Get FREE CONSULTATION with our team of experts! Click here to start!

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Starting your own company requires limitless amounts of patience, hard work, coordination on a personal front and capital, infrastructure and immense amount of paperwork at professional front in order to properly set up your company. The paperwork can be related to various aspects, it can be as menial as providing your identification proof for registration or as complex as constructing well defined and stringent contract or terms of an agreement between a partnership.

Finance Contracts are also one of the most important facets which are needed to given enough emphasis to create a strong company. Well defined finance contracts can pose as an ultimate benefit in increasing the revenue of the company as a whole and maintaining stability of the company respectively.

Therefore to first get your concepts clear about the notion of Finance Contracts, you need to have a clear idea as to what Financing refers to in a broad perspective.

The process of supplying funds for business activities, acquisitions, or investments is known as financing. Banks, for example, are in the business of supplying liquidity to companies, clients, and investors in order to help them achieve their objectives.

Financing is critical in any economic framework because it helps businesses to buy items that are out of their immediate control. To put it another way, funding is a way to use the time value of capital to put potential planned cash flows to work on projects that are already underway. Financing also takes advantage of the fact that certain people in an economy will have a surplus of capital that they want to put to work to earn money, and others will need money to spend (also in the expectation of earning money), resulting in a money market.

Finance contracts can be the need of any person who want to acquire additional capital as financial assistance, moreover it can still be the need of that company or a person who has stable amounts of capital of their own beforehand but do not want to risk all of it by putting all their eggs in one basket.

The few instances under which a need of Finance Contracts can arise in order to generate capital is elucidated below:-

Usually Start-ups require financial assistance in the initial phase of establishing their company; therefore a sound financing structure and a clear finance contract can be beneficial for them.

Any company who wants to acquire or amalgamate with the other company to increase its revenue and business operations.

A finance contract is a deal that is usually entered into between parties involved in the financial markets in the form of an independently negotiated arrangement, contract, or option to sell, buy, swap, lend, or repurchase, or some other equivalent independently arranged transaction.

The rights and obligations resulting from agreements are recognized and governed by financial contract law. In most finance contracts, the following items are included:

A currency clause is a hedging instrument that links the negotiated amount to the exchange rate of a foreign currency. In agreements with a credit institution, it ensures that the amount borrowed or collected (deposits/savings) over the duration of the agreement is adjusted to account for fluctuations in the value of the foreign currency to which a specific currency clause is pegged against the domestic currency.

Commodities are bulk commodities and raw materials used to make consumer goods, such as foods, metals, animals, oil, cotton, coffee, sugar, and cocoa. Commodities are purchased and sold on the open market and exchanged in the form of futures contracts on futures exchanges.

Finance contracts can also elucidate the rate of different interests which would be levied upon for the repayment of any amount which the company has taken in form of loans or in form of any other financial aspect. A financial instrument with a value related to the movements of an interest rate or rates is known as an interest rate derivative. Futures, options, and derivatives contracts are examples of these contracts. Institutional investors, banks, businesses, and individuals often use interest rate derivatives as hedges to shield themselves against fluctuations in market interest rates, but they may also be used to raise or adjust the holder's risk profile or to bet on rate movements.

Securities are fungible and tradable financial instruments that are used to collect funds in both public and private markets. There are three main types of securities: equity (which gives investors ownership rights), debt (which is simply a loan repaid over time), and hybrids (which incorporate elements of debt and equity).

A sound finance contract could also be made with other economic and financial interest being kept in mind. These may include acquisition of another company, or buying limited shares of a company and many more.

Finance Contract necessitates the agreement of at least two parties on potential results. The opportunity for mutual benefit is what brings the parties together. Investors would have to be even more cautious and cautious before engaging in any financial activity if there was no way to enforce a guarantee. To explain it in simple words, the increased risk that an investor will not recover their investment, let alone make a profit, implies that borrowing rates will be far higher than they are now.

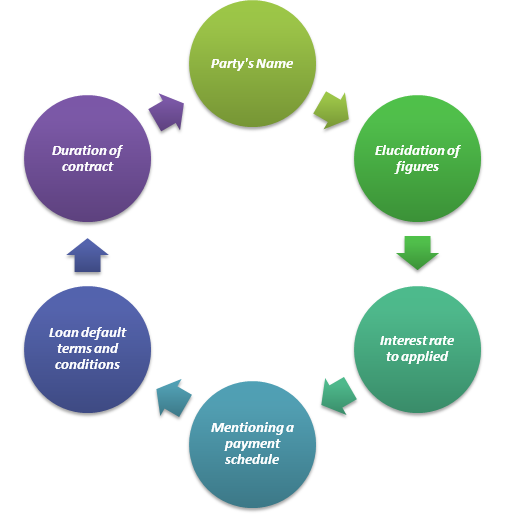

Although there is no fixed format for making a Finance Contract, but below enumerated are a few key basics which one should keep in mind while making one or observe while getting one:-

The abovementioned basics are explained below for a clear view on how to make or approach a Finance Contract:-

The contract should begin with the clear description of the party’s name between whom the finance contract is made and all the terms and conditions are agreed upon.

