An existing corporation (or other form of corporate entity, such as a limited liability company or LLC) that conducts business in a state or jurisdiction other than where it was originally incorporated is referred to as a foreign company in the UAE. The phrase refers to domestic firms incorporated in another state as well as international corporations incorporated in a country other than the UAE (known as "alien corporations"). Before conducting business in a emirate, all foreign corporations must register within the UAE.

A foreign company can establish a branch or subsidiary in the UAE and coordinate its operations with its parent company in its home country.

A foreign company's branch or subsidiary in the UAE must be registered with the appropriate government authorities.

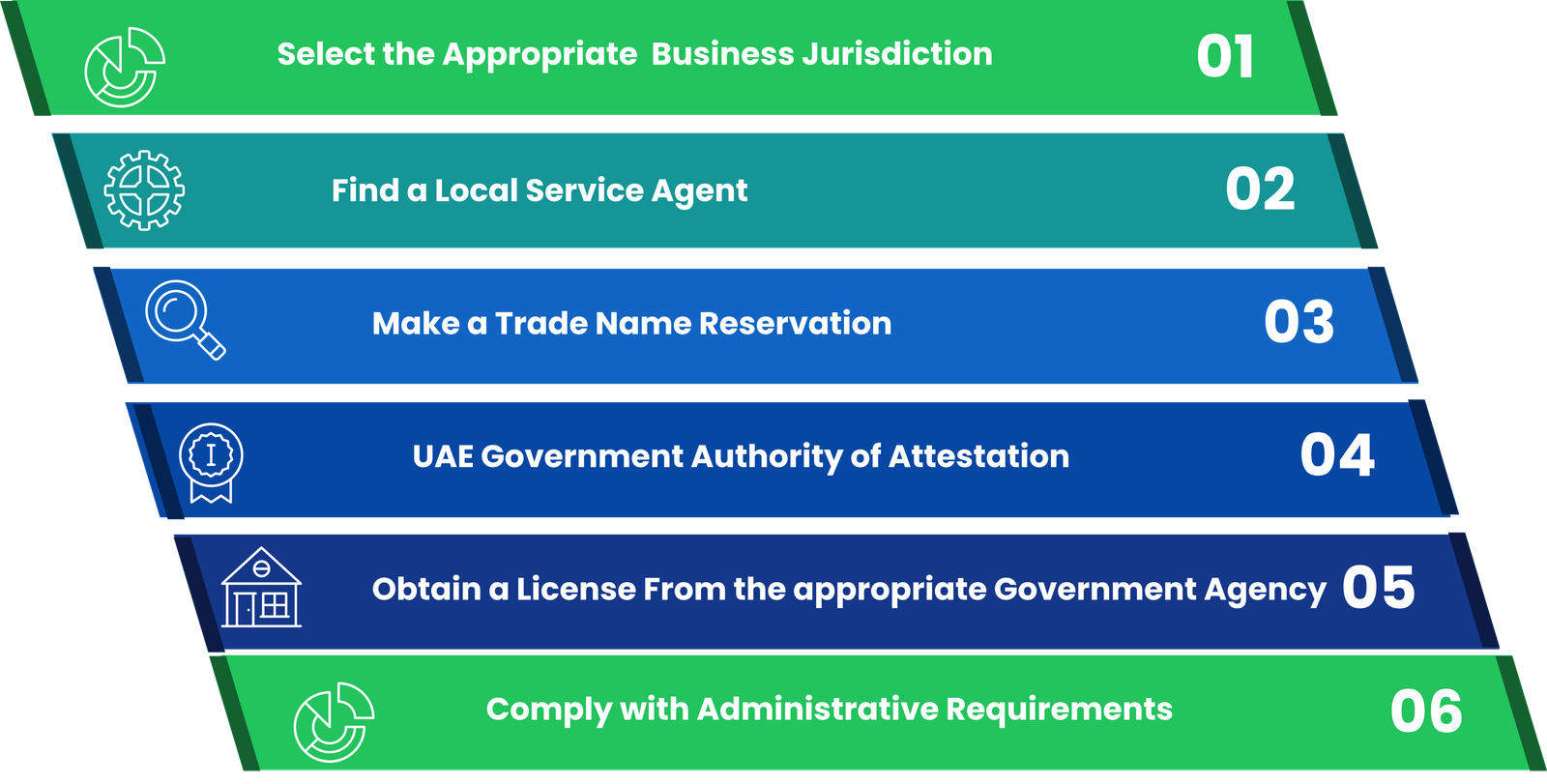

How To Set Up a Foreign Company In UAE

A branch office is a division of an existing company, not a separate legal entity from the parent company. Furthermore, Branch Offices are permitted to engage in the same business operations as their parent company in the United Arab Emirates.

A subsidiary company, on the other hand, is considered a legal entity independent from the parent firm. As long as the subsidiary firm has a valid Trade license in the UAE, it can engage in whatever activity it wants.

