Considering starting a business in the UAE could lead to a dramatic change in your life. When it comes to business, the UAE is a place of experimentation, investment, and enjoying the benefits of one's labour. In terms of potential, favourable business conditions, geographic location, rules and laws, and liquidity choices, it is everything an entrepreneur dream of.

Overseas entrepreneurs looking to start a business in Dubai/UAE have a wide range of zones and jurisdictions to select from. The two most popular options are the free zone and the mainland. Both have their own set of advantages and disadvantages. Foreign ownership can be 100 percent in Freezones, but it can be limited on the Mainland.

What is Branch Office & Representative office?

Representative Office in the UAE: A representative office is essentially an extension of an existing firm, which can be based in the UAE or elsewhere. This can lead to it being confused with a branch office; however, the difference is that the business activity and work procedures are not the same. A representative office in the UAE, on the other hand, cannot conduct business in the UAE and make a profit.

Branch Office in UAE: A branch office in the United Arab Emirates is a site where a business is done that is separate from the main office. Branch offices are generally made up of smaller divisions that deal with various parts of the business, such as human resources, marketing, and Accounting. Both the Mainland and the Free Zone have a branching legal system.

Why Open a Representative Office in the United Arab Emirates/Dubai?

One of the main advantages of establishing a representative office in Dubai, tailored to your specific requirements, is that it is incredibly cost-effective. A capital stake is usually not required to start a representative office. Because most of the resources remain with the parent company, business activities are usually smaller, and operating costs are reduced as well. Because it is considered an extension of the parent company, you can keep 100% control of the company with a free zone configuration.

Existing firms might benefit from a representative office as a potent promotional and marketing tool. This gives you a strong foundation in the rapidly increasing UAE market, allowing you to expand your business at home at cheap expenses and under favourable tax conditions.

Why Open a Branch Office in the United Arab Emirates/Dubai?

A branch office is one of the most essential business structures that a foreign corporation can establish in Dubai to make investments in specialised industries. In comparison to the liaison office, they are a more convenient choice because they engage in commercial operations and generate income. The parent company's branch office is an extension of it.

In terms of taxation, branch offices offer the same benefits as any other local firm in Dubai, including profit repatriation without additional levies when established in Dubai.

Benefits of Establishing a Branch Office

1. Tax Advantage

This is possibly the most appealing aspect of a branch office setup. The UAE has a 0% corporate tax rate, making it a particularly attractive place to open a branch.

2. Audits Streams

When it comes to foreign auditing, the process becomes more challenging. To a large extent, segmenting and establishing a branch office is beneficial. It is considerably easier to track the cash that transfer between the parent and branch offices, which makes the audit process much easier.

3. Minimal administrative overhead

Setting up a branch office can help a lot because it eliminates the requirement for a separate financial function and eliminates the need for audited accounting.

4. Cost-Effectiveness A Path to a New Market

In most cases, establishing a representative office does not necessitate the use of share capital. Only regular fees, applications, and first deposits must be paid, which proves to be a very cost-effective solution.

