The Department of Economic Development (DED) requires all mainland (onshore) UAE legal entities to be licensed and managed by the UAE Commercial Companies Law (CCL). The key benefit for international investors establishing a business in the mainland UAE is that, unlike the Free Zones, there are no territorial restrictions on business activity or office/premises placement. A mainland firm can trade anywhere in the UAE or the wider Gulf Cooperation Council (GCC) region, including all Freezones, and has a much broader selection of real estate possibilities to choose from.

Entrepreneurs and organizations in the UAE can form Limited Liability Companies (LLCs), which are one of the most frequent types of commercial enterprises. LLCs are commonly favored by entrepreneurs and organizations who wish to penetrate the UAE market and create a stable footing in the Middle East area due to their rapid and easy setup process and a large range of available business incentives.

Limited Liability Companies must have at least one or more local sponsors or Emirati partners, according to UAE commercial legislation. This indicates that the local partner/sponsor(s) must own at least 51 percent of the LLC's shares. Following the publication of UAE Federal Law No. 19 of 2018 on Foreign Direct Investment, the UAE Cabinet revealed the positive list of operations that will be covered by the FDI Law, which will allow 100 percent foreign ownership or greater than 49 percent foreign ownership. Thus, in today’s blog we will focus on the steps and other related details which you should be aware of, if you want to start your own Limited Liability Company in Dubai. So without any further ado, let’s learn!

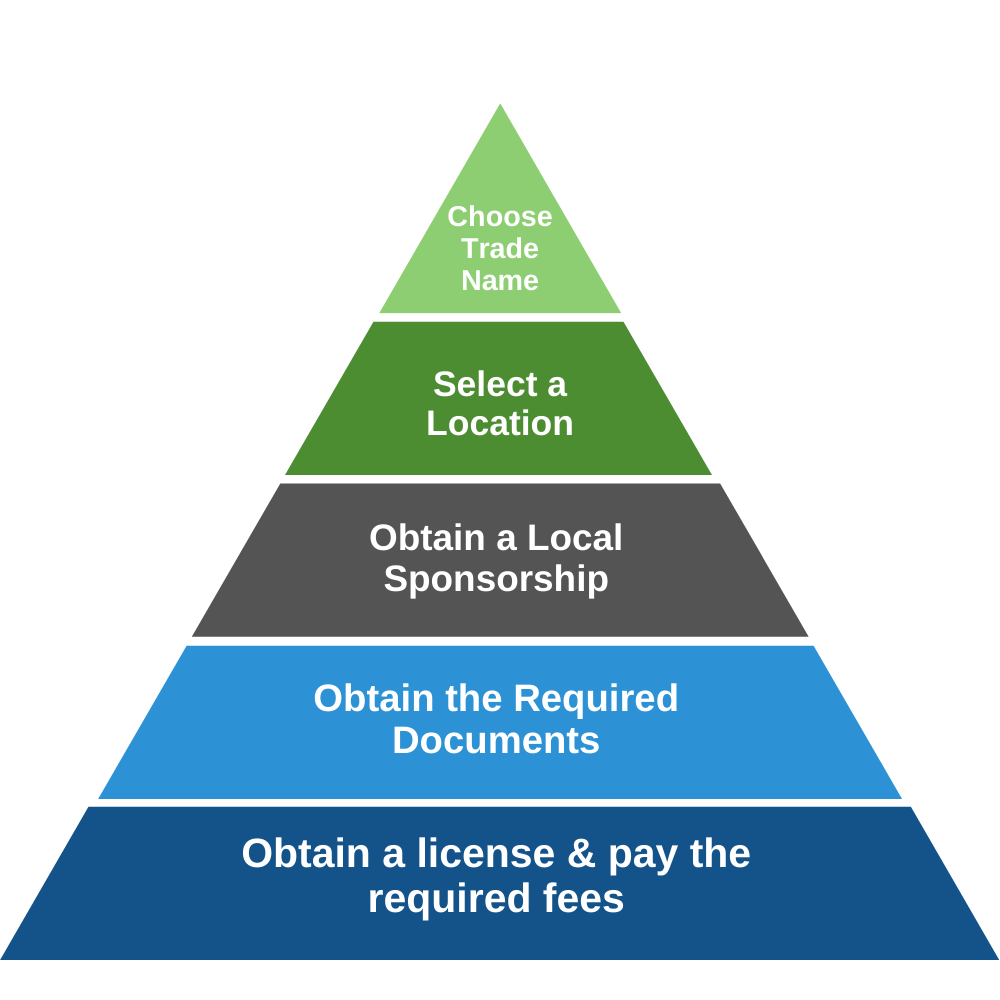

Steps you need to follow in order to open a Limited Liability Company in Dubai

The Department of Economic Development is the regulatory body in charge of establishing LLCs in Dubai. The steps are as follows:

Choose a Trade Name

Choose a name that is both unique and relatable to your business.

