Get FREE CONSULTATION with our team of experts! Click here to start!

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

DAFZA enterprises that are properly formed can reap a slew of benefits. This is why a big number of Fortune 500 global corporations have chosen to locate in this freezone. Dubai is the world's third largest re-export center, and its strategic location makes it easy to reach from Asia, Europe, and Africa. Dubai has more than 5 million visitors each year. Dhanguard, the premier business consulting firm, will make the procedure simple and straightforward for you!

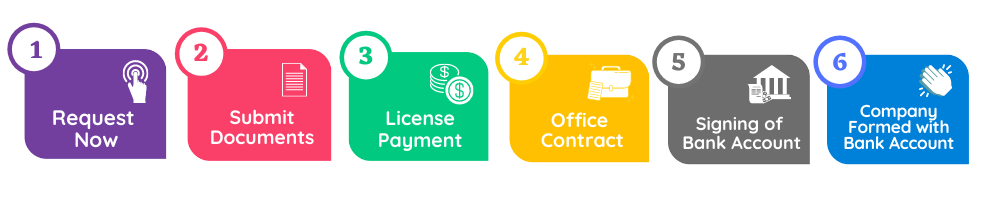

Registering a Company is quick, easy, and can be done online with DhanGuard in 6 simple steps:

The FZCO business entity is similar to a limited liability corporation that can operate in the Free Zone. Individuals, corporations, or a mix of the two might be shareholders.

FZCO has the following features:

Existing businesses can open a DAFZA branch of their parent company. There is no requirement for a share capital.

Branch Characteristics:

A trade licence entitles the holder to engage in trading operations such as product import, export, re-export, distribution, and storage.

A service licence is designed for service-oriented organisations and allows an organisation to deliver the services that are specified in the licence. It's worth noting that getting a service licence necessitates speaking with a sales representative to help you choose the correct category.

An industrial licence allows the holder to engage in light manufacturing, packing, and assembly operations.

A General Trading License permits the holder to engage in a variety of operations, including import, export, re-export, storage, and distribution.

DAFZA is conveniently located near the airport in the heart of Dubai. Following are the benefits-

Dubai Airport Freezone is one of the fastest growing free zones in the Middle East, offering investors a fantastic incentive package. The Dubai Airport Free Zone, like all of Dubai's UAE Free Zones, has a number of advantages over areas outside of the free zones.

DAFZA is one of Dubai's most prestigious and advanced free zones, offering a business-friendly climate, world-class infrastructure, tax benefits, full repatriation of earnings, entire ownership, and great facilities, making it a perfect location for doing business in the Middle East.

Our team of professionals will assist you with the following tasks related to the formation of a company in the DAFZA Free Zone.

Our team of professionals can assist and guide you with the process of establishing a business in the Dubai Airport Freezone. Your questions will be answered! Our partners will walk you through the procedure and help you get your new company or branch office up and running legally and quickly.

Our team of professionals is ready to help you get your business up and running as quickly as possible.

We welcome your questions, comments, and recommendations that will help us provide better service to you. Get in touch with us!

One of the many benefits of establishing your business with DAFZA is that we accept 100% foreign ownership. To form a corporation with DAFZA, you do not need a partner who is a UAE national.

No, companies or persons operating within DAFZA are subject to corporation or income tax.

To start a corporation, DAFZA regulations need a minimum of one shareholder and a maximum of 50.

A DAFZA firm must have a minimum share capital of AED 1,000.

No, despite its close proximity to Terminal 2, DAFZA is not a part of Dubai International Airport.

Companies formed in Dubai Airport Freezone will be able to carry out the activities outlined in their trade or commercial licence. Import, export, distribute, store, trade, and create commodities are all possible for businesses. Companies can offer consultancy services after obtaining a consultant licence, which allows them to provide competent and competent advice. Companies are also permitted to engage in light manufacturing, packaging, and assembly.

We are proud to be the only Authorized Banking Consultants in UAE!. DG is UAE's largest Banking Experts Consulting Platform

With us, you can easily search all the Banks offering company accounts. We are working with more than 50 Banks.

Compare all the account packages available ith UAE Banks. We have more than 50 packages updated.

When you have choosen the right bank and your account package, contact us and you can have your bank account ready in no time!