A subsidiary's business operations must be managed from the UAE, and it bears full responsibility for its actions, business activities, and management.

In the United Arab Emirates, a Branch Office/Subsidiary can be established in two business jurisdictions: the Freezones and the Mainland.

Attestation of Documents for the Establishment of a Branch Office in the United Arab Emirates

The attestation of the four major company documents from the UAE Embassy in the parent company's home country, as well as counter-attestation from the UAE Ministry of Foreign Affairs, is required for the registration of a Branch Office/Subsidiary.

In the United Arab Emirates, attestation fees from the Ministry of Foreign Affairs are around AED 2000 (USD 545) per document.

The similar sum would be necessary for the UAE Embassy in the Parent Company's home country to certify the parent company's paperwork.

Documents Required for Opening a Branch Office in the United Arab Emirates

Documents that must be attested by government officials in both the home country and the United Arab Emirates

- Board Resolution announcing the foundation of a Branch Office/Subsidiary Parent Company.

- Certificate of incorporation/ Memorandum of Association (MOA)

- Articles of Association (AOA).

- Power of Attorney in favour of the General Manager granting him the authority to open, Operate, and manage bank accounts on behalf of the Parent Company.

Documents Required for a Subsidiary Company in the United Arab Emirates

There are a few more documents that must be submitted in order to open a branch office in the United Arab Emirates, including:

- Application for a Trade Name Reservation

- Passport for Directors, Investors, and Managers Copy

- Accounts audited by the parent firm for the previous two years

- A declaration outlining the company's corporate goals, strategy, and significant operations activities.

- Agreements with the Local Service Agent that have been attested (LSA)

- Approvals from the government are required (if any)

Advantages of Having a Branch or a Subsidiary in the UAE

- Foreign investors have 100 percent ownership.

- In the UAE, there is no corporate or income tax.

- Visa for UAE residents and a corporate or personal bank account

- Confidentiality in the workplace

- The mainland of the UAE has a very cheap import charge of about 5%.

- Reduce the administrative load of running a huge international corporation.

- For better administration, separate auditing and boo keeping, and decentralize worldwide offices.

- Enter new market territories at a low cost. A Branch Company in the UAE does not require any share capital. As a result, investors can expand their businesses for a low initial investment.

Read More: An Overview of LLC Company Formation in Dubai

Following Steps are required to establish your Foreign Company in UAE

1.Select the Appropriate Business Jurisdiction

The foreign company must choose the appropriate business jurisdiction – Mainland, Free Zone, or Offshore – where the Branch Office will be established.

It is required to appoint a Local Service Agent to coordinate administrative activities with the UAE government authorities when establishing a business on the mainland.

2.Find a local service agent.

For an annual fee, the Local Service Agent is assigned for one year. The contract is renewable each year, with the option to switch agents if there is a disagreement.

There is no necessity to nominate a Local Sponsor in Free Zones or Offshore, and the Manager/Director will be the authorized person to handle the Branch Office's commercial activities.

Dhanguard, an experienced Business Consultant, will help you with documents approvals, visa processing, bank account opening support, and other services.

3. Make a Trade Name Reservation

The Parent Company in the Home Country must have the same name as the Branch Office.

Creating a Branch Office in the United Arab Emirates

In the case of Mainland Company, an application must be presented to the Department of Economic Development (DED) to have the name approved.

If the investor chooses these jurisdictions for the establishment, an application must be submitted to the corresponding Free Zone/Offshore authorities.

4. UAE Government Authority Attestation of Documents

The UAE embassy in the home country must certify the firm paperwork, which must also be counter-attested by the UAE Ministry of Foreign Affairs.

The following documents must be certified in their home country by UAE authorities and then counter-attested in the UAE.

- Certificate of incorporation/ Memorandum of Association (MOA), Article of Association (AOA)

- Board Resolution stating the formation of a Branch Office/Subsidiary

- Parent Company Good Standing Certificate

- Power of Attorney in favor of General Manager giving him the rights to open/operate/Management Bank Accounts on behalf of the Parent Company

5. Obtain a license from the appropriate government agency.

To obtain a Branch Office License, submit the certified documents along with the supporting documents to the appropriate government authority.

Along with the submission of the documents, there is a charge that must be paid to the authorities. The Branch Office License will be provided to the investor when the documents have been assessed.

6. Comply with the Administrative Requirements

The investor can now apply for a UAE residence visa, open a Business Bank Account, appoint a Director/General Manager, hire workers, process immigration cards and labor contracts, increase office space, and conduct business in the UAE.

Conclusion

UAE is a major business centre that services the entire Middle East. It maintains its dominance in the broad region by encouraging foreign investors to use various company start-up structures, such as foreign company formation.

Because they are owned and controlled by foreign investors, most of whom go into worldwide markets, subsidiary firms are also known as non-resident companies or international business companies. As a result, a foriegn company formation in the United Arab Emirates is perfect for investors seeking international corporate control.