If you're thinking about starting a business and want to learn more about the advantages of founding a freezone company in the UAE, you've come to the right spot. Take a look at some crucial information about doing business in the UAE before learning about the benefits of forming a Freezone company in the UAE.

For decades, the UAE government has taken a proactive approach to attracting foreign investment from all around the world.

The UAE's economic development is largely due to a visionary government, business-friendly regulations, and the entrepreneurial energy of UAE people. The government gives numerous tax-related and other financial benefits to international investors. The UAE market is divided into three types of business jurisdictions: Mainland, Free Zones, and Offshore. Investors should choose one of the three jurisdictions for company registration in the UAE based on their business activity, clients, and ambitions. There are advantages and disadvantages to creating a corporation in these jurisdictions.

We'll get a quick overview of the Free Zone jurisdiction and the benefits that come with it in this article.

What are the UAE's free zones?

Free zones are special economic zones or jurisdictions that give financial and tax exemptions to businesses in exchange for operating permits. In total, the seven Emirates have almost 40 free zones. The Free Zone Authority is the government agency in charge of a Free zone. The Free Zone Authority, often known as the FZA, is the governmental organisation in charge of the crucial activities related to free zone operations and licence issuance.

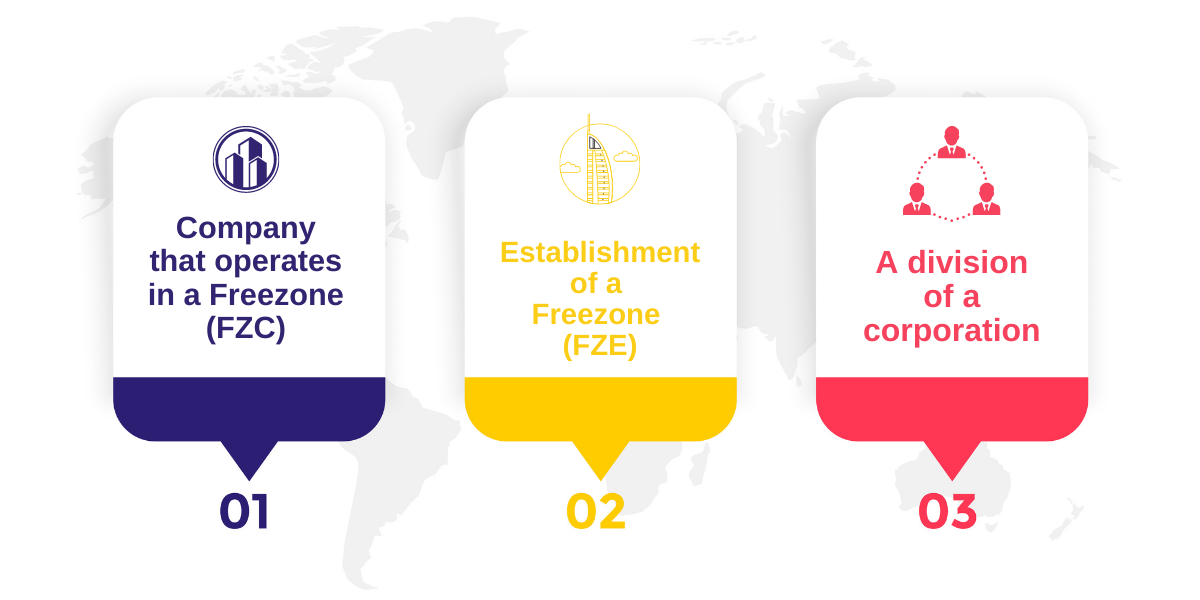

In a UAE free zone, an investor can form three different types of business entities, which are outlined below.

Relevance of Free Zones in Dubai's Economy

So, now that we've covered the aim of having Free Zones in the economy, let's look at why the government developed them in the first place. The UAE's expanding economic growth was aided by the creation of free zones. They hoped to achieve this by establishing favourable business structures in each of these niche markets. They also provide tremendous incentives for foreign businesses to set up shop in the UAE.

