Unfortunately, life insurance claims are sometimes refused, leaving your beneficiary with a lengthy battle or nothing at all. Knowing your policy and some of the most prevalent causes for life insurance claim denials will help you avoid this situation entirely.

Life insurance is a type of death benefit that can assist your loved ones in dealing with the financial consequences of your passing. In most cases, you buy an insurance and pay your insurer a monthly premium. In exchange, they pay a lump amount to your specified beneficiary following your death.

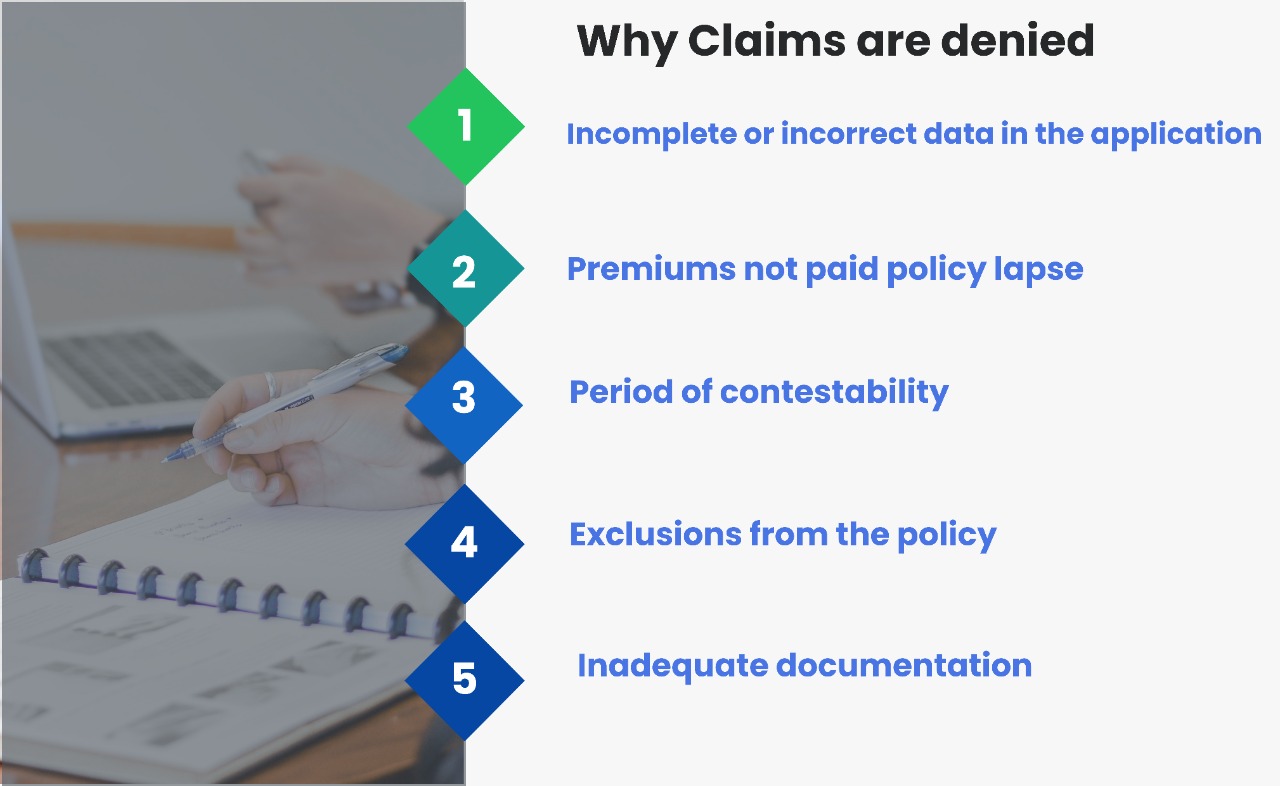

Reasons why Life Insurance Claims are denied

When purchasing a life insurance policy, you must complete a lengthy application process. This ensures that the insurer has all of the information necessary to assess your risk and determine your premiums and coverage.

The following are the top five reasons why these claims are denied:

Incomplete or Incorrect Data in the Application

You will be asked questions about your physical and emotional health in this application. You must reveal your age, family medical history, any high-risk activities you participate in, the length of insurance or coverage required, and maybe more.

A medical examination follows the application. This includes a physical exam in which your height, weight, and blood pressure are measured by a doctor. To gain a complete picture of your health, they may take blood and urine samples, as well as your medical history.

After receiving both items, the insurer conducts a thorough investigation of the claim to determine the monthly rates.

People who provide false information in their applications are a common reason for life insurance claims being declined. This might be done on purpose or by accident. People will sometimes tell what they regard to be white lies to minimize their insurance costs, or they will leave out information that they believe is unimportant.

For example: -

- Saying you aren't a smoker when you are or have been in the past

- When it comes to your driving past, being dishonest is a big no-no.

- If you have a history with drugs or alcohol, claiming that you don't have one.

- Downplaying the risks, you face in your job or in your personal life.

