Free zones assist investors in establishing businesses in the UAE by providing the necessary infrastructure and business support.

With multi-national firms and startups establishing their presence in the region and driving the business ecosystem, the UAE is one of the world's fastest-growing business centers.

What is a Free Zone?

Free zones are geographically defined areas within the UAE (although most are not fenced or gated) that allow 100 percent foreign ownership and are usually dedicated to a single industry. They were created with public funds and feature state-of-the-art facilities to facilitate strategic change in critical industries (e.g. finance).

The Dubai Media City, for example, is a free zone in the emirate of Dubai with infrastructure and licenses tailored to the media industry's needs. Similarly, the Dubai Worldwide Financial Centre (DIFC - see below) draws financial services organizations such as insurance, financial services, and investment firms, as well as banks looking to expand their international client base.

As a result, each free zone has its own set of restrictions in terms of minimum capital, office or warehouse space, and permissible activities, as well as the necessary licenses and legislation to enable its designated industry to thrive.

What Role do free zones play in the Establishment of Businesses in the UAE?

The region's Free Zones are primarily responsible for business setup in the UAE. The importance of the Free Zone in bolstering the UAE's economy cannot be overstated.

The UAE's 40+ Free Trade Zones provide the ideal starting point for firms looking to start small and scale up while keeping overall business operations and overhead costs low.

In addition, the Free Zones provide investors with superior infrastructure and business support. The ease of establishing a firm, 100 percent foreign ownership, zero corporate tax, a simple UAE residence visa, a diverse selection of office facilities and services, and more are luring international investors to the UAE's Free Zones.

What do UAE Free Zones have to offer?

As the number of specialty free zones in Dubai grows, so does their influence on the UAE economy.

Around 150,000 businesses operate in Dubai's free zones.

The Jebel Ali Freezone, which was the country's first free zone, set the standard for laws and incentives. Its quick development has served as an economic model for the other Emirates, which have established their own free zones to attract investment.

When it comes to founding a firm, the key advantages that investors have are:

- 100% foreign ownership

- 100% repatriation of capital and profits

- 100% free transfer of funds

- 100% exemption from import and export duties

- Free zone company formation is quicker than incorporation outside in the city

- Inexpensive workforce and easy recruitment procedures

- 25 years lease options, warehouse facilities, availability of areas for production and assembling, etc.

How the UAE's Free Zone Business Ecosystem Benefits Investors?

With enterprises, a large network of banks, business-friendly government programs, Free Trade Zones, start-up funding endeavour’s, financial markets, infrastructure assistance, and more, the UAE has established a powerful business ecosystem.

The Business Setup in UAE is driven by the Free Zone business ecosystem, as well as the UAE government's business-friendly programs and infrastructure assistance.

