Credit cards do not require an introduction. Almost everyone in the UAE has benefited from the many advantages of using a credit card at some point in their lives. Credit cards, for those who are unfamiliar, allow you to buy products or services on credit for a modest cost. It's a great alternative to money, or cash, because it allows you to easily channel internet and retail purchases. Credit cards are a must-have financial instrument in the UAE due to the high cost of living and maintaining a lifestyle. Today in this blog we will talk about Sharia Compliant Credit Cards in UAE.

What is Shariah Law?

Shariah law is a religious code that is deeply rooted in Islamic culture. Muslims are prohibited from participating in any financial practice or doing business with any money-lending company that charges interest, commonly known as Riba, under Shariah law.

Shariah Compliant Credit Cards

Several banks and financial institutions offer Shariah Compliant Credit Cards based on Islamic law. Gharar and Riba are prohibited by Shariah laws, and this form of credit card strictly adheres to them. Gharar is the sale of something that isn't there. Take, for example, the sale of unharvested crops. Gharar is an overcharge, whereas Riba is an interest. As a result, when a Shariah Compliant credit card is used, no interest is levied on the outstanding balance. Under Shariah law, overcharging is definitely forbidden.

As a result, no compound charges exist. Instead, depending on the credit card issuer, certain Shariah-compliant credit card companies may charge a monthly profit on the outstanding debt or a fixed monthly fee. Muslims can receive a credit card while remaining true to their beliefs by using a Shariah Compliant credit card. Shariah-compliant credit cards are also available to non-Muslims. They can choose the Shariah Credit Card instead of a traditional credit card and take advantage of its perks and advantages.

What are the Features and Benefits of having a Shariah Compliant Credit Card?

Shariah Compliant Credit Cards come with so many incredible rewards and benefits. The following are some of the primary advantages of Shariah Credit Cards.

ADDITIONAL CARDS FOR FAMILY MEMBERS

They offer the option of obtaining more cards. That means Shariah Compliant Credit Card holders can get additional cards for family members who qualify.

AMPLE OF CASHBACKS

Some credit cards provide cardholders with cash back on every transaction they make.

ADDITIONAL BONUS POINTS

Members of the Shariah Compliant Credit Card gain points for using the card. Bonus points can be exchanged for discounted purchases or waivers of yearly fees, among other things.

EXTRA BENEFITS

Shariah Compliant Credit Cards give additional benefits and privileges. They normally provide Takaful coverage to their cardholders to safeguard them from unanticipated events such as critical illness, permanent disability, and so on. In addition, members of the Shariah credit card will be able to pay their Zakat with ease.

THERE IS NO INTEREST

Under Shariah law, any form of interest (Riba) is severely prohibited. As a result, no interest is charged on Shariah Compliant Credit Cards. For the offered service, the cards charge a profit rate. If the outstanding balance is not paid during the grace period, it will be charged.

TRAVELLING PERKS

Shariah credit cards, like regular credit cards, provide cardholders with travel benefits and privileges. It meets the needs of frequent travelers by providing the best travel advantages, including travel rewards and complimentary airport lounge access.

ACCEPTED WORLDWIDE

All Shariah Compliant Credit Cards come with a global warranty. This means that cardholders can use the card anywhere in the world.

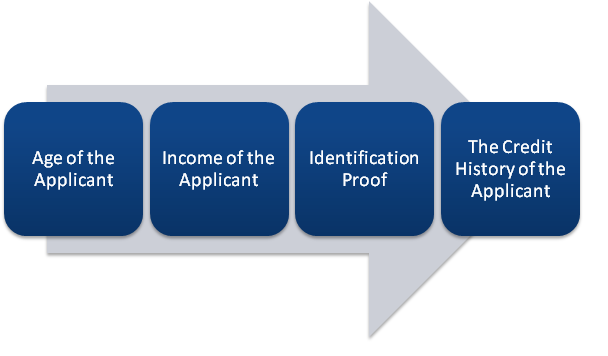

What are the eligibility criteria to obtain a Shariah Compliant Credit Card?

