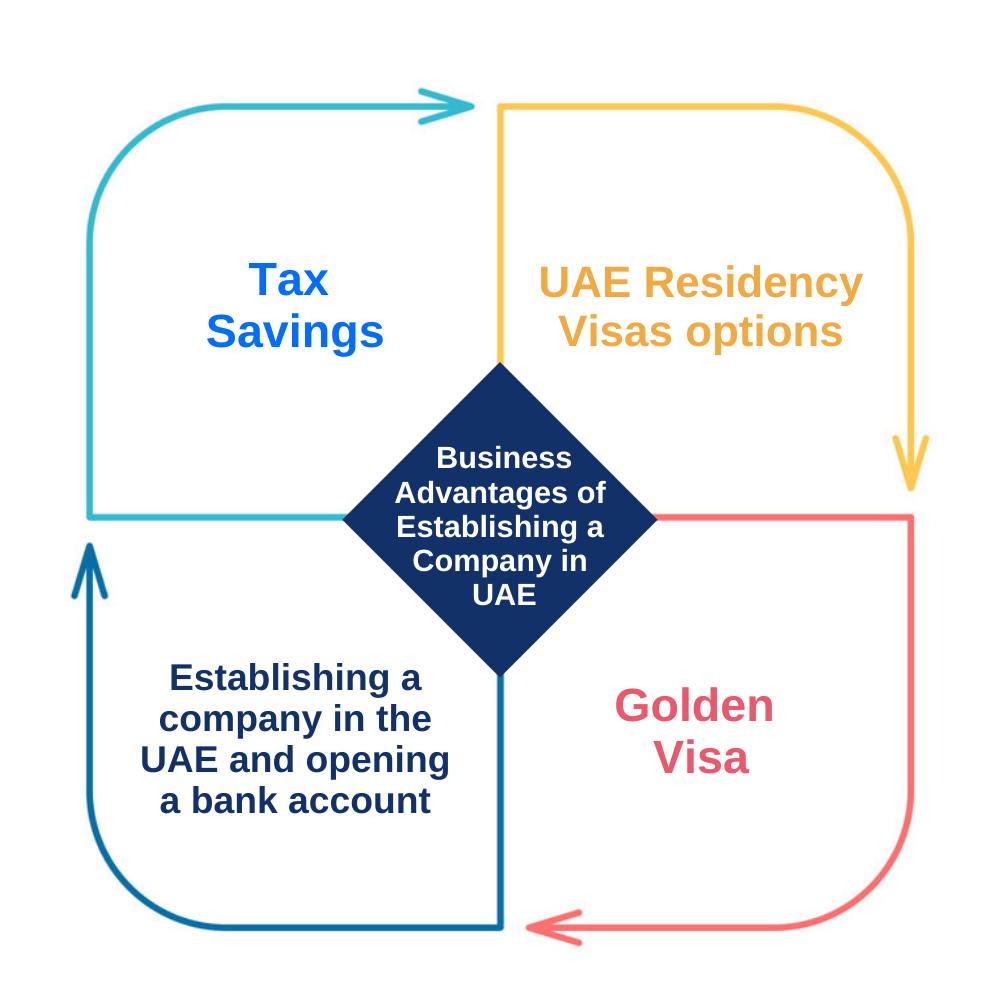

Tax savings, UAE residency visas, and corporate bank account establishment are the main reasons for forming a corporation in the UAE.

Major Business Advantages of Establishing a Company in the United Arab Emirates

When establishing a business in the UAE, there are numerous advantages, including 100 percent foreign ownership in Freezones, tax savings, a wide range of resident visa possibilities, fast bank account establishment, a growing business environment, and more.

In the region, there is no personal or company income tax. The only tax imposed in the UAE is a 5% VAT on all active transactions.

Tax Savings

Setting up a business in the UAE allows an entrepreneur to save a large amount of money in taxes in their home country. Investors in the UAE can apply for a tax residence certificate and take advantage of the 117-country Double Taxation Avoidance Agreement (DTAA) that the UAE has signed.

It will allow UAE-based investors to avoid paying taxes in their home country on profits or Investments made in the UAE.

VAT Free Trade Zones may make it easier for investors to pay VAT on all transactions that take place within the zone. The privilege of VAT calculations will be granted to a Vat Designated Zone.

Companies registered in a designated Free Trade Zone, on the other hand, have a few exclusions from paying VAT.

Options for UAE Residency Visas

Student and family visas, retirement visas, and remote working programmes are just a few of the new choices for UAE residency visas. In recent years, the UAE has revealed a slew of residency alternatives for expats looking to stay in the UAE with their families.

Students can support their families by sponsoring them.

Ex-pat students will be able to sponsor their family under the new regulation if they are financially capable and meet specific conditions.

Virtual Program on the Internet

The next option is a ‘Virtual Working Program,' which is for those who live and work outside of the UAE and want to relocate there.

You can relocate to Dubai through the Virtual Working Program and continue working for the organisation you're with remotely.

Entrepreneurs and professionals who live and work outside the UAE can now stay and use the facilities in the UAE. They can also sponsor the family for a year in the UAE, which can be renewed by paying a fee and reapplying.