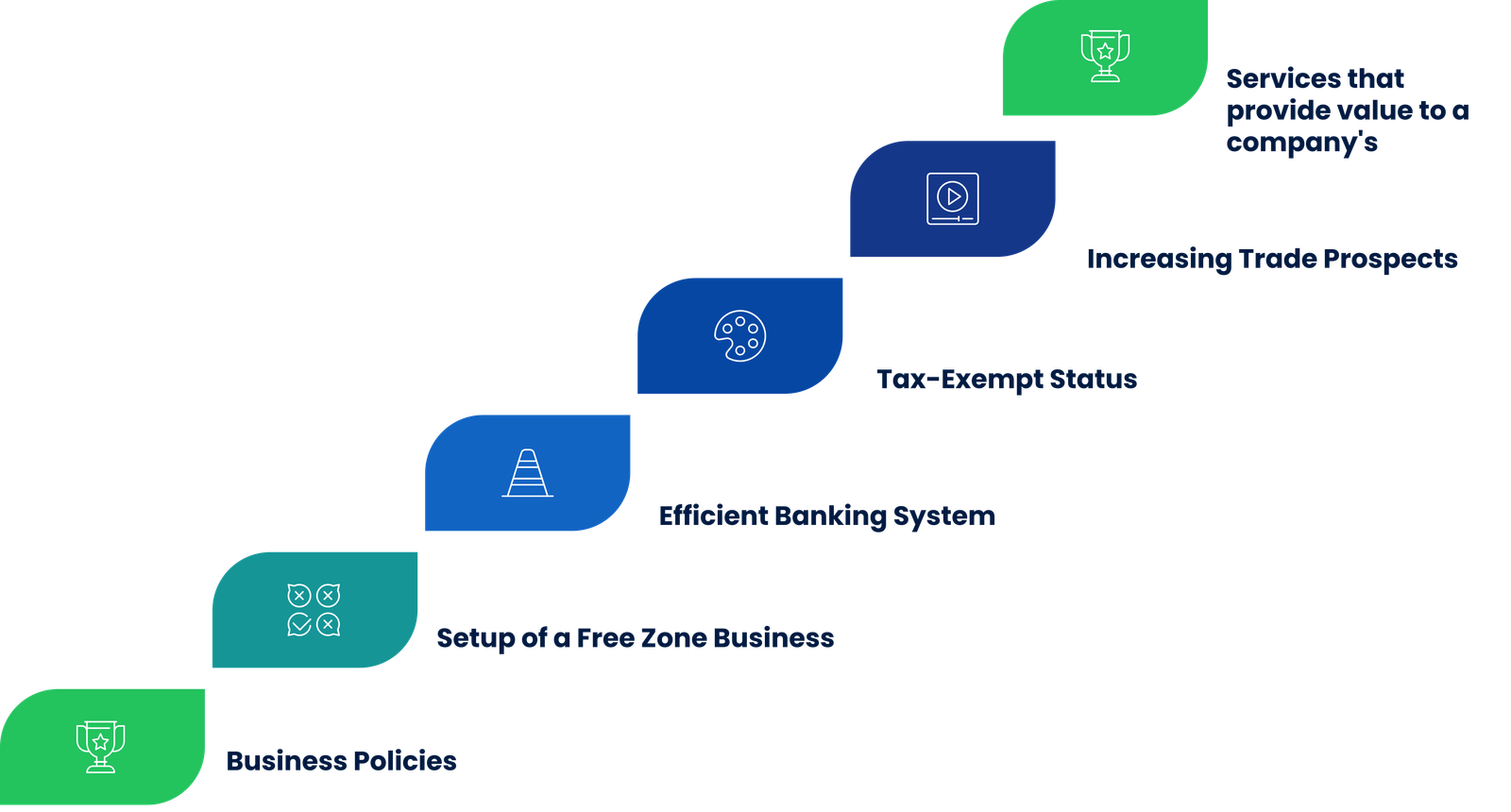

Business Policies

The UAE features some of the world's most business-friendly legislation and regulations. It promotes business formation and provides a simple company formation process.

By utilizing the numerous company setup packages offered by the Free Zones, investors can enjoy a hassle-free business setup in the UAE.

The UAE's Free Zones offer customized business establishment packages tailored to the needs of investors.

Setup of a Free Zone Business

The Free Zones provide a wide range of business infrastructure amenities to entrepreneurs, ranging from Flexi-Desks to executive offices and specialized warehouse spaces.

The UAE's Free Zones provide the most competitive pricing, with business licenses starting at AED 11,500 and no Visa Quota.

In addition to awarding business licenses, the UAE's Free Zones provide a variety of amenities and business support services, including investor visa processing, in-house customs clearance (for a limited number of free zones), and more.

Efficient Banking System

With international and national banks, the UAE boasts a well-established and robust banking network. Entrepreneurs can choose from a choice of financial services based on their individual business needs.

The creation of a bank account is subject to specific documentation requirements as well as strict Know-Your-Customer (KYC) compliance. The fight against unlawful transactions is a top concern. In the United Arab Emirates.

Various Free Trade Zones have cooperated with UAE national banks to make it easier for international investors to create accounts and form businesses in the UAE.

Tax-Exempt Status

There is no corporate or income tax in the UAE; instead, a 5% Value-Added-Tax (VAT) is imposed on corporations and individuals for any trade or transaction invoiced in the UAE.

Only a few of the region's designated Free Zones are VAT-free. As a result, businesses operating in these designated Free Zones are exempt from paying VAT in the UAE.

There are, nevertheless, a few requirements that must be completed in order for a company to be classified as VAT-Exempt. The company must either do business within the designated Free Zone or be solely engaged in international trade to qualify for the VAT exemption. VAT applies to all transactions that take place within the UAE.

Increasing Trade Prospects

The United Arab Emirates is strategically located between east and west, connecting the world. It serves as a commerce route connecting Europe and Asia.

Entrepreneurs have a plethora of options, ranging from trading to providing IT services. E-commerce is the newest trend in the UAE, with more people opting to shop and fulfil other daily needs online.

The UAE's strong business and logistic infrastructure makes it the top choice for entrepreneurs looking to start a firm.

Services that provide value to a company's

The UAE's Free Trade Zones offer a wide range of value-added commercial services to UAE investors.

There are registered Business Consultants that assist investors in setting up their businesses in the Free Zones of their choice. To have a seamless company setup procedure and save money in the long run, it is best to seek the advice of an expert business consultant.

Conclusion

In a word, the UAE is an excellent place for an entrepreneur to launch a business and scale it up smoothly. UAE is a wonderful family-friendly business hub to live, work, and settle due to its abundant business infrastructure and better lifestyle.

Connect with our professional staff right away to learn more about company formation in the UAE. Contact to us at Dhanguard.com