UAE is a land brimming with chances for budding businesses. If someone wants to start a business outside of their native nation, the United Arab Emirates is the first place that springs to mind. According to the World Bank's 2017 Ease of Doing Business Report, the UAE is ranked 21st. This is due to the government's development of unrivaled infrastructure, a rich and diversified culture, and a business environment that have all had a favorable impact on the economy.

Overview of Business Loan in UAE

Due to its strong financial system, UAE has become a commercial hub and is a popular international investment location. It is not difficult for banks in UAE to provide financial assistance to entrepreneurs in the form of business loans.

Business loans in UAE are quite easy to come by, with a variety of banks and credit businesses offering various packages. Keep the 5 Cs of your credit in mind if you want to get the most out of a small company loan: capital, capacity, character, collateral, and any other 'conditions' from the lender. They are not risk-free, no matter how simple or convenient they are to obtain. In this article, we'll discuss the many types of business loans available in UAE, as well as the dangers and aspects to consider before applying for a small company loan in UAE.

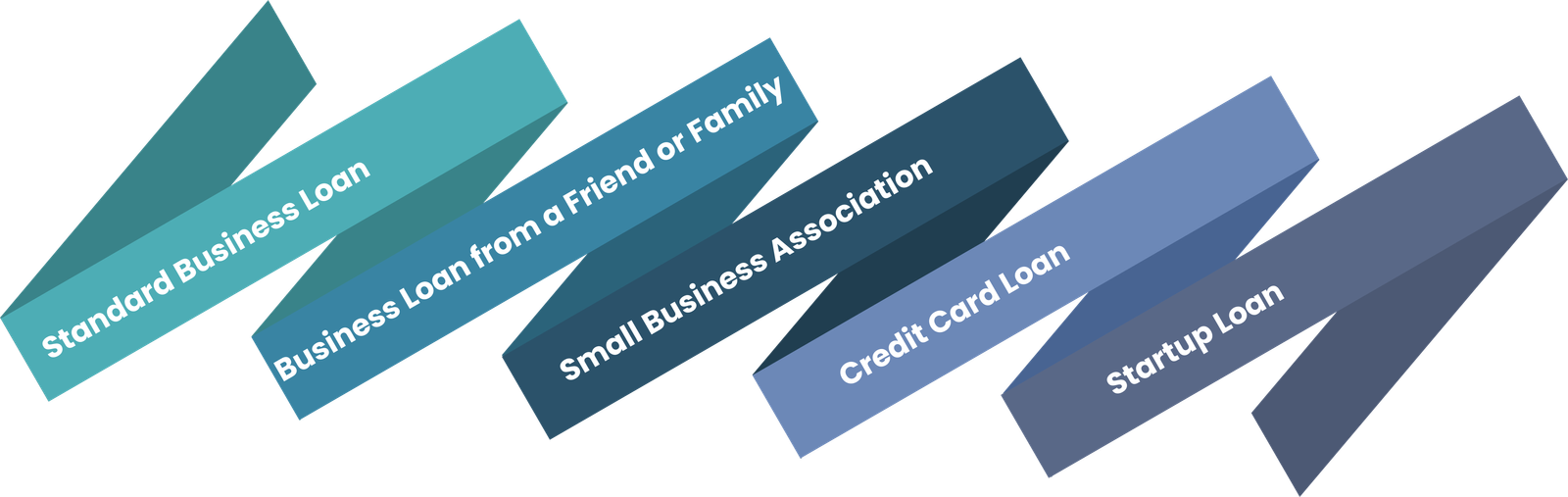

Various Types of Small Business Loans for SMEs and Startup

Here are examples of some Business Loan provided to SMEs and Startup

Standard Business Loan

You normally pay a monthly payment for a set length of time in this style. The conditions and amount of payment are set in stone and cannot be changed afterwards. However, if you take out a variable-rate loan, the conditions and amount of the loan may alter. If you do not comply with the bank's terms and conditions, the contract and your account may be terminated.

