The United Arab Emirates is a land brimming with prospects for entrepreneurs to launch their businesses. If someone wants to start a business outside their native nation, the United Arab Emirates is one of the first places to mind. This is due to the Government's development of unrivaled infrastructure, a rich and diversified culture, and a business environment that has all benefited the economy. Starting a new business in the United Arab Emirates (UAE) can be exciting, but it often requires substantial financial investment. Due to its strong financial system, Dubai, the UAE's commercial hub, is a popular international investment location. It is easy for banks in Dubai to provide financial assistance to entrepreneurs through business loans. Many aspiring entrepreneurs seek funding options to kickstart their ventures, and one popular choice is a business loan for startups. This blog will delve into the essentials of obtaining a startup business loan in the UAE, including details on securing financing without requiring extensive bank statements.

What is a Business loan?

It is an unsecured loan taken by an individual or entity from a bank or non-banking financial company (NBFC) based on his income to meet their financial needs. A business loan is a lifeline for those struggling with liquidity issues, financial sickness, and working capital. It also helps businesses to expand and open new business lines, etc. There are many types of business loans, which can be suggested according to the requirements and availability.

Almost all central banks in the UAE provide attractive lending options for start-ups and entrepreneurs. Any bank where you have a current account and new banks can offer you several possibilities. Flexible payment plans ranging from a few months to two years are available.

The Need for Startup Business Loans in UAE

Launching a new business in the UAE can be a costly initiative. Entrepreneurs often face business registration, licenses, office space, inventory, marketing, and more expenses. While personal savings and investments from family and friends may cover some of these costs, securing a business loan can provide the financial boost necessary to establish a thriving enterprise.

Types of Startup Business Loans in UAE

Some of the major Types of Startup Business Loans in UAE are as follows:

-

Traditional Bank Loans: Banks in the UAE offer business loans to eligible entrepreneurs. However, these loans typically require a comprehensive business plan, a solid credit history, and substantial collateral, making them a challenging option for many startups.

-

Government Grants and Subsidies: The UAE encourages entrepreneurship through various grants and subsidies—research local and federal initiatives to discover if your business qualifies for financial support.

-

Online Lenders: Fintech companies and online lenders have become increasingly popular in the UAE, offering quick and accessible financing options for startups. These loans often have less stringent eligibility criteria compared to traditional banks.

-

Angel Investors and Venture Capitalists: Some entrepreneurs opt for external investors who provide capital in exchange for equity in the business. While this option may not involve traditional loans, it can be a valuable source of funding for innovative startups.

Eligibility Criteria

You must know whether or not you are eligible for a bank loan. Only some banks have policies that are tailored to your specific needs. Instead, each has its own set of eligibility requirements. Most significantly, before approving a loan, banks examine the nature of the firm and the directors/partners/shareholders' profiles. Banks assess their risk in the sector by looking at how well-established it is, how long it has been in business, and what assets it has.

The most common requirements are:-

-

A business should be at least a year old.

-

There should be a business set-up.

-

There should be an active company account.

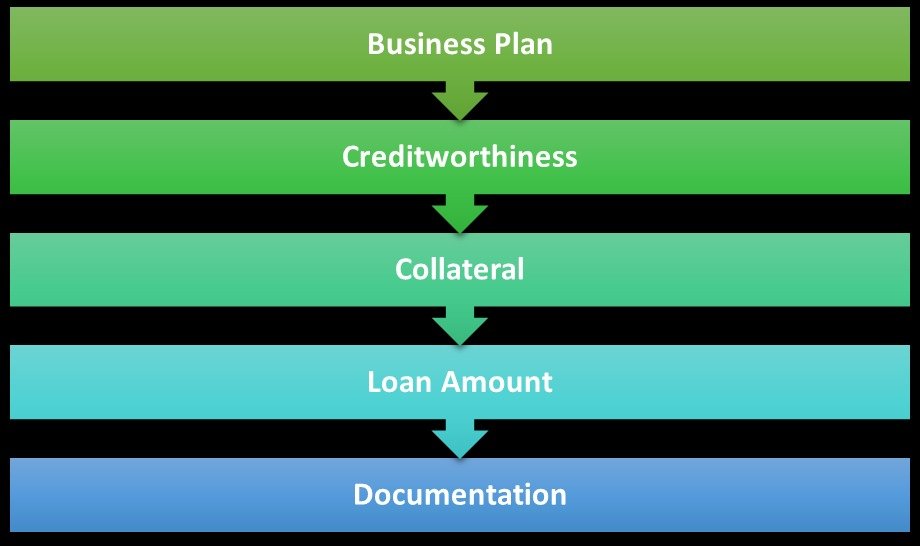

How to Secure a Startup Business Loan in UAE

Following is the process to Secure a Startup Business Loan in Dubai, UAE:

-

Business Plan: A well-structured business plan is essential regardless of the lending source. It should outline your business idea, market research, financial projections, and how you plan to use the loan.