The Emirati economy has experienced tremendous growth, with the creation of Free Zones playing a vital role in improving Dubai's and the UAE's overall status. How does the importance of Dubai's Free Zones affect the economy as a whole? According to estimates released by the Dubai Free Zones Council in 2018, Dubai Free Zones accounted for 31.9 percent of Dubai's gross domestic product (GDP) in the first nine months of that year.

The Free Zones have helped to propel significant non-oil external trade growth as Dubai and the other emirates attempt to expand beyond the traditional oil and gas sectors. Dubai's non-oil external trade increased from 143 billion Dirhams to 1.271 trillion Dirhams between 2000 and 2019. While we have yet to see the full data for 2020, Dubai Customs announced that Dubai trade figures in the first half of 2020 were over 551 billion dirhams, with transactions jumping by 24.5 percent to 11.2 million in the first nine months of the year. The data indicate that the city will be able to recover from the COVID outbreak.

Many of the UAE's trade hubs are located within Free Zones, attracting a slew of international investors. These investors provide more job opportunities, attractive compensation, a strong knowledge base, and an overall degree of quality to their businesses. Because of its high rate of growth, safety, and quality of life, Dubai is one of the most popular ex-pat destinations in the world, with many of them working in Free Zone enterprises.

Advantages of Creating a Free Zone Company

Let us now get to the meat of the matter. The advantages of forming a free zone firm are stated below.

100 % Foreign ownership

One of the most obvious advantages of founding a free zone company in the UAE is the ability to have 100% foreign ownership. This means that a foreign investor does not need to obtain a UAE national sponsor to start a business in the UAE. Foreign ownership is possible regardless of the investor's nationality.

No Currency restrictions

Currency rules are government-imposed limits on the exchange of foreign currencies. In UAE free zones, there are no currency restrictions of any type. This facilitates financial transactions.

Duty-free Imports and Exports

The UAE's free zone jurisdictions are exempt from import and export duties. This contributes to the promotion of international trade.

Tax advantages

Free zone businesses are tax exempt to the full extent of the law. This includes both personal and business income taxes.

Benefits of Repatriation

Full repatriation benefits are available to the corporations. Profits and financial assets are included in this.

Effortless Labour Recruiting

Companies in the free zone can execute labour recruitment formalities quickly and cost-effectively. Companies are permitted to hire foreign nationals.

Workplaces that are readily available

Free zone countries have plenty of warehouse and Office Space. Free zones in the United Arab Emirates are great for SMEs and start-ups.

Incorporation of a business is simple

The procedures for forming a company in a free zone are easy and straightforward. In comparison to other countries, you may be able to complete the licence procedures in less days.

Immigration procedures that are trouble-free

The immigration facilities associated with UAE Free zones are efficient, saving time.

Excellent Infrastructure and Communication

Free zones in the United Arab Emirates have the most up-to-date communication technologies and infrastructure. Energy is both cheap and plentiful in free zones.