The first aspect of a sound finance contract is describing the amount to be taken or given as a loan. This amount should be clearly specified in order to avoid facing any of the hindrances which can come at the time of repayment of the loan. Also if there is any extra amount which will be provided as the medium of financial assistance later after the initiation of the contract from this amount should also be properly specified.

Most of the finance contracts include a fixed percentage of interest which would be levied upon the principal amount to calculate the repayment amount. In many cases, the percentage of interest levied is not fixed and can change from time to time, during the pendency of the finance contract. This solely depends upon the person who is making the finance contract to provide finance to the company or person but the rate can be negotiated as well by mutual consent. Therefore this section must also be clearly defined in a clear manner.

This section of the finance contract will include the details about when will the repayment have to be made and the mode of repayment also. The lender can decide if they want the repayments on a monthly, quarterly, half yearly or yearly basis depending upon the terms and conditions of the finance contract. Therefore this section also plays an important role.

Many a time finance contracts include a clause which defines the consequences on the event of any default committed by the borrower. The consequences can vary in nature entirely depending upon the terms and conditions which have been explained and agreed upon by both the parties of the contract through mutual consent. Therefore a borrower should avoid committing any defaults related to the contract so that its consequences do not hamper the smooth operation if his/ her company in the future.

A finance contract also includes the timeline or the duration of the contract during which the contract will stay in force. It will lay out the duties and responsibilities of the borrower to carry out all the terms and conditions of the contract which were agreed upon during the event of making of the finance contract. Failure to do may lead to the consequences which can also be defined in the terms and conditions with respect to default related to the finance contract.

State of ______________

LOAN AGREEMENT

This Loan Agreement (this “Agreement”), is made as of this ______ day of _______________, 20______ (the “Effective Date”)

By and Among/Between

Borrower(s): ________________________________________________, located at _______________ _________________________________________ [Address] ("Borrower"),

And

Lender(s): ________________________________________________, located at _________________ _______________________________________ [Address] (“Lender”).

The parties agree as follows:

1. Loan Amount. Lender agrees to loan Borrower the principal sum of _____________ (the “Loan”), together with interest on the outstanding principal amount of the Loan (the "Principal Balance"), and in accordance with the terms set forth below.

2. Repayment of Loan. (Check one)

3. Security. (Check one)

4. Guaranty. (Check one)

5. Interest.

The Principal Balance shall bear interest at the rate of __________% per annum, accruing daily. Notwithstanding, the total interest charged shall not exceed the maximum amount allowed by law and Borrower shall not be obligated to pay any interest in excess of such amount.

6. Late Fee. (Check one)

7. Prepayment. (Check one)

Discount (Check one)

8. Acceleration. (Check one)

9. Remedies.

Lender may enforce its rights or remedies in equity or at law, or both, whether for specific performance of any provision in this Agreement or to enforce the payment of the Loan or any other legal or equitable right or remedy. The rights and remedies of Lender now or hereafter existing at law or in equity or by statute or otherwise shall be cumulative and shall be in addition to every other such right or remedy.

10. Costs and Expenses.

Borrower shall pay to Lender all costs of collection, including reasonable attorney's fees, Lender incurs in enforcing this Agreement.

11. Waiver.

Borrower and all sureties, guarantors and endorsers hereof, waive presentment, protest and demand, notice of protest, demand and dishonour and non-payment of this Agreement.

12. Successors and Assigns.

This Agreement will inure to the benefit of and be binding on the respective successors and permitted assigns of Lender and Borrower.

13. Joint and Several Liability.

The obligation of each Borrower shall be joint and several under this Agreement.

14. Amendment.

This Agreement may be amended or modified only by a written agreement signed by Borrower and Lender.

15. Notices.

Any notice or communication under this Loan must be in writing and sent via one of the following options: (Check all that apply)

16. No Waiver.

Lender shall not be deemed to have waived any provision of this Agreement or the exercise of any rights held under this Agreement unless such waiver is made expressly and in writing. Waiver by Lender of a breach or violation of any provision of this Agreement shall not constitute a waiver of any other subsequent breach or violation.

17. Severability.

In the event that any of the provisions of this Agreement are held to be invalid or unenforceable in whole or in part, the remaining provisions shall not be affected and shall continue to be valid and enforceable as though the invalid or unenforceable parts had not been included in this Agreement.

18. Assignment.

Borrower shall not assign this Agreement, in whole or in part, without the written consent of Lender. Lender may assign all or any portion of this Agreement with written notice to Borrower.

19. Governing Law.

This Agreement shall be governed by and construed in accordance with the laws of the State of _________________, not including its conflicts of law provisions.

20. Disputes.

Any dispute arising from this Agreement shall be resolved through: (Check one)

21. Entire Agreement.

This Agreement contains the entire understanding between the parties and supersedes and cancels all prior agreements of the parties, whether oral or written, with respect to such subject matter.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first stated above.

SIGNATURES

Borrower Signature Borrower Full Name

_________________ _________________

Grantor Signature Grantor Full Name

_________________ __________________

Lender Signature Lender Full Name

__________________ ____________________

Disclaimer: The information contained in the sample document is general information and should not be considered as bank or authorized advice to be applied to any specific factual situation. All information and documents are as per dhanguard experience.