Get FREE CONSULTATION with our team of experts! Click here to start!

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Setting up shop in Umm Al Quwain is a fantastic opportunity for all types of businesses, from small to large. Start thinking about how you'll set up your business in the Umm Al Quwain Free Zone right now with the help of business set up consultants in Dhanguard.

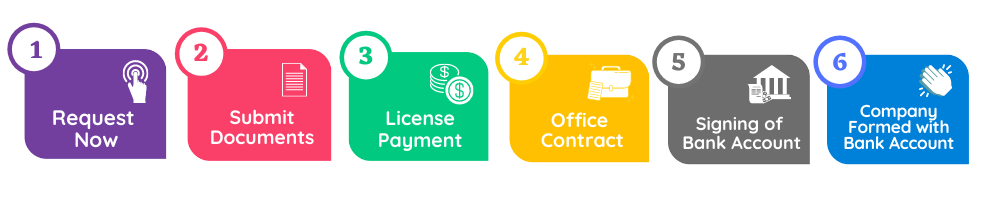

Registering a Company is quick, easy, and can be done online with DhanGuard in 6 simple steps:

Umm Al Quwain Free Trade Zone is located in Umm Al Quwain, one of the seven emirates in the United Arab Emirates, and is only 45 kilometres from Dubai. The free zone in Umm Al Quwain is adjacent to the UAE's main seaports and is only an hour's drive from Dubai International Airport and Sharjah International Airport, allowing for quick access to the rest of the globe. Companies doing business in the Umm Al Quwain Free Zone can release their goods and maintain them as inventories for re-exporting without paying customs taxes. A company based in the Umm Al Quwain Free Zone is free to conduct worldwide commerce.

Umm Al Quwain is a basic city with a strong cultural base. It is home to the UAE National Museum and Al Sinniyah Island, a protected lagoon. It is one of the seven Emirates of the United Arab Emirates, and it is situated in the country's northernmost region.

The Umm Al Quwain Free Zone provides a fantastic chance for small business owners to thrive or start a small firm with zero to two visas, as well as large investors searching for warehouse space. It offers all forms of trade permits, including consultation, general commerce, freelance, and industrial, as one of the few free zones in the UAE that does not require the investor to be physically present during the company registration process.

It enables for object storage, supply, import, and export, as described in the licence. A commercial licence will include 10 product lines that are similar and three product lines that are different.

This licence allows for a broader range of activities, giving you complete freedom and flexibility to trade in any service that is acceptable in the UAE.

This licence allows the licensee to import raw materials, then manufacture, assemble, package, and export the finished product. It enables the holder to import raw materials for the purpose of product manufacturing, processing, and/or assembly.

It enables the licensee to carry out the services listed on the licence within the Freezone, such as logistics, courier services, insurance, travel agencies, tour services, automobile leasing, and so on. It is mostly for service providers.

This licence is for units that offer professional or expert advice, and it is given to all experts, including artisans and builders. It also enables for two tasks that are connected.

This allows a person to work as a freelance expert and do business under their first name rather than a trade name, brand name, or corporation. The Freelance permit is intended for persons working in the cinema, technology, media, and publishing industries, and it is awarded to ability roles, innovative positions, and select managing jobs.

As a member of the Umm Al Quwain free zone, you will have access to a variety of benefits and services. The free zone complex in Umm Al Quwain is large enough to accommodate ocean vessels and also has area set aside for industry. There are solid provisions in place for electricity, water supply, and all other infrastructural requirements to run the business smoothly. Business owners who are tenants in the Umm Al Quwain free zone can also get logistical assistance. In the free zone, there is an administrative entity that handles day-to-day activities.

There are various advantages to establishing your business in the UAE's Umm Al Quwain free zones. Tax exemption, capital and profit repatriation, total foreign ownership, and a single point of contact are all available to you. All of these reasons make the free zone an excellent place to start a business in the UAE.

The government's tax-free approach and lack of restrictions on capital repatriation have enticed investors from all over the world to set up shop in Dubai in order to take advantage of the environment that is ideal for business growth. Furthermore, the availability of effective transportation services and other infrastructure has aided the expansion of such businesses. As a member of the Umm Al Quwain free zones, you can take advantage of a number of additional benefits.

Apart from providing foreigners with 100 percent ownership, there are several other advantages to founding a corporation in the Umm Al Quwain Free Zone:

When it comes to setting up a flexi desk, it can take as little as one to two working days. Furthermore, you are not need to be present throughout the registration process with the UAQ authorities.

To obtain permits for small or even new businesses, you do not need to go through multiple governments and departments. You also do not require a No Objection Certificate from your present sponsor or employer in your native country. It simplifies and expedites the procedure.

Aside from inexpensive labour and living costs, Umm Al Quwain is conveniently located between Dubai and Sharjah. It allows you to reach out to billions of potential customers throughout the Middle East, North Africa, and the Indian subcontinent. The free zone is close to Sharjah International Airport and Dubai International Airport, which are both in the United Arab Emirates.

Umm Al Quwain is a planned city with modern infrastructure and facilities, such as inexpensive office spaces, industrial areas, and warehouses with world-class services.

There are no limitations on the amount of money that can be invested or the amount of profit that may be made.

You do not have to pay any personal or business taxes. You don't have to conduct audits or reveal accounts, ensuring complete anonymity.

The process of Umm-al-Quwain has been simplified, and the legalities and formalities associated with it have been decreased. You can also hire business setup advisors to help you start your firm in the free zone. In most free zones, there are numerous services available to assist you in starting your business. The UAE has a large number of free zones, each with its own set of requirements. The free zones in Umm Al Quwain offer your company a location to operate, as well as foreign ownership, exemption from income tax, customs tax, import and re-export taxes, and other benefits. Dhanguard will assist you in your company formation.

We are proud to be the only Authorized Banking Consultants in UAE!. DG is UAE's largest Banking Experts Consulting Platform

With us, you can easily search all the Banks offering company accounts. We are working with more than 50 Banks.

Compare all the account packages available ith UAE Banks. We have more than 50 packages updated.

When you have choosen the right bank and your account package, contact us and you can have your bank account ready in no time!