A Designated Zone is an area that has been designated by cabinet decision and meets the requirements of the UAE Executive Regulation. To put it another way, the Designated Zone is a VAT-free zone that is deemed outside the UAE for VAT purposes. As a result, no VAT will be charged on any items transferred between Designated Zones.

The Federal Tax Authority (FTA) is the governing body for issuing all guidelines for the Value-Added-Tax registration, return filing, and other general VAT related amendments in UAE.

FTA has published a guide on Value Added Tax in Designated Zones. It aims to provide clarity on the way VAT is applied to companies in the Designated Zones. Many business investors want to know the way VAT is levied in Designated Freezones of UAE.

What are Designated Zones?

The Designated Zones are defined by the UAE Cabinet as areas that are not subject to VAT in the UAE. Not all free zones are designated zones, and designated free zones must meet certain criteria in order to be excluded from VAT.

The VAT laws for Designated Free Zones are a little tricky because there are a lot of case-by-case transactions between a company in a designated free zone and other enterprises in the UAE and abroad that may be subject to VAT.

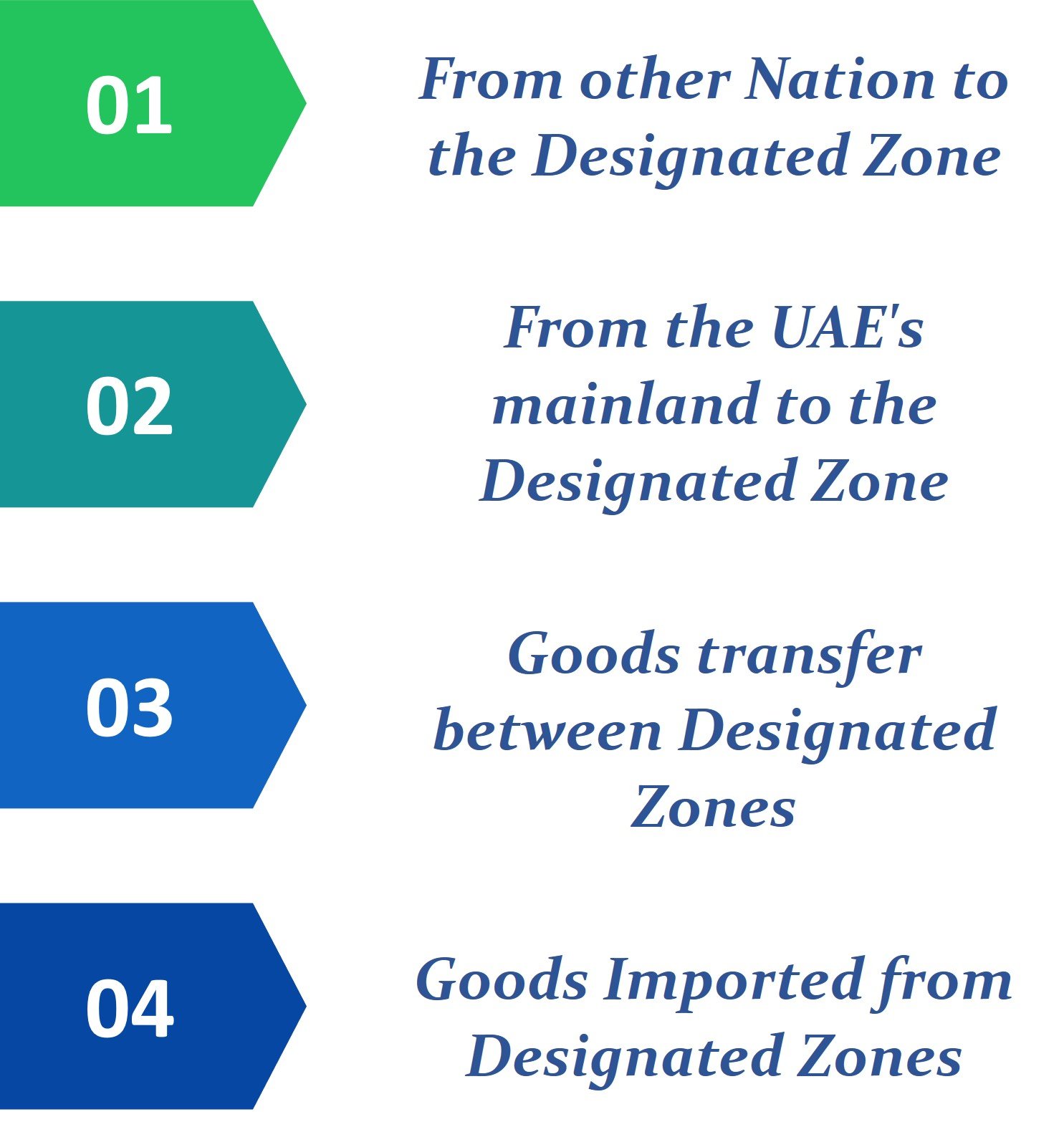

From other Nation to the Designated Zone

Because the items are not being delivered to the UAE but are being transported from one nation to another, they are not subject to VAT. The company, which is based in the United Arab Emirates, is just enabling worldwide trade.

