Get FREE CONSULTATION with our team of experts! Click here to start!

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Dhanguard Business Consultants will help you set up your financial services or allied services business in the DIFC. Because DIFC firms are focused on finance and investment, the concerned authorities must conduct a detailed evaluation of the shareholder profile, company activities, and business strategy.

Our legal and commercial professionals will guide you through the whole company formation process in the DIFC. If you'd like to learn more about the DIFC Company Formation process, contact one of our expert consultants immediately!

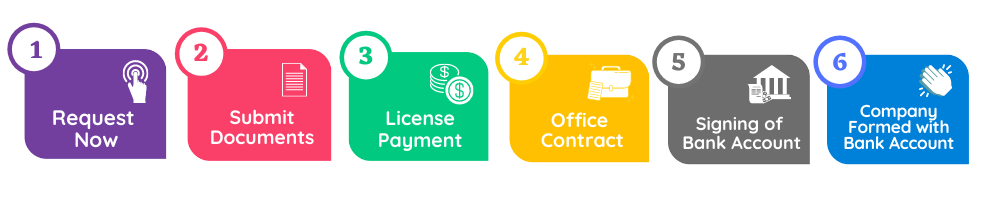

Registering a Company is quick, easy, and can be done online with DhanGuard in 6 simple steps:

The Dubai International Financial Centre (DIFC) is the city's financial centre. It was formed under UAE Federal Decree No. 35 of 2004, UAE Federal Law No. 8 of 2004, and Dubai Law No. 12 of 2004 as a federal financial free zone. The DIFC has a physical footprint of around 110 acres. The DIFC has its own legal system and courts that are separate from the UAE's, with authority over corporate, commercial, civil, employment, trusts, and securities law.

The DIFC's mission is to create a platform for financial institutions to do business with the region's growing markets. It was founded with the goal of fostering growth, progress, and economic development in the UAE while also facilitating access to regional markets by providing internationally recognised legal and commercial practises, as well as infrastructure that meets international standards.

It is a financial hub ideally placed between the eastern and western time zones, surrounded by a rapidly rising region rich in natural resources and petrodollars. It offers an unrivalled financial destination and powerhouse when combined with a tax-friendly framework and a laissez-faire attitude toward capital repatriation and fund movement.

DIFC's expanding prominence as a global financial centre serving to the area is reaffirmed by the geographic diversity of the Centre's total number of regulated enterprises. Europe accounts for 36% of regulated enterprises, followed by the Middle East (27%), North America (16%), Asia (11%), and the rest of the world (10%).

DIFC has increased not only in size but also in the sophistication and complexity of financial operations it conducts since its inception. Innovative legislative actions that addressed specific sector demands and the region's rising financial services requirements were important growth drivers.

A financial regulatory system keeps track of business activity related to finance and banking.

In the DIFC, non-managed licences are those that are not related to finance or banking.

Subsidiaries and incorporated entities have 100 percent ownership in DIFC, as well as a world-class regulatory framework that provides for a variety of legal entity structures.

The legal system and courts of the DIFC are based on a Common Law framework that is overseen by an independent and well-respected regulator and adjudicated by a court system that is similarly well-respected.

Companies based in the DIFC incur no capital or profit flow limitations, and there are no currency exchange regulations in the US-dollar denominated jurisdiction.

The Dubai Financial Services Authority (DFSA), an independent risk-based regulator, awards licences and oversees financial services conducted through DIFC.

DIFC provides a platform for organisations to centralise regional and worldwide operations management, as well as its deployment to worldwide branches.

The DIFC Authority, which was founded as a judicial entity established by the Government of Dubai under Law No. 9 of 2004, is the organisation in charge of monitoring the operation and administration of DIFC. Its functions include formulating and directing overall strategy, promoting DIFC, and attracting licensees to operate in the DIFC.

Established under Law No. 9 of 2004 and completely separate from the DIFC Authority and the DIFC Judicial Authority, the DFSA is the integrated regulator responsible for the authorization, licencing, and registration of institutions and individuals wishing to conduct financial and professional services in the DIFC.

The DIFC Courts are charged with administering and enforcing DIFC's civil and commercial legislation.

The ROC is a separate legal entity constituted as a ?Corporation Sole? under the Companies Law. The ROC is responsible for advising on, receiving, reviewing, and processing all applications submitted by prospective DIFC registrants in accordance with the Companies Law, the General Partnership Law, the Limited Liability Partnership Law, or the Limited Partnership Law, and the implementing regulations applicable thereto.

The ROS is in charge of recording and registering security pledged against loans, guarantees, and other financial transactions, and therefore establishing priority.

The RORP safeguards the interests of purchasers, sellers, and lessees.

DIFC Investments (LLC) is a company based in Dubai, United Arab Emirates. In keeping with the growth of the Centre's investment strategy and policies, DIFC Investments maintains and maintains a wide portfolio of investments. It strives to develop strategic alliances to help DIFC achieve its aims and objectives.

Hawkamah Institute of Corporate Governance is an international network of corporate governance practitioners, regulators, and institutions whose principal mission is to create Middle Eastern corporate governance best practises.

Mudara - Institute of Directors (IOD) is a membership organisation in the Middle East and North Africa (MENA) area that serves directors, professional leaders, and governance experts.

Dhanguard will help you establish up a financial services or allied services business in the DIFC. Because DIFC firms are focused on finance and investment, the concerned authorities must conduct a detailed evaluation of the shareholder profile, company activities, and business strategy.

Our legal and commercial professionals will guide you through the whole company formation process in the DIFC. If you'd like to learn more about the DIFC Company Formation process, contact one of our expert consultants right immediately!

Because the DIFC is a Dubai free zone, the 51 percent local partnership requirement does not apply, which is one of the benefits of this free zone. The Dubai International Financial Centre Authority does not require non-financial enterprises to have a minimum share capital. At least one shareholder and two directors are required for a DIFC firm. In order to operate in the Dubai International Financial Centre, the company must also acquire a business licence.

It takes around 30 business days to form a company in Dubai international Financial Center.

DIFC's peculiarity stems from the fact that it has its own court system and has enacted a financial services code of law. The zone offers a variety of services to investors, including licencing, registration, incorporation, and leasing, to name a few. Investors can manage their firms more efficiently and develop regionally and worldwide in the future.

Banking Services (Investment Banking, Corporate Banking, and Private Banking); Capital Markets (Equity, Debt Instruments, Derivatives, and Commodity Trading); Asset Management and Fund Registration; Insurance and Re-insurance; Islamic Finance & Professional Service Providers are some of the areas where the DIFC focuses.

The Registrar of Companies is Dubai's primary regulatory body for business formation. This registrar would serve as a centralised authority for completing various forms of company compliance and registration. In most cases, a business registration application in Dubai is submitted to the Registrar of Companies.

A company formation in the DIFC is a viable choice for an investor. There are numerous advantages to choosing this area, which include more than just the simplicity of forming a business or complying with regulations. When it comes to foreign ownership of a corporation in the DIFC, there are no restrictions. As a result, the directors and shareholders of a Dubai-based corporation can be entirely foreign-owned.

We are proud to be the only Authorized Banking Consultants in UAE!. DG is UAE's largest Banking Experts Consulting Platform

With us, you can easily search all the Banks offering company accounts. We are working with more than 50 Banks.

Compare all the account packages available ith UAE Banks. We have more than 50 packages updated.

When you have choosen the right bank and your account package, contact us and you can have your bank account ready in no time!