Dubai Freezone License: Cost, Types & Complete Setup Guide (2026)

Dubai Freezone License Cost...

Dubai Freezone License Cost...

Ajman Free Zone Business Setup Cost...

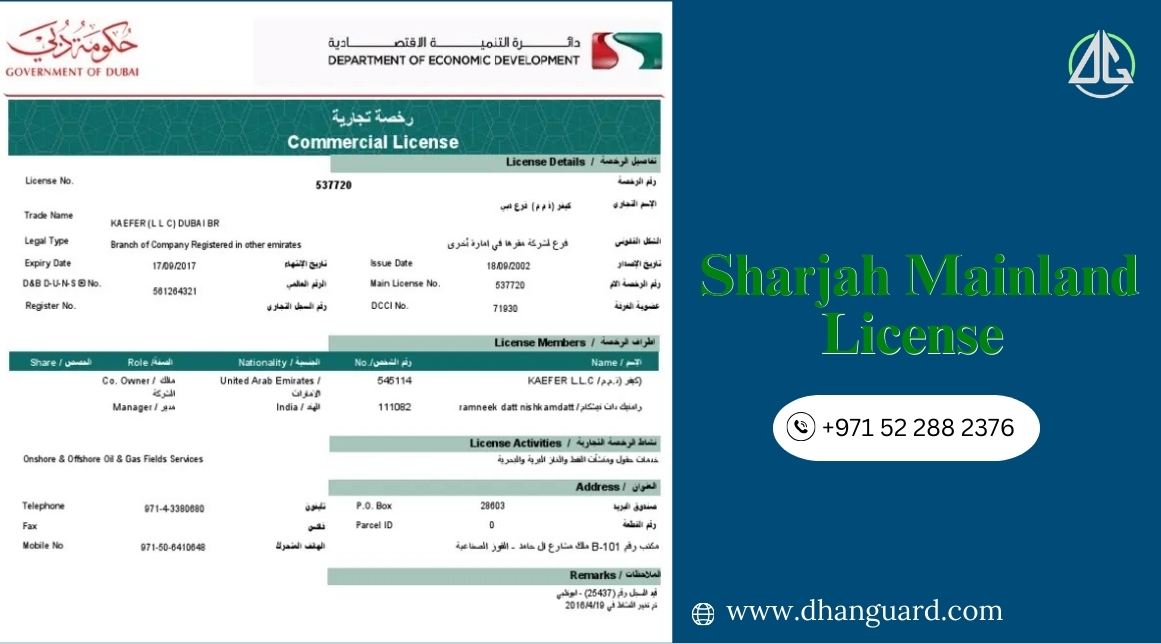

Sharjah Mainland License Cost...

How to Find the Right Business Consultant in Dubai...

A new business setup in Dubai is an excellent choice, especially for new entrepreneurs or investors. The UAE offers investor-friendly policies, tax b...

Business Setup in Dubai 2026...

Technical Services Company in UAE & Dubai...

How to Open a Company in UAE...

Online Company Registration in Dubai...

Mainland Company Setup in UAE...

Get Free Consultation