Business loan from a friend or family

You might also approach a member of your family or a friend for a business loan. The benefit would be the flexibility of the terms and the lack of interest, but the danger would be that you may ruin the relationship if you were unable to repay.

Small Business Association

If your local bank refuses to give you a business loan in Dubai, you can apply for one through the SBA (Small Business Association). The government backs SBA loans. They are an excellent alternative for small enterprises, but the risk is that if you are unable to repay, the government will pursue you aggressively. Because the repercussions of not paying back are so severe, most people try to avoid it.

Credit Card Loans

Small firms are permitted to obtain cash advances by credit card, although there is a hefty interest charge. It's quite difficult to get out of debt, yet it's still preferable to an SBA loan.

Every sort of company loan has some risk, which is logical given that lenders are entrusting you with their money.

It is quite simple to obtain a business loan in Dubai if you have genuine and acceptable documentation. The most significant of these is a Trade License.

Startup Loan

A Start Up Loan is a government-backed personal loan available to individuals looking to start or grow a business in the UAE

In addition to finance, successful applicants receive 12 months of free mentoring and exclusive business offers to help them succeed.

The loan is unsecured, so there’s no need to put forward any assets or guarantors to support an application

Criteria for Obtaining a Business Loan in UAE

You must determine whether you are eligible for a bank loan. Not every bank has policies that are tailored to your specific need. Instead, each have their own set of eligibility requirements. Most significantly, before approving a loan, banks examine the nature of the firm and the directors/partners/shareholders' profiles. Banks assess their risk in the sector by looking at how well-established it is, how long it has been in business, and what assets it has.

The following are the most prevalent requirements:

- The company should have been in operation for at least a year.

- An offshore company's branch or representative office can easily obtain a loan.

- Amount of minimum annual turnover

Interest rates for business loans are established by banks. SME interest rates are typically lower (Small and Medium Enterprises). SMEs provide a significant contribution to the UAE's economy. Banks and other financial institutions recognize the importance of SMEs and provide business loans to them.

The criteria for obtaining a business loan for a small business are not completely defined. It is dependent on,

- The client's business and the industry in which he works.

- Performance over time

- Needs for financing or risk mitigation vs. what has already been sourced

- Client's plans for the future of the company

The most essential aspect in deciding the loan amount is turnover. The company's bank account and audited financial documents show the company's turnover.

Other Benefits

Apart from business loans, other benefits given by banks include

- Free credit cards

- Free life insurance cover

- Shariah compliant business loans

- Option to choose between fixed interest rates or reducing interest rates

- No need to provide security for the loan

Advantages of Business Loan

- You can borrow a significant amount of money for major business projects

- You have full control of the money you borrow

- You can easily access the funds

- The interest rate is usually low

- You will enjoy a tax deduction

- Your business credit will improve

- You won’t have to share your business profit

Conclusion

Obtaining a Business Loan in UAE is a simple yet difficult process. You must obtain the appropriate license and prepare the essential documentation in order for the loan to be approved. UAE banks have stringent compliance policies. The bank will reject your loan application if there is a contradiction between your business activity and your license. To avoid this, we recommend that you contact our experts, who will guide you through the process of securing a loan for your business. For more information, go to Dhanguard company creation services.

DhanGuard: All-in-One Solution for Business Setup in Dubai, UAE

DhanGuard is your ultimate one-stop solution for all your business needs. Whether you’re planning to set up a new company or expand your existing business in the UAE, we’ve got you covered with our comprehensive range of services. From Company Formation in UAE and Business Bank Account in UAE services to managing your financial and legal compliance, we provide everything you need under one roof.

Our services include:

- Company Formation in UAE and Dubai

- Opening a Business Bank Account in UAE and Dubai with a 99% success rate

- VAT & Corporate Tax Compliance

- Accounting, Bookkeeping, and Auditing Services

- Trade License Renewal

- Golden Visa Assistance

Let DhanGuard make your journey of Business Setup in Dubai seamless and hassle-free!