The ease of banking withinside the UAE certainly is increasing. Number of high net-worth people do not forget that UAE is a secure home for investments. More of the world’s wealthiest should circulate their money to the country. over the following decade, in line with the New World Wealth and the wealth report.

Many analysts believe that the banking region is powerful and enormously huge thinking about the scale of the population. Some fifty-two nearby and overseas banks perform withinside the country and are participants of the UAE banks federations making for a sturdy economic region. Of those 22 are countrywide banks. The UAE Central Bank video display units of all banking sports withinside the nation and regulates new commercial enterprise in addition to the adoption of recent technologies.

Documents needed to open a business account in UAE

The requirements for opening an account vary from bank to bank, but the presence of a major shareholder or director is typically required. Sometimes attorneys can set up accounts on their clients’ behalf, though this is not often the case.

To open an account, the first step is completing an account opening application, which will be supported by detailed company records. That information can include proof of business, like contracts and invoices, as well as information about the company’s clients and suppliers.

Though the list varies between banks, typically the required documents will include:

- The passport (with residency visa) of the company’s shareholder representative

- Copy of the Emirates ID card of the shareholder representative

- Passport copy of the company director

- Information about the type of activities on the account

It is important for the company to specify that what kind of business activities it’s going to participate because for few sectors you need different license that are issued by separate government bodies for example if you want to do a business in insurance industry then the license need to be approved by the Insurance Authority UAE only then you can start your insurance business.

- Disclosure of the source of funds

The current capital of the business and source of funds which are used to run the business need to be specified even in future if funds are raised, they need to be disclosed for fair transparency.

- Existing contracts

Existing contracts between the firm and any other company also need to be disclosed as to make sure that the firm runs the business compliance to the policies of the government.

- Reference letters from business partners

If the company is coming for a joint venture, then reference letter from a partner can be used to authenticate its venture

- Business Plan

A business plan is a formal written document containing the goals of a business, the methods for attaining those goals, and the timeframe for the achievement of the goals.

- Full set of certified company incorporation documents

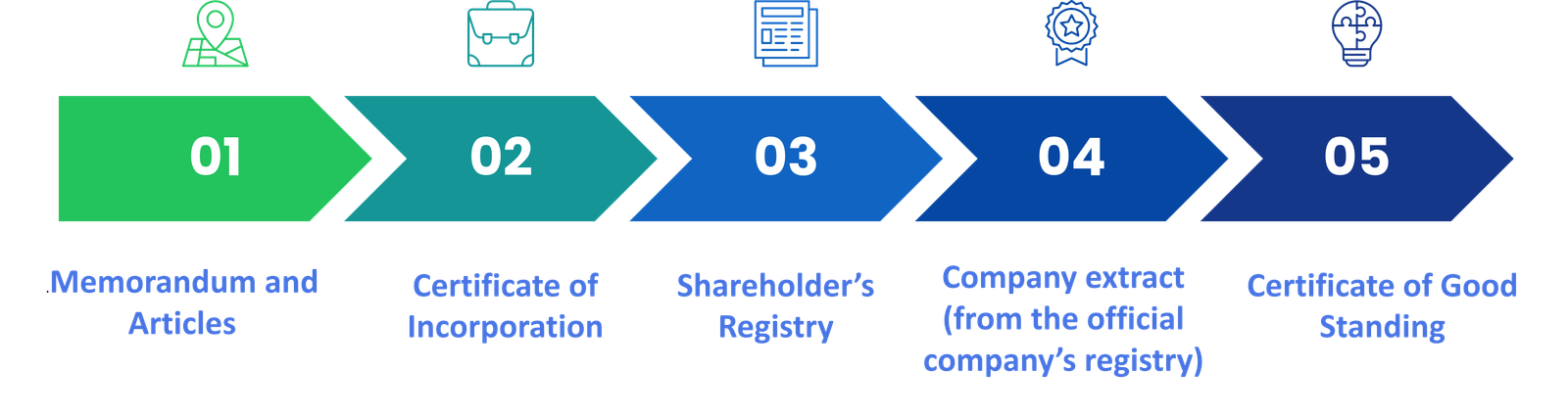

List of Company Incorporation Documents are as follows-

Memorandum and Articles of Association

In short, the memorandum contains the names of all the subscribers (the people who were there at the founding point of the company e.g., initial shareholders) and the Articles of Association are a set of rules that govern how the company is run

Certificate of Incorporation

The United Arab Emirates Certificate of Incorporation is issued by the United Arab Emirates companies registry when a United Arab Emirates company is incorporated it includes the company name, company number, date of incorporation and states that a company is registered.

Shareholder’s Registry

A shareholder register is a list of active owners of a company's shares, updated on an ongoing basis. The shareholder register requires that every current shareholder is recorded.

Company Extract (from the official company’s registry)

A Company Extract is a report designed to help you verify the legitimacy of an entity by providing details about a company

Certificate of Good Standing

A Certificate of Good Standing simply indicates that the entity has filed all reports and fees with the Secretary of State's office. It serves as proof, or evidence, that the entity exists and is authorized to transact business in the state.

Next, the bank will gather background information about the applicant’s management team, including shareholders and directors. The information gathering process will also encompass financial projections.

Last, the bank will conduct an interview with the applicant. Once those stages are complete, the account will be opened.

3 Tips While Choosing a Bank for a Business Account

It's tempting to open a business bank account with the bank where you have your personal accounts because then you can manage your money all in one place, but this isn't always your best option. Compare bank accounts and fees from several banks and make your choice based on which account is best for your business, even if that's an account at a separate bank. You can always transfer funds from one bank to the other.

Make sure your business account leaves you room to grow

Some commercial enterprise financial institution money owed impose transaction limits and fee your greater expenses for exceeding them. This can show high-priced in case you are continuously bumping up in opposition to this limit. Review your commercial enterprise finances and expect how your company's destiny increase should influence how a great deal you pay in expenses each month. If you suspect your present-day commercial enterprise financial institution account should end up restrictive, test to look if the financial institution had some other account that might offer you with the extra unfastened transactions or different offerings you need.

Save time with accounting integration software

Some commercial enterprise financial institution money owed combine with famous accounting software. This can prevent time about dealing with your commercial enterprise price range and growing fee reviews and stability sheets due to the fact you may not manually appearance up records on your commercial enterprise financial institution account and input this into your accounting software.

Conclusion

Opening a business account in UAE is far more lucrative and beneficial than any other country because of its effective policies which not only take care the welfare of the sate but also its customers all over the world. it may require a lot of paperwork but in the end the services and offers provided by the banks of UAE make it a smooth journey which will help the business entity to grow fast and help to earn more profits. To learn more, connect to our experts at Dhanguard.