You may believe that being slightly dishonest about these matters may help you get authorized or cut your prices. However, if they discover you have been dishonest during the application process, the penalties might be severe. You could be denied coverage or perhaps charged with insurance fraud.

If an investigation is conducted after the death and the dishonesty is discovered, your family may receive a considerably reduced amount of money, or the claim may be refused entirely despite years of premium payments.

Premiums not Paid/Policy lapse

A contract between you and the insurer is life insurance. You agree to pay them a monthly amount for a certain number of years in exchange for them paying your beneficiaries a lump payment if you die. If you don't pay your life insurance premiums on time, your policy will lapse, and you will lose coverage.

Most life insurance policies feature a grace period during which the policy will continue to be valid notwithstanding a payment default. This grace period is usually 30 days; however, it might vary depending on the firm and policy. If your policy fails because of a missed payment, you can request that it be reinstated. Some insurers will allow this pending a medical assessment within 5 years of the lapse. In most cases, you'll have to repay the missed installments — plus interest.

This isn't to say that every company will agree. It is entirely up to them to decide. Some companies will allow you to reinstate payments, although the contestability period may be restarted. You may be out of luck if you don't pay the premiums, but you may be able to cancel and "cash out" the remainder of the claim with a penalty if you don't pay the premiums.

If you get life insurance via your job, the premium is usually deducted from your income, and you won't even notice. It is vital to know, however, that if you leave your employment, you will no longer be covered.

Period of Contestability

A life insurance claim's contestability period is the time during which the insurer can investigate and deny claims. Typically, the period begins two or three years after the life insurance policy is purchased. This varies depending on the policy.

In other cases, an investigation may be conducted only if there is a red signal for the insurer. A mysterious cause of death or something that contradicts the application are both red flags. However, if a death occurs during the contestability period, regardless of the cause, an investigation is launched.

This does not mean that if you die within the first two or three years, your family will be left with nothing; it simply means that a mandatory investigation will be conducted.

The claim could be refused for a variety of reasons within the contestability period. They will usually investigate whether you answered the questions on your application honestly. If you didn't, they can use that as a reason to reject your claim, even if it has nothing to do with the cause of death.

It's crucial to be aware of the contestability phase, but you or anybody else won't be able to manage it in most circumstances because death is unpredictable.

Exclusions from the policy

Every life insurance policy is unique, as I've explained several times. It's critical to understand what you're joining up for.

A policy exclusion is a clause in the policy that excludes coverage for a certain type of risk that the insurer does not want to cover. Many policies feature stipulations that say they don't have to pay out if you die under specified circumstances.

The following are some of the most typical exclusions:

Suicide

This condition is in place at some insurance firms to dissuade people from taking their own lives when they or their beneficiaries are in financial distress. Some policies will compensate you if you die because of suicide, but only if it occurs outside the contestability period.

Extremely dangerous behavior

Consider skydiving, scuba diving, or rock climbing as examples. The insurance company may argue that death caused by a dangerous hobby is a "self-inflicted injury," and that you would still be alive if you hadn't been careless. Alternatively, they may point out that you failed to disclose this behavior on your application, implying that the entire transaction was made in bad faith.

Almost anything could be covered by a policy exclusion. When obtaining an insurance, it's critical to understand your individual policy and what it covers. Pay close attention to the details. It's occasionally a good idea to have a lawyer go over it with you ahead of time.

Inadequate documentation

Finally, insufficient documentation can lead to a life insurance denial. This is something that would be the beneficiary's obligation, not the policyholders.

You'll need appropriate papers to collect a life insurance policy. A certified copy of the death certificate is always required. A copy of the insurance policy, the claims form, a physician's statement, or a full coroner’s report may also be required. Additional paperwork may be required if the death happens outside of UAE

It's critical to understand what you need to submit and to have all your documentation in order. Some extra documents may be more difficult to collect but attempting to claim life insurance without them may result in a delay or refusal.

Conclusion

Nobody like dealing with denied claims, and it prolongs the time it takes for you to be compensated for your services. Fortunately, there are a number of things you may do to reduce the likelihood of this occurring. Excellent medical billing systems, excellent communication with patients and insurers, and well-trained coding professionals and front desk employees may all help you avoid claim denials and the problems that come with them. To learn more, you can connect to us at Dhanguard.

DhanGuard: All-in-One Solution for Business Setup in Dubai, UAE

DhanGuard is your ultimate one-stop solution for all your business needs. Whether you’re planning to set up a new company or expand your existing business in the UAE, we’ve got you covered with our comprehensive range of services. From Business Setup in UAE and Company Formation in Dubai to managing your financial and legal compliance, we provide everything you need under one roof.

Our services include:

- Company Formation in UAE and Dubai

- Opening a Business Bank Account in UAE and Dubai with a 99% success rate

- VAT & Corporate Tax Compliance

- Accounting, Bookkeeping, and Auditing Services

- Trade License Renewal

- Golden Visa Assistance

Let DhanGuard make your journey of Business Setup in Dubai seamless and hassle-free!