Dubai has always presumed that a business idea should not be limited by where you live or work. That's why the newly launched Virtual Company License in Dubai has made it easier to start a business in Dubai. The new virtual business license in Dubai will allow foreign business owners/investors to establish a business in the city without having to physically reside in the UAE!

In this blog, we get deep knowledge about the new virtual business license and how you might be able to start a business in Dubai from your home country!

What is the Dubai Virtual Commercial License?

The Dubai Virtual Commercial License is a program that allows investors from all over the world to integrate all enterprise-related activities online, including document signing and digital submission, with the documents being legally binding in the UAE under the highest legal standards. In a nutshell, it is a new directive that allows foreign entrepreneurs to digitally establish a business in Dubai without first obtaining a residency permit.

The new virtual license in Dubai is available to foreign businesses from over 101 countries and covers key sectors such as creative industries, technology, and services. The new Dubai Virtual Company License seeks to align with the third article of His Highness Sheikh Mohammed's 50-Year Charter for the Development of a Virtual Commercial City in Dubai.

During the initiative's launch at Dubai Investment Week, Dubai Economic Department Director-General Sami Al Qamzi stated:-

"We are proud to launch the first Virtual Commercial City in the region that will provide virtual licenses for doing business digitally and without requiring residence in Dubai, in partnership with the General Directorate of Residency & Foreigners Affairs. The initiative underlines the role of Dubai's Economy in shaping the future of business as envisioned by His Highness Sheikh Mohammed bin Rashid Al Maktoum. It also marks a quantum leap in the concept of doing business and will be a major attraction for the next generation of entrepreneurs."

The scheme's creators hope that this new virtual commerce hub will attract at least 100,000 corporations from across the globe. The initiative aims to maintain the Emirate's position as one of the top ten FDI destinations over the last decade.

What are the Eligibility Requirements for a New Business License in Dubai?

Some of the prerequisites for obtaining a virtual commercial license in Dubai are classified below:-

-

Applicants for the Virtual Company License must be UAE residents.

-

Virtual company owners in Dubai must be nationals or tax residents of one of the 101 approved countries. Canada, India, Pakistan, the United States, Russia, China, Saudi Arabia, Japan, and other countries are included. (A complete list of approved countries can be found on the VCC's official website.)

-

Only business operations from the prespecified sectors are permitted to establish a virtual business in Dubai. Printing and advertising service activities, consultancy, computer programming, related activities, and design activities in jewelry, fashion, and interiors are among the predefined sectors.

Virtual company owners in Dubai should keep in mind that their businesses will continue to be subject to corporate, individual income, and social income taxation in the country in which they are based. If the virtual company's revenue generated within the UAE exceeds $100,000 per year, it will be subject to the UAE's 5% Value Added Tax (VAT). This means that a holder of a Dubai Virtual Company License will be required to register the company with the UAE's Federal Tax Authority.

Another important point to remember is that the Dubai Virtual Company License does not automatically grant any of the company members physical access to the UAE via a business/visitor/resident visa. The same holds true for opening a business bank account in the UAE. Commercial banks will have the ultimate authority on whether or not to open a bank account.

Advantages of Getting a Virtual Commercial License

The Virtual Commercial License translates the work and life of entrepreneurs and freelancers by providing:

-

To start and grow your business, you will incur moderate costs and administrative burdens.

-

Online access to your business.

-

Access to Dubai's business opportunities.

-

Gaining access to new clients, markets, and investment opportunities.

-

Participation in the virtual business directory.

How to Apply for a New License in Dubai

-

Fill out the online business registration form.

-

Background check, which will take between 1 and 30 days

-

Visit for identification and validation

-

Payment and acquisition of the Virtual Company License

The fee is determined by the license validity period you selected in the online company registration form.

The Virtual Company License is a joint initiative of the Dubai International Financial Center (DIFC), Dubai Economy, Smart Dubai, the General Directorate of Residency and Foreigners' Affairs (GDRFA), and the Supreme Legislation Committee.

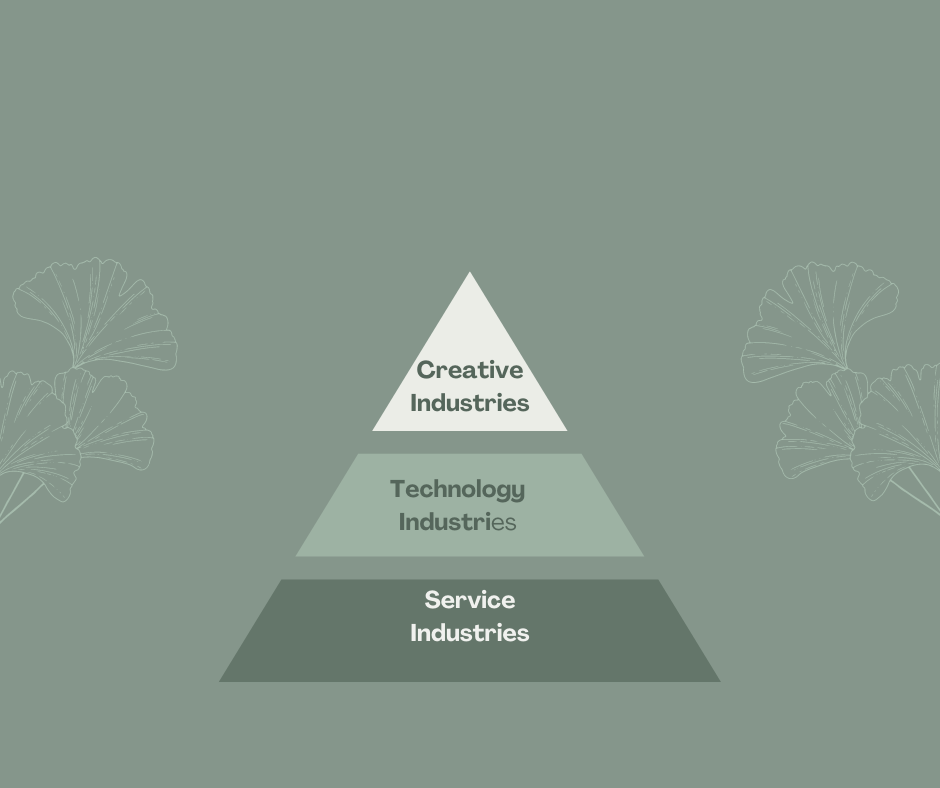

It focuses on three main sectors:

-

Creative Industries

-

Technology Industries

-

Service Industries

Conclusion

This is expected to increase as a result of Dubai's new virtual business license. Kudos to this virtual company license; nearly 100,000 companies are expected to bring their business ideas and services to Dubai.

If you want to set up an online business in Dubai, you should learn about the e-trader license, which also serves as a home business license. For more information, contact Dhanguard. We will gladly like to assist you!