In this day and age, surety is that privilege which everyone wants to have but only a few can afford. This surety can be related to any facet of life. Bid bonds also serve as a medium of surety to the project owner in an impregnable way. Bid bonds are preferred by contractors because they are less costly and do not tie up cash or credit lines during the bidding process. It also verifies that the contractor or supplier bidding on the project is eligible to do so. A bid bond is provided to a project owner by a contractor as part of the supply bidding process. A bid bond ensures that the winning bidder will accept the contract on the terms set out in their bid. A bid bond guarantees that the bond owner is compensated if the bidder fails to start the project. So till now you might have acquired some idea about the gravity of Bid Bonds in Business and how they can help you. Thus let’s understand the ins and outs of the Bid Bonds without any further ado.

What are Bid Bonds?

A bid bond is a form of construction bond that safeguards the owner or developer during the bidding process for a construction project. It is a promise that you, as the bidder, give to the project owner to ensure that the owner will be paid if you fail to honor the terms of the contract. A bid bond is usually purchased from a surety firm, such as an insurance company or a banking organization, and it serves to ensure that a contractor is financially sound and has the capital required for completing a project. On projects that include performance bids and payment bonds, bid bonds are often needed.

The obligee, the principal, and the surety are usually the three parties involved in a bid bond. The owner or developer of the building project under bid is the obligee. The bidder or proposed contractor is the principal. The surety is the company that provides the principal with the bid bond.

How is Bid Bond relevant for you?

Bid Bonds can play an important role for you and your upcoming or pre established business by the following-

- Bid bonds guarantee that contractors can follow through with their bid contracts and complete their work at the agreed-upon price. Most public building contracts enable contractors or subcontractors to secure their bids by offering bonds to the client, which function as a legal and financial safeguard.

- Project owners will have no way of knowing if the bidder they choose for a project would be able to finish the job properly without bid bonds. An underfunded bidder, for example, might run into cash flow issues along the way. Bid bonds also help clients avoid wasting time reviewing and selecting contractors by preventing wasteful bids.

Developers (Obligees) Profit from Bid Bonds in Three Ways:

- A Bid Bond guarantees that if the contractor (the principal) is awarded the contract, they will be able to have a Performance Bond.

- If the developer awards the bid to a contractor who then cancels, the developer will then assert the difference between the principal's bid and the next lowest bid on the bond.

- Bids are qualified by a Bid Bond, which ensures that all bids are serious proposals.

What are the basics of Bid Bonds?

The basics of a Bid Bond are elucidated below-

The obligee, the principal, and the surety are usually the three parties involved in a bid bond. The owner or developer of the building project under bid is the obligee. The bidder or proposed contractor is the principal. The surety is the company that provides the principal with the bid bond. The principal pays the surety a fixed amount for the bid bond, similar to a premium for an insurance policy. The penal sum is the bond's coverage value, and it constitutes the maximum amount of penalties that the surety can cover. Penalties will vary from 5% to 20% of the winning bid.

How do Bid Bonds work?

- Contractors may use bid bonds to prohibit them from making frivolous or unfairly low offers in order to win a contract. Various contractors (principals) predict how much the job would cost to complete and apply their price to the owner (the obligee) in the form of a proposal during the construction bidding process. The project is awarded to the contractor who wins the competition.

- A bid bond ensures that the contractor who wins the bid will follow through with the terms of the contract until it is signed. The contract will be violated if the contractor fails to honor the terms of the bid—for example, if he increases his job price after the contract is signed—and the owner may have to find another contractor for the project, most likely the next-lowest bidder.

- The owner is compensated for the cost difference between the original contractor's offer and the next-lowest bid with a bid bond. Depending on the terms of the bond, the surety agency can sue the contractor to recover these costs.

How large Bid spreads can be a hindrance-

In real life, bid bond claims are extremely rare. If a bond company agrees to fund a contractor's proposal, they will usually issue performance and payment bonds to that contractor. They do not, however, have to. When there is a big bid spread, surety companies get very anxious. This means that the gap between the first and second-place bidders is greater than 10%. If this occurs, be prepared to demonstrate to your bond company why the project is necessary. If the bond firm declines to help the contractor, the contractor must find a new bond company to issue the performance and payment bonds. Jumping an offer bond is what it's called in the market, and many bond firms won't do it. Surety, like all bid bonds, is a result of indemnification. That means that if a bond firm declines to fund the offer and we are unable to find a replacement bond company, the bond company will come after the construction company for reimbursement for any sums paid out.

Is it possible to get a Bid Bond with Bad credit?

If you're concerned that your credit score or financial background could jeopardize your ability to obtain a bid bond, the surety company you choose is critical. Some companies refuse to work with people who have poor credit. Others recognize that bad credit does not necessarily imply that an individual is ineligible for a bond. Before issuing you a bond, surety bond firms check your credit to see how likely you are to fulfill your financial obligations under the bad credit surety bond. Any legitimate claims filed against your bond must be paid by you, the bonded party. If you don't, the surety firm will pay, but they will attempt to recover the same amount from you.

Your credit score is one predictor of your trustworthiness and accountability, as determined by your payment history. Having bad credit does not always imply that you are a bad person or that you will default on your obligations. However, it does indicate that the surety firm is taking a greater risk. This will be reflected in the premium price you'll pay.

How are Bid Bonds claims handled?

