Start-ups in the finance and fintech industries have taken off in Dubai. Financial technology (Fintech) in Dubai, in particular, is undergoing a transformational period of change. As a result, there has been an increase in demand from both commercial and private clients.

As a result of the pandemic, financial support from local and international banks as well as other financial institutions in the UAE increased.

Dubai's Fintech Industry is Growing

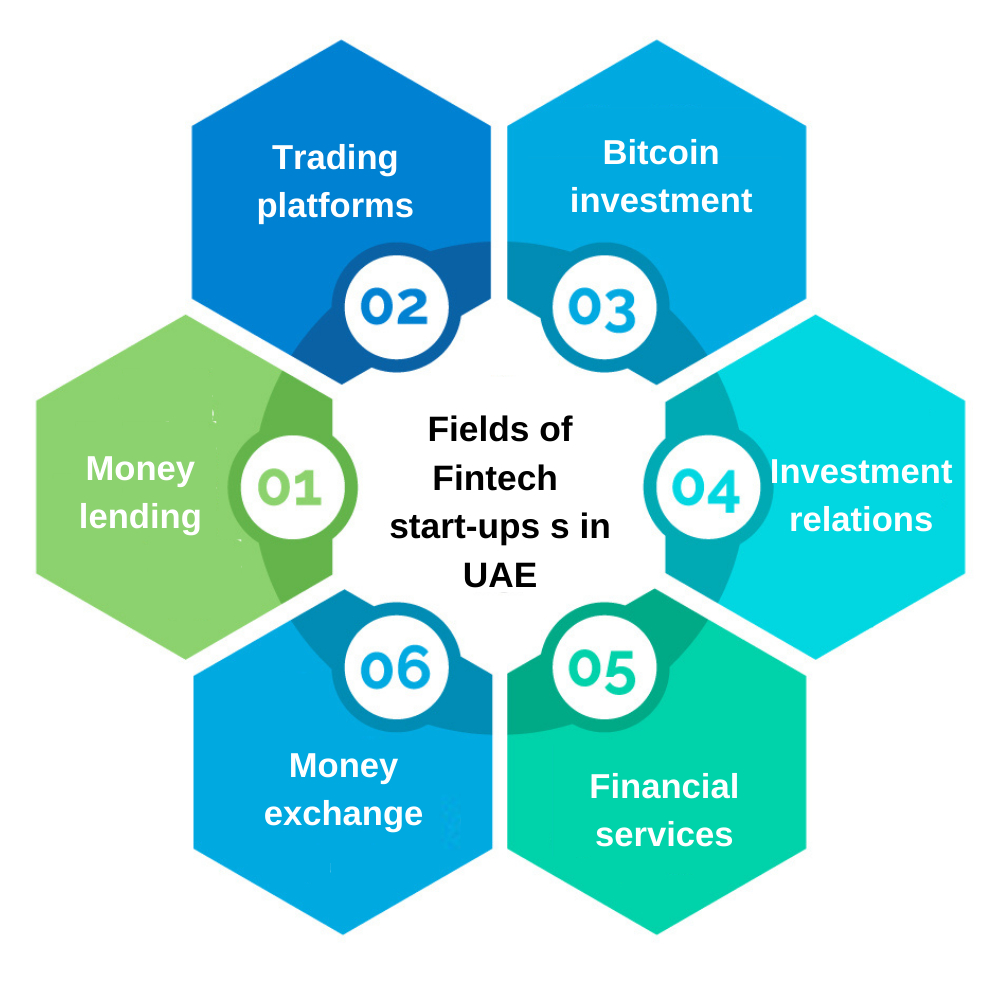

Companies and Fintech start-ups in various fields. There are many types of money lending and trading platforms out there.

- Money lending,

- Trading platforms,

- Bitcoin investment,

- Investment relations,

- Financial services,

- Money exchange, and more.

Increasingly, Dubai's financial and fintech ecosystem is expanding, and more companies are venturing into the space market. By providing financial assistance and solutions to other industry segments that are experiencing downtime as a result of the pandemic, the UAE's finance sector contributes significantly to the country's economy.

As a result of Dubai's Stimulus Package, many small and medium-sized businesses have been able to stay afloat and continue operating.

In a downturn in the hospitality, Real Estate, and tourism industries the financial sector grew. Financial companies are flocking to finance-specific zones, such as Dubai International Financial Center, according to the Dubai Statistics Centre (DIFC).

What is Fintech?

When it comes to financial technology, things are moving fast, both in terms of technology and geographic boundaries merging. Using customer data to provide targeted financial advisory and support services to customers is all that is involved in this process.

A wide range of financial services are available through it – including online payments and credit facilities as well as money lending and foreign currency transactions, as well as mobile app-based transactions, among others.

Scope of Dubai's FinTech

So that Fintech services can provide a seamless transaction, financial regulators around the world must show some flexibility when it comes to relaxing certain financial laws.

Also, maintaining regulatory standards and avoiding any risk of misrepresentation or money laundering acts should be considered.

Fintech, which combines financial institutions, financial regulators, and technology, has the potential to have a significant impact on the way we handle finance on the commercial and personal fronts. Fintech solutions make transactions more transparent and secure.