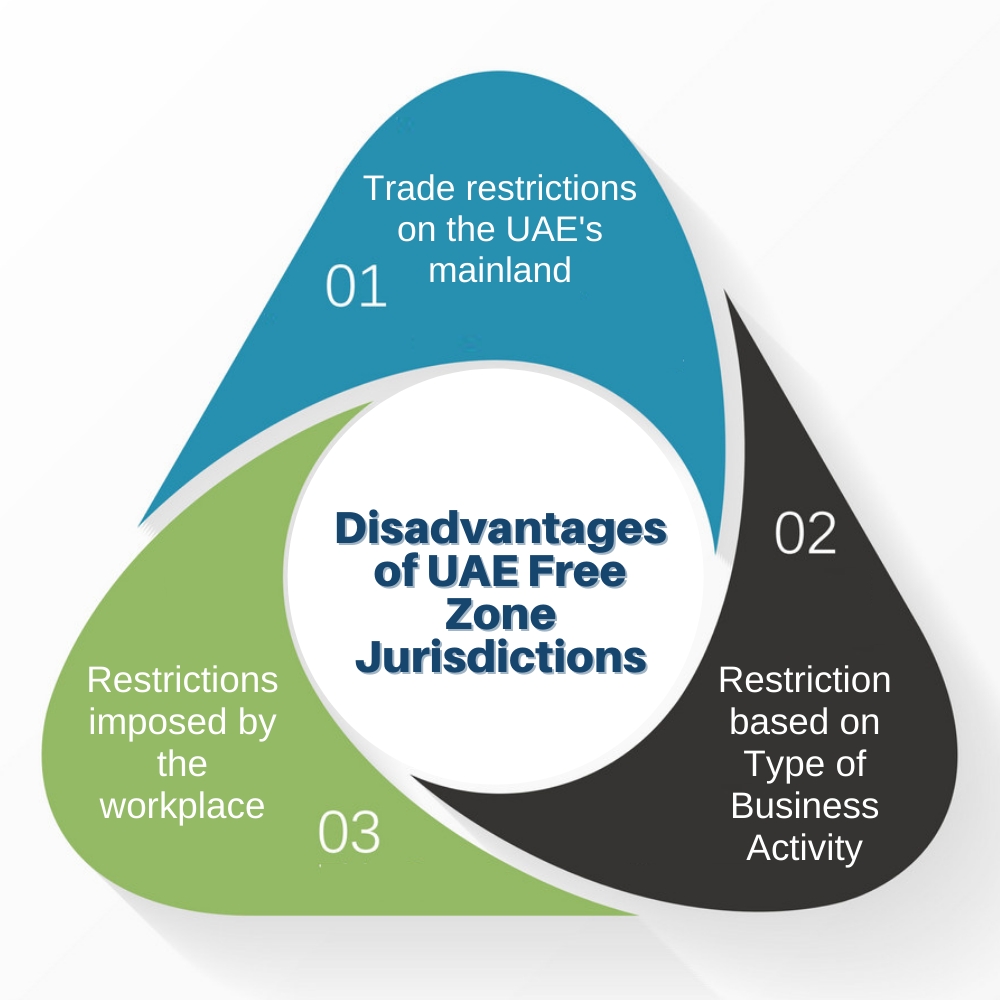

Disadvantages of UAE Free Zone Jurisdictions

It's not just about the advantages of founding a free zone corporation in the United Arab Emirates. An investor must also be aware of the constraints. These restrictions are enumerated below.

Trade restrictions on the UAE's mainland

Direct dealing with the UAE's domestic market is absolutely forbidden for enterprises based in UAE Free Zone countries. Trading within the UAE market is only accessible through a local distributor for companies formed in the UAE free zone. The free zone corporation must pay a 5% tariff when selling goods or commodities in the UAE local market.

Restriction based on Type of Business Activity

There are some limits based on the type of business activity. Certain business activities or a combination of business activities are allotted to UAE free zones. As a result, the firm incorporated in a certain free zone must carry out the specified economic activity. This means that the freedom to conduct business is restricted.

Restrictions imposed by the workplace

If an employee has a Free zone company Visa, he or she must work within the Free zone's boundaries.

Expensive Formalities

In comparison to the mainland, the cost of notarization and translation in a Free zone is higher.

List of the Freezones in UAE

Here is the following list of freezone to learn which businesses are most likely to prosper, as well as how easy it is to set up a firm in the UAE.

Conclusion

I hope you now understand the advantages of starting a free zone corporation in the UAE. Working with a business setup expert like Dhanguard can make the process of forming a company go smoothly and quickly. Dhanguard can help you form a corporation in any of Dubai's or other Emirates' major free zones. The rules and documentation involved in forming a company differ depending on the free zone jurisdiction. Contact Dhanguard as soon as possible if you require assistance with company formation or related services.