Get FREE CONSULTATION with our team of experts! Click here to start!

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

You don't have to wait or think twice before grabbing that sleek, wonderful ride. With the concept of vehicle loans in existence, getting a new car is more easier and quicker than it used to be. Today, practically all major banks offer auto loans in the UAE and Dubai, with reasonable interest rates, flexible repayment terms, and a variety of other incentives.

Features & Benefits of taking Vehicle Loan Consultation from Dhanguard-

Buying a car is made simple and hassle-free with Dhanguard Vehicle Finance in UAE. We provide you with the prospect to bring home the car you always wanted with the minimum possible trouble including paperwork & payments.

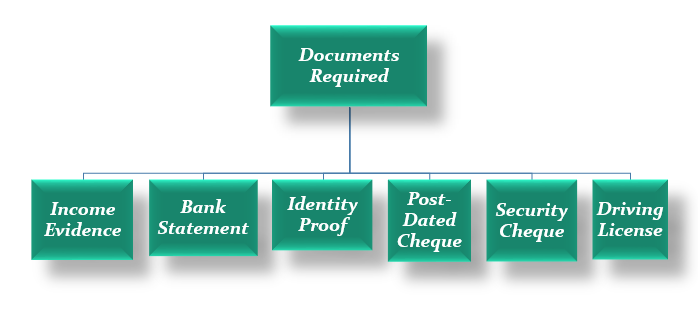

The documents required for acquiring Vehicle Finance are as follows-

You are required to submit your salary certificate or any documented evidence to show your income.

You need to submit bank statements for three months for your salary account as well.

You are required to submit copy of valid passport with a valid UAE Residence Visa. The latter is only applicable for emigrates itself (You also have to show your original documents for verification).

You need to submit a post-dated cheque if it is applicable

You need to submit a cheques as security for your loan

You need to obtain a quotation or pro-forma invoice from the dealer for acquiring loan for new vehicles.

You need to submit a copy of your driver’s license. (Only in cases where it is asked for)

If you want to take loan for used cars, then following documents are required to avail the loan-

If you want to take loan for car and you are a company then the following documents are required

One can repay the finance using the following prescribed methods:

The important things to remember before taking Vehicle finance in UAE

The eligibility criteria for applying for a Vehicle Finance are mentioned below-

Some of the considerations to look into before applying for Vehicle Finance consists of the following-

A Vehicle Finance is basically a loan that is supported by any financial institution or bank in order to buy a vehicle. With a Vehicle Finance, you are not compensating on the devaluation of the vehicle like you do with a lease. You will be paying on the vehicle purchase price plus interest on it.

The bank or any financial institution provide finance for Vehicle for a period of 5 years for new or old cars. In case the car is much older than the time period is much shorter than the set limit.

Yes, the amount for down payment will be 20% of the car’s price.

Yes, this can be done as per the prevailing policy guidelines.

Dhanguard has an expert group of team that works for the satisfaction and ease of their clients in providing the required services. For acquiring hassle free services contact our well-knowledged team at Dhanguard.