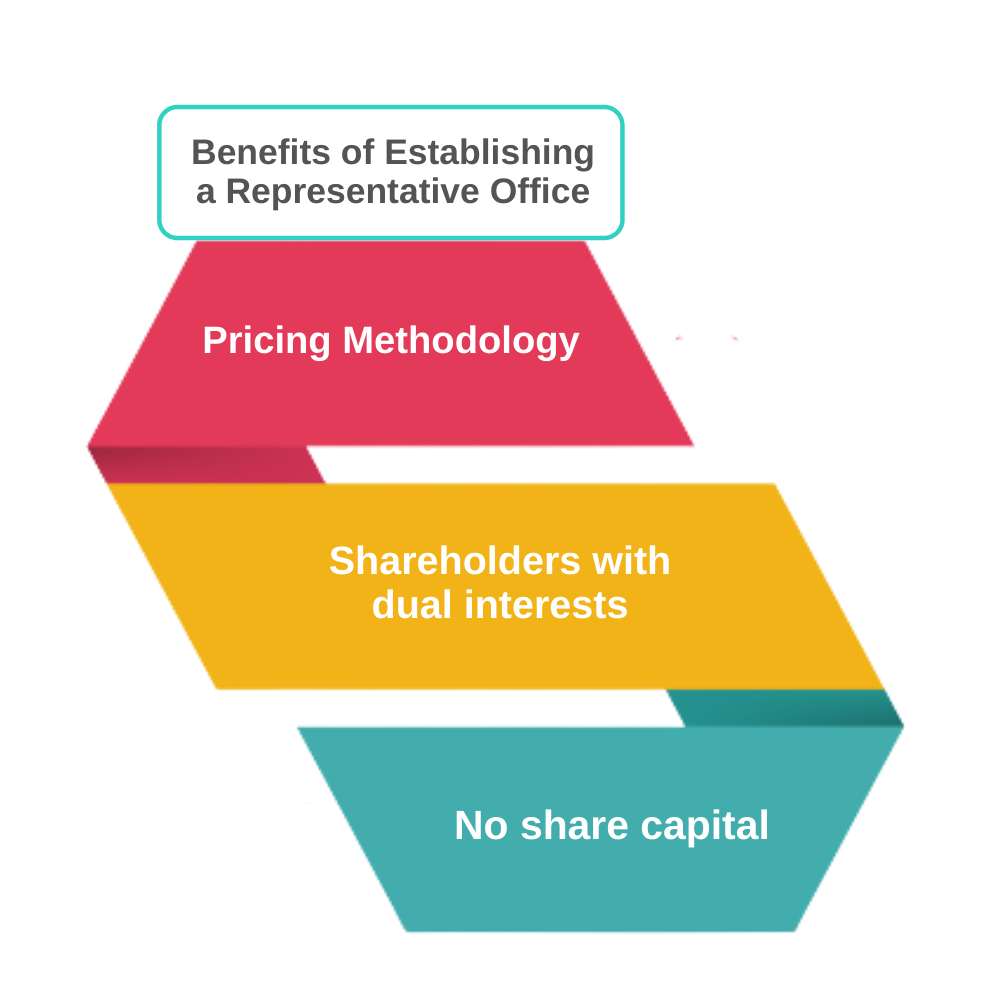

Benefits of Establishing a Representative Office

1. Pricing Methodology

A representative office in the United Arab Emirates costs roughly AED 100,000 to set up.

2. Shareholders with dual interests

It is possible to set up a representative office with several shareholders, up to a maximum of 50.

3. There is no share capital.

It is feasible to open a representative office in the UAE without a minimum share capital requirement.

Read More: 6 Reasons Why You Should Invest in LLC Company Formation in Dubai

Various types of foreign business entities

Depending on the business activity, a foreign firm may pick one of four types of corporate entity structures to establish as an offshoot in the UAE:

1. Shareholder in a corporation

It is a legal entity that owns stock in another limited company and has the same rights as a non-corporate shareholder. The parent firm can be situated in the UAE or anywhere in the world. It gives shareholders the right to vote at general meetings, receive a percentage of the company's income as dividends, and receive the capital contribution if the company is wound up.

2. Branch Company

The parent firm, like a corporate shareholder, can be situated in the UAE or elsewhere. A branch company differs from a corporate company in that the parent business remains the sole owner of the branch company, and the child company follows the parent company's articles of association.

3. Representative Office

A UAE national or a foreign firm can be the parent company. The key difference is that a representative office is not authorised to create individual profits, and its business operations are limited to parent company promotion and sourcing.

4. Subsidiary

Out of all of the aforementioned branches, this is the most distinctive. It has its own identity independent from that of its parent company and is completely responsible for its business decisions. The parent firm might be situated in the UAE or elsewhere, but the management must be based in the UAE.

How can I open a branch office in the United Arab Emirates?