Since a surety company promises payment on all legitimate claims, it usually conducts a thorough investigation to ascertain the validity of a claim. When it comes to bid bonds, though, things are a little different. Since there's no doubt whether or not a bonded contractor backed out of a contract award, the surety will pay the claim in full, then focus on recovering the debt from the principal. The principal agreed to take financial responsibility for all claims by signing the surety bond agreement and, as a result, cannot escape payment responsibility. While it might seem self-evident, it is worth repeating: the best way to escape bid bond allegations is to complete projects after winning a bid.

What are the requirements for obtaining a Bid Bond?

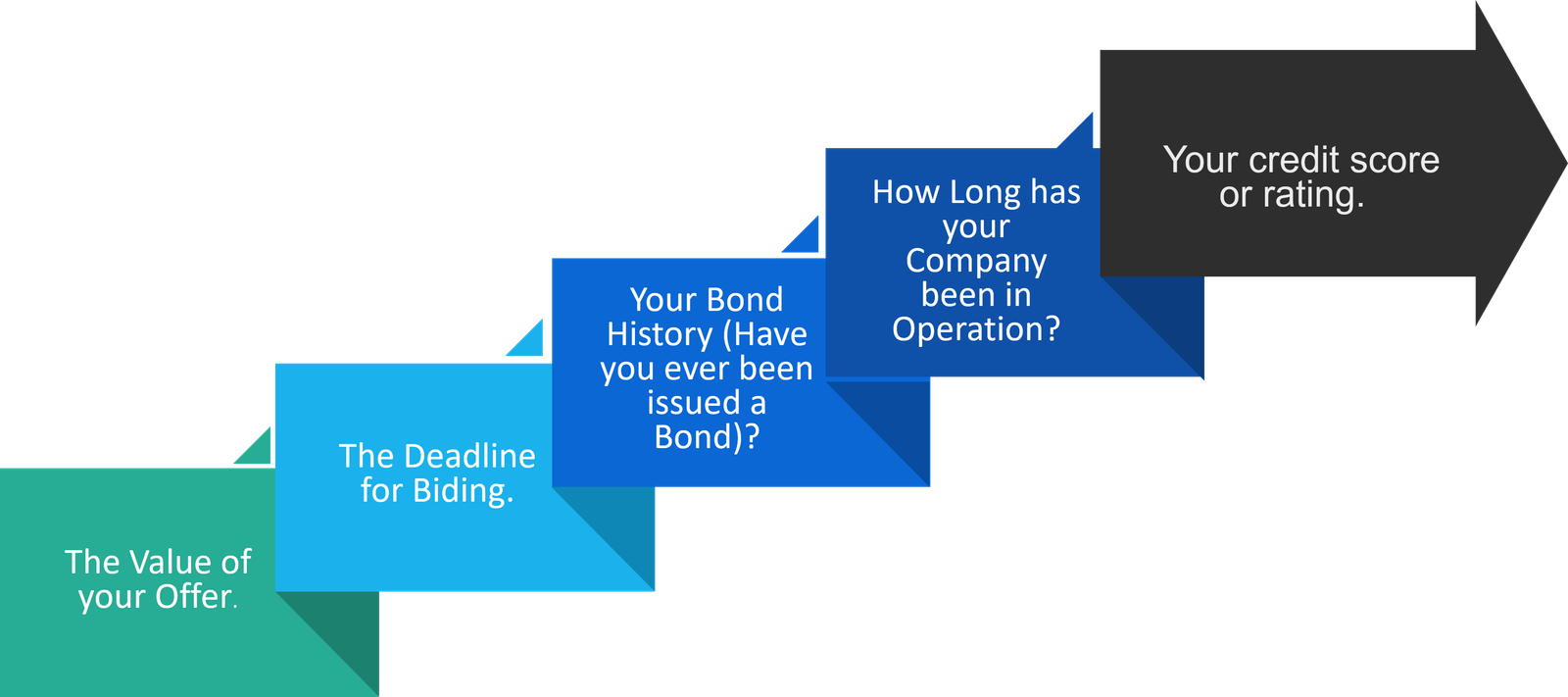

Applying for a Bid Bond is similar to applying for a Performance Bond because when a surety provides you with a Bid Bond, they also promise to provide you with a Performance Bond if your bid is approved. Thus following things may be considered to apply for a Bid Bond:-

Conclusion

In the end we come to an understanding of the fact that Bid Bonds do play a crucial role in securing high revenue attracting projects for your company. Therefore a complete elucidated knowledge of what are bid bonds and how can they supplement the growth of your company is very important. Bid bonds are a predominant piece of document and absolute care and precision should be practiced while obtaining one. It is not utterly compulsory to have a bid bond, however, you should. Bid bonds are a type of "bid insurance" that can be used instead of other types of security like a certified check or a bank's irrevocable letter of credit. We hope this blog is advantageous for you in order to accumulate the correct knowledge regarding Bid Bonds.

DhanGuard: All-in-One Solution for Business Setup in Dubai, UAE

DhanGuard is your ultimate one-stop solution for all your business needs. Whether you’re planning to set up a new company or expand your existing business in the UAE, we’ve got you covered with our comprehensive range of services. From Company Formation in UAE and Business Bank Account in UAE services to managing your financial and legal compliance, we provide everything you need under one roof.

Our services include:

- Company Formation in UAE and Dubai

- Opening a Business Bank Account in UAE and Dubai with a 99% success rate

- VAT & Corporate Tax Compliance

- Accounting, Bookkeeping, and Auditing Services

- Trade License Renewal

- Golden Visa Assistance

Let DhanGuard make your journey of Business Setup in Dubai seamless and hassle-free!