If the person meets the eligibility requirements, they can easily apply for a Shariah Compliant Credit Card. Some of the variables that go into determining whether or not an application is eligible for a Shariah Compliant Credit Card are as follows

AGE OF THE APPLICANT

To be eligible for a Shariah Compliant Credit Card, the applicant must be at least 21 years old and no more than 65 years old.

INCOME OF THE APPLICANT

The applicant must have a consistent source of income in order to apply for the Shariah Compliant credit card.

IDENTIFICATION PROOF

UAE natives must have an Emirates ID, while expats must have a valid passport and visa to apply for the Shariah Compliant Credit Card.

THE CREDIT HISTORY OF THE APPLICANT

The applicants must have a strong Credit history, as a negative one may result in the credit card application being rejected.

Factors to consider while choosing the best Shariah Compliant Credit Cards

Several banks and financial organizations in the UAE offer Shariah Compliant Credit Cards. However, not all perks and characteristics are the same. They may differ from one credit card supplier to the next. As a result, it's a good idea to compare credit cards online based on their features, benefits, and fees so that the cardholder can choose the best one.

PROFITABILITY

Comparing the profit rates of various Shariah Credit Cards is the first significant step before picking a Shariah-compliant credit card. It assists in locating the lowest profit-rate Shariah-compliant credit card.

CHARGES

Checking the fees and charges linked with the card's use is critical since it allows the cardholder to utilise the card wisely.

TAKAFUL INSURANCE

Before choosing a Shariah Compliant Credit Card, make sure to examine whether Takaful coverage is required or optional. Also, if Takaful coverage is required, be sure to verify the additional price for Takaful coverage.

What is Takaful Insurance?

Takaful is a form of Islamic insurance in which participants combine their funds to insure one another. Takaful-branded insurance is based on Shariah, or Islamic religious law, and it covers health, life, and other types of insurance.

REWARDS SPENDING

The majority of Shariah Compliant Credit Card providers offer special discounts and extra points for using their cards, which may be redeemed for a variety of perks.

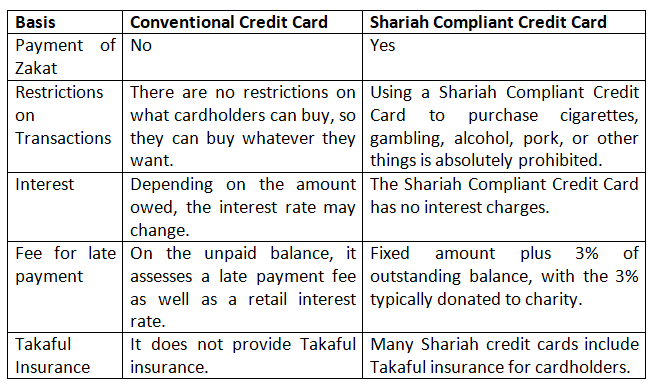

What are the differences between a Shariah Compliant Credit Card and a Conventional Credit Card?

Limitations of Shariah Compliant Credit Cards

The purchasing limit set by the credit card provider on a particular credit card is known as a credit card limit. In terms of money, the credit card limit refers to the maximum amount a cardholder can spend on the card in a given month. For example, if the credit card company gives a credit card with a limit of AED 50,000, the cardholder will be unable to spend more than that amount. Every Shariah Compliant Credit Card, on the other hand, has a credit limit that differs from applicant to applicant and is based on characteristics such as:

- Credit history of the applicant

- Monthly income of the applicant

- Other credit card restrictions

Conclusion

Dhanguard is an all-in-one site that lets you compare different financial solutions. It helps people make better financial decisions by providing unbiased information. The cardholder can examine numerous advantages, features, and costs when looking for the finest Shariah Compliant credit cards. We at Dhanguard assist the applicant to select the best Shariah Compliant credit card available.