Gold ETF (exchange-traded fund) is a type of indirect investment that tracks the price of physical gold. In its most basic form, a Gold ETF is similar to purchasing gold in an electronic form. One gram of gold is equal to one unit of Gold ETF, which investors will get in dematerialized form. Because it is a Gold ETF, the units are listed on stock exchanges, allowing investors to sell and purchase the units just like any other equity product. As a result, if an investor sells the Gold ETF, they will receive money rather than real gold. Exchange-traded funds (ETFs) are securities that can be bought and sold on a stock exchange.

The objective is to profit from the sale. The main advantage of investing in a Gold ETF is that you don't have to worry about having gold on hand while still making a profit. Purchasing gold in the form of necklaces, gold bars, and ornaments is quite expensive when compared to Gold ETF. Gold ETFs are bought at a lower selling price than the current gold rate in Dubai. Thus in this blog we will discuss all the relevant details that you should be familiar with so as to know about Gold ETFs and the investment capabilities. So without any further ado, let’s learn.

The Gold ETF: An Overview

As everyone knows, the United Arab Emirates is known around the world for its gold market. UAE is a large gold consumer due to its passion and fascination with the metal. Rather of investing in physical gold, most people prefer to invest in paper gold, such as Gold ETFs, Gold stocks, Gold bonds, and so on. An ETF (Exchange Exchanged Fund), like stocks, is traded on a stock exchange. It's a type of security that includes a variety of assets, such as stocks. ETFs are very similar to mutual funds. The only difference is that ETFs are traded on a stock exchange, and share prices fluctuate throughout the day. Mutual funds, on the other hand, are not traded on a stock exchange.

- Gold Exchange Funds combine gold investment with stock exchange trading. The current gold rate in the United Arab Emirates is taken into account, and investments are made in the form of bullions. One gram of gold is equal to one unit of Gold ETF, as previously stated. These Gold ETFs, like corporate stock, are sold on the stock exchange cash market. Stockbrokers handle the trade and can assist you in purchasing gold at the current rate in the UAE. Investors can keep track of their funds by reviewing gold prices on an hourly or daily basis.

- There are no restrictions on the number of Gold ETFs that may be purchased; an investor can trade with only one ETF. When compared to stock exchanges, the brokerage charge on Gold ETFs is quite low. Hedging tools such as gold ETFs are used to safeguard against political instability, war, inflation, and changes in the value of domestic and international currencies. When the price of international currency falls, investors are more likely to invest in gold ETFs.

Who should invest in Gold ETFs?

An investor who wants to diversify their portfolio can set aside a particular amount of money to buy Gold ETF. It is vital to remember that while real gold cannot be obtained, a certificate that is comparable to gold can be obtained throughout the redemption process. A gold ETF can be held for investment purposes, but an investor who wishes to buy gold cannot do so through such instrument.

Gold ETFs in the United Arab Emirates

NASDAQ, in partnership with the World Gold Council and the Dubai Multi Commodities Centre, launched the world's first Sharia - compliant gold ETF, dubbed Dubai Gold Securities. This product is transacted using an exact and Sharia - compliant international gold price. It is backed by gold that has been physically allocated and is kept in a London vault. The physical gold factor eliminates the possibility of a third-party default.

Gold is easily accessible to retail investors. Gold is a safer investment than other asset classes. The transparency of gold ETFs is governed by strict investing restrictions. The fund's gold investment quality is transparent, and it receives the correct market value, which is transacted in units. There are currently no additional fees for accepted applicants who wish to redeem Dubai Gold Securities. Dubai Gold Securities on Nasdaq Dubai can be traded through authorized channels for usual brokerage fees. The demand for gold in Dubai is expanding, and market participants require an ETF market. Because the Dubai ETFs are consistent with Sharia law or Islamic law, no interest is charged on the investment.