-

Creditworthiness: Maintain an excellent personal credit score as it can significantly impact your loan eligibility. Pay off outstanding debts and address any credit issues before applying.

-

Collateral: If applying for a traditional bank loan, be prepared to offer collateral such as real estate, assets, or a personal guarantee. However, online lenders may provide unsecured loans.

-

Loan Amount: Determine the exact amount you need and only borrow what is necessary. Overborrowing can lead to unnecessary debt.

-

Documentation: Gather all the required documentation, including bank statements, financial statements, business licenses, and any other documents the lender specifies.

Mandatory Documents

Some of the mandatory documents needed to get a startup business loan in the UAE are as follows:

-

Trade license: (The trade license is a permit issued by the UAE government to investors, allowing them to conduct business. Every trade has its own set of trade permits, which vary depending on the nature of your firm. The price for a trade license would range from AED 3,900 to AED 183,000. Most business people prefer a general trade license, which may be used to conduct business in various commodities. The trade license is advantageous for business loans and other types of loans in the UAE, such as personal, home, and auto loans. For self-employed people, a trade license is a crucial document.)

-

A valid copy of the partners' Passport, Resident visa, and Emirates ID.

-

MOA or AOA.

-

Twelve months' bank statement of the company account.

-

Tenancy Contract.

-

3-5 Sales and purchase vouchers.

Business Loan in UAE without Bank Statement

Securing a business loan without providing extensive bank statements can be challenging but not impossible. Here are some options to explore:

-

Online Lenders: Some online lenders in the UAE offer loans with less stringent documentation requirements, reducing the need for extensive bank statements.

-

Government Initiatives: Explore government-backed initiatives that provide startup funding without demanding exhaustive financial documentation.

-

Alternative Financial Statements: If traditional bank statements are not readily available, consider alternative financial information, such as cash flow projections, invoices, or tax returns.

-

Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers with individual investors who may have more flexible lending criteria.

Some General Factors that the Bank Considers when Examining the Application

Few things which Bank looks while reviewing the Application are as follows:

Cash Flow

In the day-to-day operations of a business, cash flow is frequently overlooked. On the other hand, banks pay close attention to a company's cash flow during normal operations. It is a reliable measure of a company's financial well-being.

Knowledge

Business owners and management must possess extensive professional knowledge. Banks frequently note that SMEs and startups need to gain appropriate expertise in their sector or field. In addition, a lack of experience in the industry is a source of concern. As a result, the entity's management must demonstrate that they have the necessary knowledge and skills to ensure the enterprise's success.

Business Plan

Another crucial component is the business plan. This may seem self-evident, but a well-organized and well-written business plan is critical to receiving a loan. The banks will scrutinize the business plan to see if the company has a clear vision and reasonable expectations for success. A strong business plan can prevent your application from being denied, even if it is immaculate and fits all of the standards.

Corporate Governance

Corporate governance is a crucial predictor of a company's riskiness. Banks consider corporations that lack a well-structured corporate governance system to be risky. As a result, having a corporate governance framework in place is critical; it must be solid, and you must be able to demonstrate it to banks.

Transparency

When dealing with banks, it's also crucial to remember that transparency and excellent communication are essential. Feel free to speak up about anything, even a business issue. This will enable the bank to be informed of any circumstances, preventing concerns from arising unexpectedly in the future.

Conclusion:

Starting a new business in the UAE can be rewarding, and securing the right financing is a critical step on that journey. Whether you opt for traditional bank loans, online lenders, government grants, or alternative sources, careful planning and preparation are key to successfully obtaining a startup business loan. Securing a business loan in the UAE is a simple yet tricky process. You must obtain the appropriate license and prepare the essential documentation to approve the loan. UAE's banks have stringent compliance policies. The bank will only accept your loan application if there is a contradiction between your business activity and your license. To avoid this, we recommend contacting experts who will guide you through securing a loan for your business. While acquiring a business loan in the UAE without extensive bank statements can be more challenging, exploring diverse financing options can help you realize your entrepreneurial dreams. Remember, each startup is unique, so choose the financing option that aligns best with your business goals and needs. Contact us today to start your journey now!

DhanGuard: All-in-One Solution for Business Setup in Dubai, UAE

DhanGuard is your ultimate one-stop solution for all your business needs. Whether you’re planning to set up a new company or expand your existing business in the UAE, we’ve got you covered with our comprehensive range of services. From Business Setup in UAE and Company Formation in Dubai to managing your financial and legal compliance, we provide everything you need under one roof.

Our services include:

- Company Formation in UAE and Dubai

- Opening a Business Bank Account in UAE and Dubai with a 99% success rate

- VAT & Corporate Tax Compliance

- Accounting, Bookkeeping, and Auditing Services

- Trade License Renewal

- Golden Visa Assistance

Let DhanGuard make your journey of Business Setup in Dubai seamless and hassle-free!