From the UAE's mainland to the Designated Zone

The transportation of products is within the UAE and is not regarded an export from the UAE, hence it is treated as a taxable transaction.

Goods transfer between Designated Zones

Because the items are not used or altered during the movement between the approved zones, it is viewed as being outside the scope of VAT. It should be mentioned that items must be transported in accordance with UAE Customs Laws.

Goods Imported from Designated Zones

Importation into the UAE is defined as the transportation of products from a designated zone to the mainland. As a result, it is taxable and considered an import.

Treatment of VAT on supplies of goods to Designated Zones

As previously stated, the Designated Zones are viewed as being outside the UAE for VAT purposes, hence no VAT will be charged. Despite the fact that it is classified as being outside the state, not all supplies will be eligible for this benefit; some will still be subject to a 5% VAT. The rationale for this is because only the supply of products will be tax-free, subject to specific criteria, and only a few types of supplies made from or to the Designated Zone will be taxed, depending on the location of supply. The VAT rates for supplies made from/to the Designated Zones are listed in the table below.

|

Type of Supplies |

From |

To |

Taxability |

|

Goods |

Designated Zone |

Designated Zone |

Non-Taxable |

|

Goods |

Designated Zone |

Mainland* |

Taxable at 5% VAT |

|

Goods |

Mainland* |

Designated Zone |

Taxable at 5% VAT |

|

Goods |

Designated Zone |

Oversea/GCC countries |

Non-Taxable |

|

Goods |

Oversea/GCC countries |

Designated Zone |

Non-Taxable |

*Mainland refers to any location in the UAE other than the Designated Zones.

As shown in the table above, any movement of products from one Designated Zone to another is tax-free only if the conditions set forth in the UAE Executive Regulations are followed.

Supply of goods between Designated Zones without paying VAT

Only if the following conditions are met will supplies made between Designated Zones be Exempt from VAT:

- During transfer between the Designated Zones, the Goods are not released.

- During the transfer between the designated zones, goods are not used or altered in any way.

- The goods are transferred in compliance with the GCC Common Customs Law's rules for customs suspension.

In addition to the conditions that must be met for VAT-free supplies of goods between Designated Zones, the authority may ask the owner of the goods to provide a financial Guarantee for the payment of any tax for which that person may be held liable if the conditions for movement of goods are not met.

Treatment of VAT on Services Provided in a Designated Zone

Between Designated Zones, there is differential treatment for the supply of goods as well as the supply of services. While the supply of goods between Designated Zones is tax-free, the same cannot be said for the supply of services. The reason for this is that if the place of supply is in the Designated Zone, it is considered to be within the State of UAE. This means that any services provided from the mainland to the Designated Zone or inside the Designated Zone will be subject to the usual rate of VAT of 5%.

Supply of water or any other form of energy to a designated zone is subject to VAT

Though water and all forms of energy are considered to be supplies of goods, these supplies are distinguished from other goods and treated differently in the Designated Zone. The place of supply of water or any form of energy will be considered to be inside the State if the place of supply is in a Designated Zone. This means, the supply of water and all forms of energy supplied to Designated Zone will be subject to VAT at 5 percent in the same way it would be in the non-Designated Zone areas of the UAE.

Supply of products to the Designated Zone for self-consumption

If items created in a Designated Zone are to be used by the owner or a third party, the place of supply will be in the United Arab Emirates. This means that any self-consumed goods sold within Designated Zones will be charged a 5% VAT. However, there are some unusual circumstances in which items consumed within a Designated Zone are not subject to VAT. The following are examples of exceptions:

- The incorporation of products into other goods is a common occurrence.

- Attaching products to other goods is a common practise.

- Things are used in such a way that they become part of other goods.

- In the same Designated Zone, goods are used in the production or sale of another good.

Goods produced in a Designated Zone are not subject to VAT

Consumption of products located in a Designated Zone on which the owner has not paid VAT will be viewed as goods imported into the State by the owner and, if unaccounted for, will be liable to VAT. These products, however, will not be subject to VAT if they are used by the owner under the scenarios specified above (self-consumption scenarios).

Conclusion

It's obvious that the VAT treatment of supplies related to Designated Zones varies depending on the type of supply. To begin with, the benefit of VAT exemption is only available in certain scenarios for the supply of goods, and the supply of services within the Designated Zone is taxable. Second, conditions set forth in UAE Executive Regulations must be met in order to be eligible for VAT exemption on goods supplied within the Designated Zones. As a result, it is critical for businesses to understand the VAT treatment of their supply, analyse the impact of VAT on their business, and plan accordingly.