There are a few steps to opening a branch office in the United Arab Emirates:

1. Make a list of local agents.

This is the first task that must be completed. Identifying a local agent is one of the most common activities that both branch and representative offices do. The local agent must be a UAE national or a firm that is entirely owned by UAE nationals.

2. Make a Trade Name Reservation

An application for trade name reservation and office registration approval must be submitted to the Emirate's Department of Economic Development (DED).

3. Submit an application to the Ministry of Economy

The application must include a complete image of the firm, including information about the share capital, the head office, the nature of the business, the name of the general manager in the UAE, and other required documents for approval.

4. Obtain a Department of Economic Development License

The Ministry of Economy (MOE) will provide a clearance letter to either the Abu Dhabi Department of Economic Development or the Dubai Department of Economic Development after the appropriate documents have been submitted and examined. At this point, the customer must submit a new set of documents in addition to the original application. These are some of them:

- MOE approval was received, as well as various industry-specific approvals.

- A copy of the proposed lease in the United Arab Emirates.

- Copies of documents submitted to the Ministry of Education.

- The overseas parent company's undertaking.

- A letter from the UAE auditor certifying its existence and describing the parent company's two-year financial results.

The DED will issue a business licence for a period of one year upon the submission and verification of the aforementioned documents, and it will be subject to annual renewal.

5. Carry out administrative responsibilities

After receiving the licence, you can focus on other aspects of company formation, such as finding office space, Opening Bank Accounts, and obtaining visas and labour cards for staff.

6. Join the Chamber of Commerce and Industry as a member

The final step is to join the Abu Dhabi Chamber of Commerce and Industry by submitting an application with copies of the office lease agreement and a business licence from the Department of Economic Development.

Documents Required to Open a Branch Office in the United Arab Emirates

Documentation plays an important part in each phase, as we've seen. Let's have a look at the mandatory documents for opening a branch office in the UAE, which include:

- Trade name reservation and initial approval forms

- Certificate of Incorporation, Memorandum of Association (MOA), Articles of Association (AOA)

- Board resolution that authorizes the opening of the branch office, certificate of good standing

- Power of attorney in favour of General Manager

- Director’s passport copy

- Audited accounts of the parent company for the last two years

- A statement that highlights the company’s establishment aim, main operational activities

- Notarized agreement with the local agent

- Government approval

A representative office must register with the following agencies before engaging in business activities:

- Ministry of Economic and Commerce

- Company Registrar

- Chamber of Commerce

Advantages of Opening a Branch or Representative Office in the United Arab Emirates

Let's take a brief look at the advantages of establishing a branch or a representative company in the UAE:

- Foreign investors have the possibility of 100% ownership.

- Owning a bank account allows you to be more flexible.

- The confidentiality of business information is rigorously protected.

- There is no business tax.

- Personal income tax is 0%.

- Imports are subject to a 5% minimum charge.

Three basic differences between Branch Office and Representative Office

The three main distinctions between a branch office and a representative office in the UAE are as follows:

Activities: Representative offices do not engage in any sales, service, or commercial activity. Its main purpose is to promote the parent firm. A branch office, on the other hand, can perform both functions.

Sponsorship:

The notion of sponsorship is only applicable to Mainland branch offices.

Banking Procedures:

Only Mainland branch offices are eligible for the refundable deposit bank guarantee.

That's it in a nutshell. A representative office is a branch office set up by a parent business for the purpose of marketing a foreign company in the UAE market. In the UAE, a representative office cannot export, import, or sell. A representative office exclusively does promotional work for its parent company's products and services. A branch office, on the other hand, can do business in the UAE while also serving as a marketing tool.

Conclusion

Setting up a branch or a representative office serves as a supporting pillar and an extension of the parent company, ultimately assisting them in capturing the mass market in various parts of the world. Do you intend to open a branch office in the United Arab Emirates? It's a wise move that will help your company expand at a faster rate on a global scale. As business advisors, Dhanguard is familiar with the establishment procedure and has assisted a number of clients in establishing their businesses in the UAE. If you'd like to move on to the next level, please contact us; we'd be pleased to help.