The United Arab Emirates is a prominent economic hub that attracts international investors from all over the world. Despite the decline caused by Covid-19, the number of company licenses issued in the UAE is increasing. The process of establishing a business in the UAE entails a series of procedures that investors must complete in order to obtain a business license.

According to reports, the Dubai Economy will grant around 42,640 new company licenses in 2021. The growth of new business licenses is on the rise, thanks to the Free Trade Zones' attractive savings and competitive company formation packages.

Where Should You Begin When Registering a Company in the United Arab Emirates?

For entrepreneurs with a business idea, there are a variety of choices for forming a company in the UAE. Setting up a business in the UAE is dependent on a number of variables, the most important of which is the Business Jurisdiction in which the firm is founded.

Each free trade zone offers a distinct set of benefits, similar to mainland company formation options. Depending on the investor's business needs, the nature of the business activity, staff size, budget, and other factors, the best option must be chosen.

What is The Best Place to Start a Business?

In the UAE, investors have a plethora of possibilities for forming a business. The first and most significant stage in the creation of a company is to choose a business jurisdiction.

In the United Arab Emirates, companies are founded in the Mainland, Free Zones, and Offshore jurisdictions. For investors, establishing a firm in one of these jurisdictions has advantages in establishing a business in the United Arab Emirates

The most significant distinction between the three jurisdictions is that in the case of a Free Zone company, the ex-pat has total ownership. Free Zone firms are more flexible and fully protect the ex-100 pat's percent ownership of the business.

When it comes to mainland business establishment, however, there is a new amendment to the Firms Law that allows 100% ex-pat ownership in mainland companies and eliminates the necessity for a UAE person to serve as the sponsor.

There are around 122 business activities where 100% ex-pat ownership is permitted.