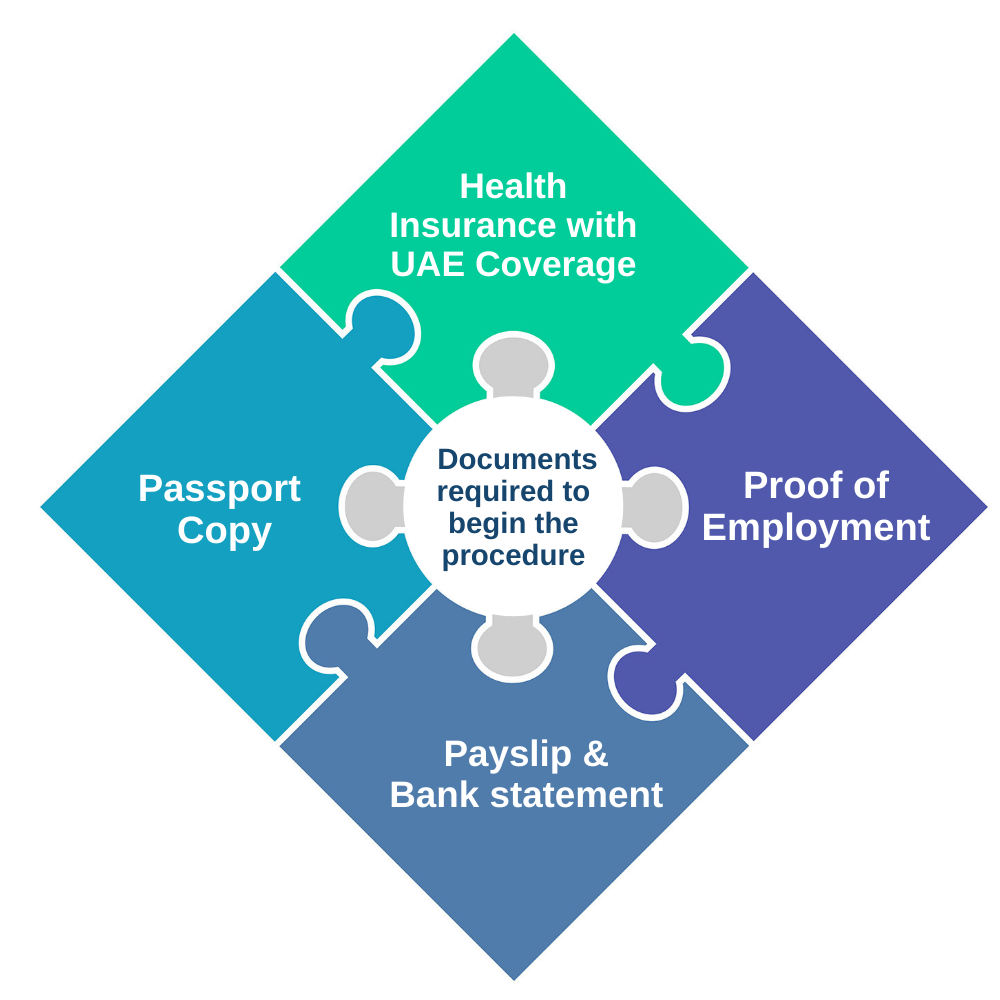

Documentations

To begin the procedure, you must submit the following documents.

- Passport copy, (Valid for at least six months)

- Health Insurance with UAE Coverage

- Proof of employment from the current employer with one-year contract validity. (Minimum 18,000 AED salary)

- Last month’s payslip and 3 month’s bank statement

The Dubai Tourism Department is in charge of the visa process. The paperwork, as well as the visa fee, medical insurance, and processing fee, must be presented to them.

Visa for Retirement

Ex-pats over 55 years old who match specific eligibility conditions can now apply for a 5-year renewable retirement visa in the UAE.

To apply for a retirement visa, ex-pats must have the following documents ready.

- A valid medical insurance card covering the United Arab Emirates is required.

- Meet the financial requirements (Any one of the 4 criteria).

- You must own a property worth at least AED 2 million. (Not a mortgaged property)

- In the UAE, make a bank deposit of at least AED 1 million.

- If you have a monthly income of at least AED 20,000 or an equivalent in another currency, you must provide proof of income.

- AED 2 million is the total worth of the property and savings. (Property Value + Bank Deposit)

Documentations

- Individual and dependents' passport copies

- For the sponsoring spouse, a copy of the marriage certificate is required.

- A copy of the visa that is currently valid (if a resident of UAE).

- A copy of the emirates identification card (if a resident of UAE).

- A copy of a current health insurance policy is required.

- Address and phone number for your current residence.

Proof of Funds Documents

The relevant documentation must be submitted depending on the application options chosen.

- Copy of the property title deed detailing the purchase price.

- The value of the deposit is stated in a letter from the bank.

- Bank As proof, provide a statement for the previous six months and proof of income.

Read More: All you Need to Know about 100% Company Ownership in the UAE

Golden Visa

Ex-pats in the UAE can now apply for long-term resident visas that allow them to live, work, and study in the country known as Golden Visa.

The best part about this Visa is that it does not require a national sponsor. The Federal Authority for Identity and Citizenship issues the visa to the individual.

Establishing a company in the UAE and opening a bank account

Opening a Business account in the UAE is a necessary step for most businesses to efficiently handle their financial activities.

The United Arab Emirates has a strong network of foreign and local banks that provide competitive business banking services. Investors can apply for a bank account with the appropriate banking partners based on the company's operations, annual turnover, and other characteristics.

By examining your company portfolio and the nature of your business operations, experienced advisors like Dhanguard can help you choose the proper business banking network provider for your organisation.

Conclusion

The UAE boasts one of the world's most open and dynamic economies. The UAE's advantages in international business have been recognised by a number of global business indexes.

The UAE is an attractive destination to do business because of the aforementioned qualities, as well as its strategic geographic location, increasing infrastructure, and extremely safe environment. To learn more, contact Dhanguard.