Artificial Intelligence (AI) advancements can now identify different customer transactions and suggest specific financial solutions based on the transaction history.

Changes in Financial Business Models

Several new Fintech firms are obtaining banking licences in order to compete with established international banks.

Bank solution providers and Fintech companies are working together to streamline financial products and services for as many customers as possible.

It is also possible to create a proprietary Digital infrastructure in order to enhance the brand's digital offerings.

To reach the unbanked population, new banking service revolutions are opening up new avenues of opportunity. As well, provide them with efficient banking products to meet their daily needs.

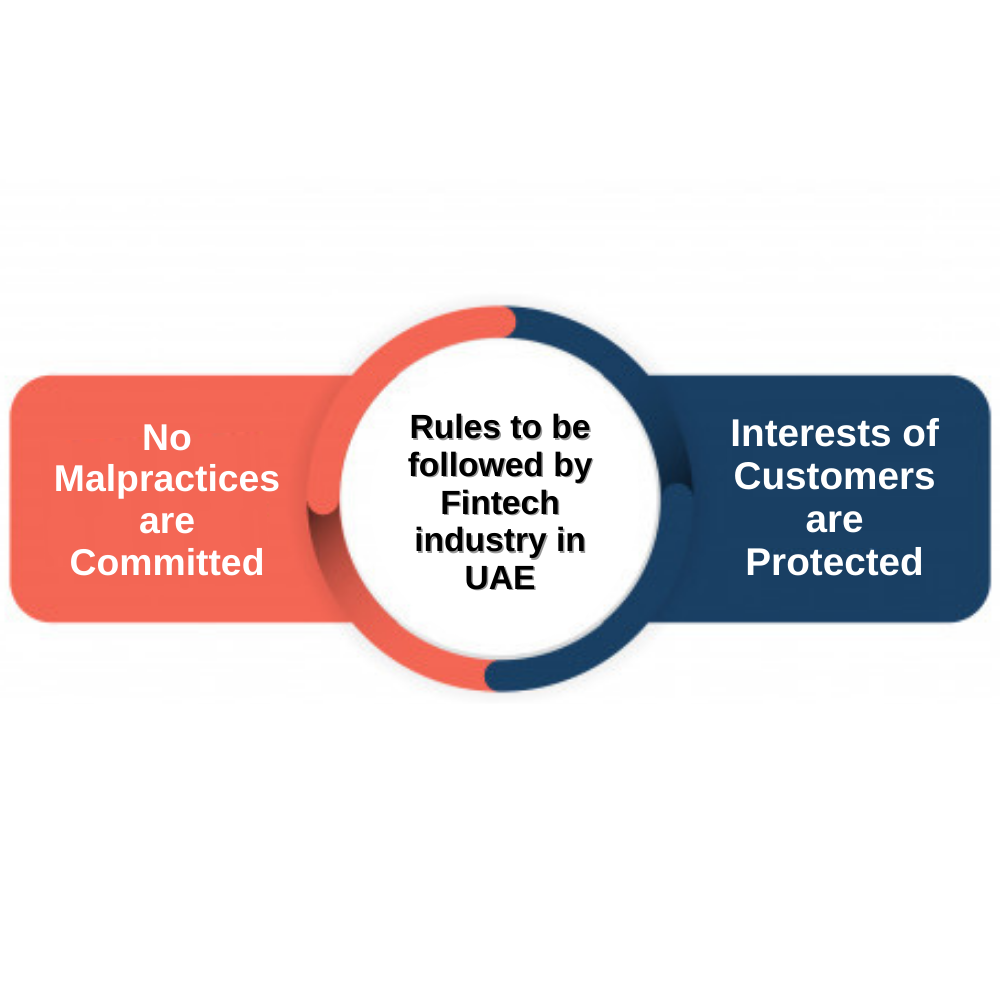

Rules that must be followed

The Fintech industry is still heavily regulated, with the Central Bank providing guidelines to ensure that no malpractices are committed and that the interests of customers are protected.

Fintech Solutions, on the other hand, are favoured by government financial regulations in order to generate successful products and services that assist the public in spending, saving, investing, and transacting efficiently.

Fintech Companies Can Set Up Shop in the United Arab Emirates

The UAE's Fintech Ecosystem is quickly expanding, and the UAE's Freezones are one of the primary drivers of this growth, particularly among Fintech start-ups.

Specific free zones, such as Abu Dhabi Global Markets (ADGM), Dubai International Financial Centre (DIFC), Dubai Multi Commodities Centre (DMCC), Dubai Airport Free Zone (DAFZA), Dubai Technology Entrepreneur Centre (DTEC), and others, offer the ideal environment for start-ups and other businesses to grow.

Fintech companies can design, test, and manage their solutions in specific business incubators in Freezones like the ADGM. The Financial Services Regulatory Framework (FSRA) would control the companies registered in ADGM to ensure complete transparency and the absence of any anomalies in their transactions.

Conclusion

Fintech enterprises benefit from technical improvements as well as a strong network of international and local commercial banking solution providers. It will assist them in launching their support services, either in collaboration with banking providers or independently, in order to meet the region's expanding demand. Connect with our Specialist Business Consultants right immediately to learn more about starting a Fintech company in the UAE and the stages required in company formation!