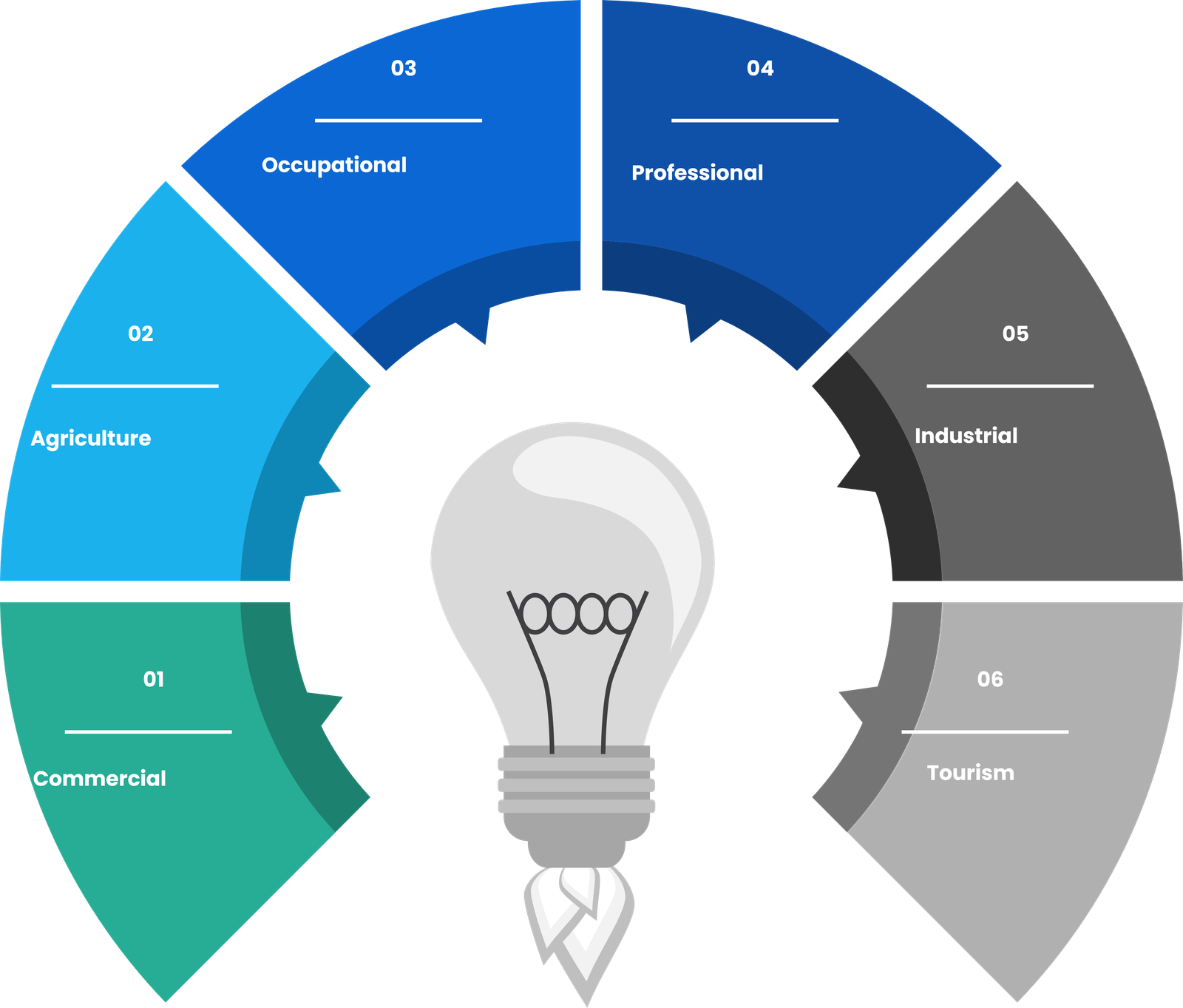

Types of Business Licenses

To start a business in the UAE, there are six different types of business licenses to choose from:

- Commercial (General Trading, Contracting, Real Estate, Transportation, etc.)

- Agricultural Sector (Farms, Fisheries, etc.)

- Occupational/Craftsmanship (Carpentry, Blacksmithing, Printing, etc.)

- Professional (Consultants, Lawyers, Auditors, etc.)

- Industrial Sector (Factories, Manufacturing, etc.)

- Tourism (Hotels, Travel Agencies, Restaurants, etc.

Legal Business Structures

The following factors determine a company's legal status:

- Sole Proprietorship/Individual Establishment

- Business Corporates / Companies

- Limited Liability Companies (LLC)

- General Partnership Company

- Public Joint Stock Companies

- Private Joint Stock Company

- Branch of a Foreign Company

Approvals are Needed.

Depending on the business activity, economic departments or authorities may require additional approvals.

For example, Dubai International Financial Centre is the ideal option for some particular business operations such as establishing a law practice in the UAE.

However, after extensive due diligence including KYC and compliance checks, the DIFC follows a rigid compliance process for obtaining the legal practice license.

Following DIFC approval, the investor must get approvals and permits from the Dubai Legal Affairs Department in order to practice law in the UAE successfully.

Approvals for a Specific Business Category

In some situations, building a cafeteria or restaurant in the United Arab Emirates necessitates specific approval from the Dubai Municipality and the Department of Food Safety.

To begin operating in the UAE, strategic industries such as finance, banking, healthcare, tourism, and others will need a special permit from the ministry and other government authorities.

Documents Required for Establishing a Business in the United Arab Emirates

To obtain a business license and establish a company in the UAE, the following documents must be submitted to the appropriate authority or business jurisdiction.

- Shareholder’s and manager’s valid passport copy

- most recent entry stamp into the UAE, UID number (on tourist visa copy) or UAE residence visa, and Emirates ID copy (if already a resident of UAE)

- Certain Free Zones and activities in the mainland require a business plan with a detailed description of the business activities

- Duly filled-in license application form, pre-approvals (if applicable), attested professional qualifications, or university degrees.

The Cost of a Business License in the United Arab Emirates

The cost of a business license in the UAE varies depending on the business jurisdiction, kind of license selected, office space needs, capital requirements, local sponsor costs, and other factors.

The UAE's Free Trade Zones are the most cost-effective way to start a business.

Particularly in the northern emirates, such as Sharjah, Ajman, and Ras Al Khaimah, the cheapest company creation options are available.

Selecting a Bank Account

Investors can open accounts and conduct business with UAE banks in a variety of ways.

In the United Arab Emirates, corporate banks have strong KYC standards and compliance requirements. Depending on the company structure, nature of the business activity, shareholder profile, and other factors, the bank may impose various restrictions, such as depositing a minimum share capital, maintaining a minimum balance, and so on.

Conclusion

To obtain a business license in the UAE, a well-structured procedure must be followed, which includes permissions from a number of government departments. In order to effectively incorporate a company in the UAE, investors must also meet certain compliance standards.

As a result, it is advisable to seek the advice of a knowledgeable Business Consultant who is familiar with business processes in both free zones and the UAE's mainland, as well as resident visa requirements and regulations.

Connect with us at Dhanguard right away to learn more about company formation in the UAE.