Select a Location

Choose a location that is appropriate for your sort of business. A physical/virtual office or warehouse is required to carry out company operations.

Obtain a Local Sponsorship

Make a deal with a local sponsor to own 51 percent of the shares in your LLC, and the remaining 45 percent can be owned by you.

Obtain the Required Documents

Gather all relevant documentation and send it to the Department of Economic Development (DED) along with a fully completed application.

Obtain a license and pay the required fees

Obtain a Trade license, a Memorandum of Association (MoA), stock certificates, a tenancy agreement, a certificate of incorporation, Visas, labour cards, and other legal documents from the appropriate authorities. According to the type of LLC to be formed in Dubai, the following documents must be filed to the DED and other authorities:

- Form of application for registration that has been filled out

- Copies of all shareholders' and management's passport

- a copy of the local sponsor's passport

- Sponsor's approval (if manager or partner has residence visa in UAE)

- Association Memorandum (duly attested from a public notary)

- DED initial approval and trade name registration

- Each shareholder's bank reference letter

- Dubai Municipality's Planning Department and Civil Defense Department attested to the location plan and tenancy contract.

Dubai LLC Registration

- Compliance with the DED is achieved by completing the trade name application form as well as the warrant application form. If one or both members are companies, a copy of the Certificate of Incorporation, as well as an Association Memorandum and a Board of Directors decision, are required to approve the LLC Subscription. It will also be necessary to have a Power of Attorney that authorizes someone to act on behalf of the LLC's stockholders.

- Also included were copies of shareholders' passports, as well as suggestions for a general manager and directors. The Department of Environmental Protection (DED) will thereafter grant an initial approval to this effect. Depending on the LLC's anticipated operations, further approvals may be necessary.

- The 2011 Licensing Law, also known as the "Law on the Organization of Economic Activities Practice in the Emirate of Dubai," streamlined the licensing procedure by allowing the DED to receive permits from the necessary ministries and departments. The Power of Attorney holder must sign an LLC formation contract before a notary after receiving initial permission and approvals from the required ministries and/or agencies. The above-mentioned documents must be secured for LLC registration in Dubai once the contract is totally finished.

Read More: What is the Cost of Company Formation in Sharjah

In Dubai, a Limited Liability Company is used for a variety of purposes

Foreign investors are allowed to use the limited liability corporation for a variety of objectives, making it a particularly versatile corporate form. The following are the several types of limited liability companies that can be formed in Dubai:

- that of a Dubai-based onshore private limited liability corporation that is used for business purposes.

- that of a Dubai-registered offshore corporation engaged in trading activities outside the Emirate.

- a public corporation — in Dubai, joint stock firms can also be registered as Limited Liability Companies.

- that of a free zone limited liability company – a free zone limited liability company's registration requirements are determined by the free zone in which it is incorporated.

- that of a subsidiary company - overseas corporations can establish subsidiaries in Dubai using limited liability companies.

- Aside from them, most shelf or ready-made businesses in Dubai are registered as limited liability corporations. In Dubai, the limited liability company can also be utilized to form a joint venture.

Benefits of Forming a Limited Liability Company in Dubai

The benefits of forming a limited liability corporation in Dubai are numerous, particularly for foreign investors. Among these, we'd like to call attention to the following:

- It is a popular business type since it has correspondents in almost every country on the planet.

- For individuals interested in beginning a business in Dubai or the UAE, it provides access to all industries

- By forming a limited liability company, you can receive any type of business license

- The limited liability corporation will give complete ownership to a foreign investor if it is established in a Dubai free zone.

- When forming an onshore limited liability company, there are no share capital requirements.

- It is simple to register and create a local bank account for, however the incorporation procedure requires the appointment of a local agent.

Taxation Advantages of a Limited Liability Company in Dubai

- The Dubai limited liability company provides a number of tax benefits. Apart from the oil and petroleum industries, Dubai enterprises are not subject to corporation taxes in the majority of industries. However, due to a recent change in tax legislation, the value added tax (VAT) was implemented, which is levied at a very low rate. The VAT rate in Dubai is 5%.

- Apart from this tax, the Dubai limited liability company offers a number of benefits, including free repatriation of profits for foreign investors who create the firm and fall under the UAE's double tax treaties.

Conclusion

Formation of a Limited Liability Company is a hassle free process. Our experts at Dhanguard are committed to provide you with speedy resolutions to help you to form your Limited Liability Company in no time. We hope this blog provided you with incite full information. For more information on other related aspects, fee free to check out our website as well.