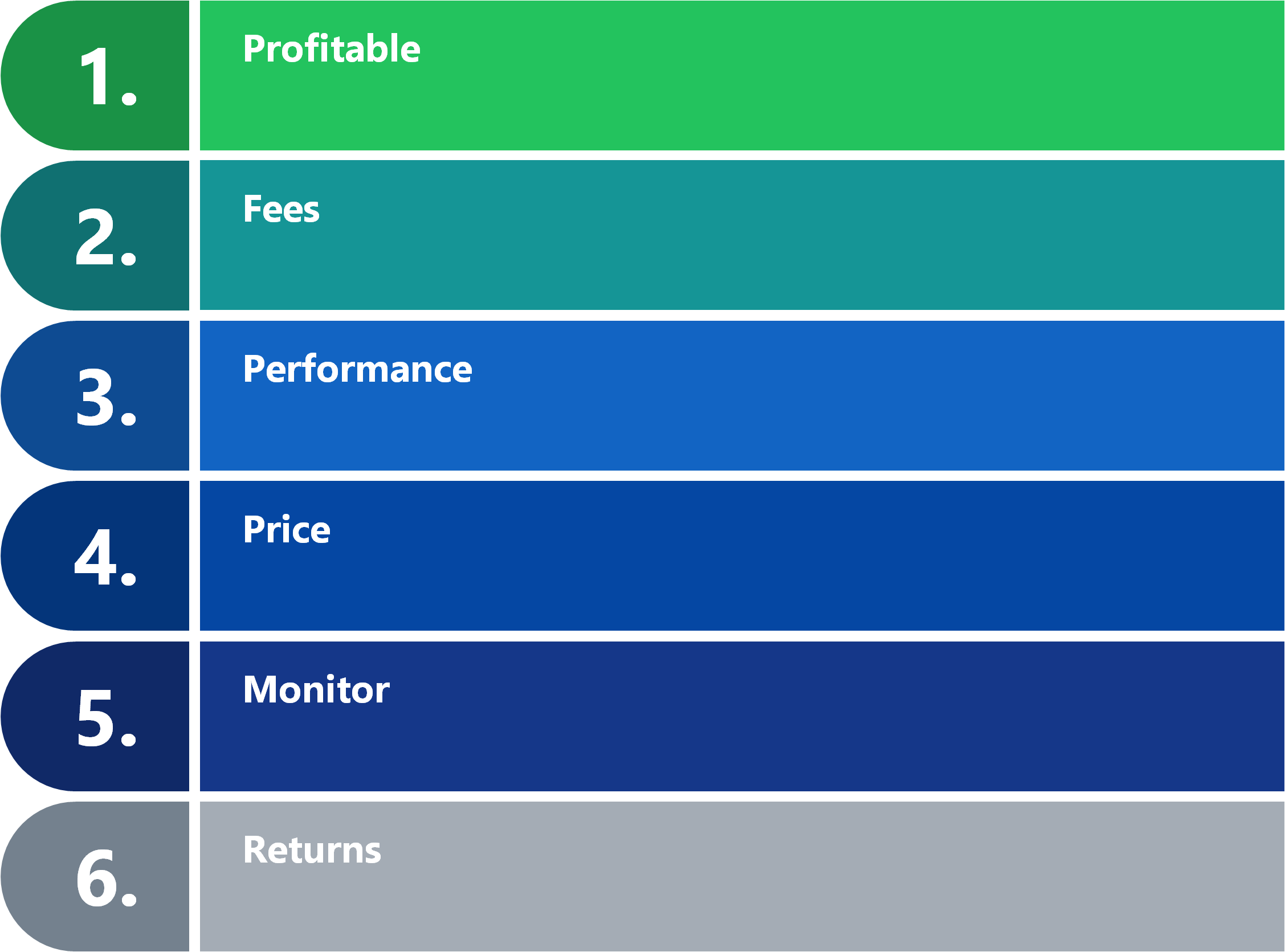

Tips to consider before investing in Gold ETFs

Profitable

If you want to invest big amounts of money or trade frequently, gold ETFs are more profitable than other gold-based investments.

Fees

Because gold ETFs have brokerage or commission fees ranging from 0.5 to 1%, look around the ETF market for a stockbroker/fund manager with reasonable fees.

Performance

Low costs alone should not be used to select a gold ETF or fund manager. Examine the fund's performance over the last few years to get a sense of how well the managers are managing the accounts.

Price

Before you begin trading, keep an eye on the gold price movements. You may wish to buy gold ETFs at cheap prices and sell them when prices rise, just like stocks.

Monitor

Keep an eye on your account and the trades that are being done for you if your gold ETF is managed by a fund manager. Monitoring your portfolio on a regular basis might help you improve its performance.

Returns

Long-term returns on gold are typically as low as ten percent each year, making it a better short- to medium-term investment. Make no excessively large or long-term gold investments. It's a good idea to allocate 5% to 10% of your investment portfolio to gold ETFs. This will also aid in the stability of your portfolio's results.

Benefits of investing in a Gold ETF

The benefits of investing in a Gold ETF are enumerated below.

- An investor can securely invest in gold without considering aspects such as gold purity, price transparency, locker availability, making charges, and many other factors.

- A unit is equal to one gram of gold, and an investor can purchase as little as one gram of gold at a time.

- The ability to acquire and sell instruments is more flexible, and the price difference can favor the seller.

- It has higher liquidity and is a liquid investment that can be bought and sold at current exchange rates.

- In the United Arab Emirates, gold rates fluctuate at a far lower pace than equities, lowering financial risk.

- Gold ETFs are regarded as a secure investment option.

- Physical gold is more expensive than gold ETFs. Smaller denominations are also available. You cannot ask for one gram of gold when buying physical gold, and whatever physical gold you buy will be subject to manufacturing costs, but one Gold ETF unit is equivalent to one gram of gold. There are no concerns concerning price variations, quality, purity, weight, or buying units.

Conclusion

Gold ETFs are the best investing options because they are gold investments. It is a secure investment since it can act as a hedge against inflation and market volatility. The gold ETFs held by the investor serve as collateral for lending. Gold exchange-traded funds (ETFs) provide portfolio stability and investment pool strength.

Investing in Gold ETFs lowers the risk of losing money. The United Arab Emirates is a pioneer in the gold market and a global leader in the gold industry. Gold ETFs are the ideal option for investors who wish to invest in gold in paper form, and the UAE leads the world in all aspects of gold trading and investing. We hope this blog provided you with incite full information. For more information on other related aspects, feel free to check out our Website as well.

DhanGuard: All-in-One Solution for Business Setup in Dubai, UAE

DhanGuard is your ultimate one-stop solution for all your business needs. Whether you’re planning to set up a new company or expand your existing business in the UAE, we’ve got you covered with our comprehensive range of services. From Business Setup in UAE and Company Formation in Dubai to managing your financial and legal compliance, we provide everything you need under one roof.

Our services include:

- Company Formation in UAE and Dubai

- Opening a Business Bank Account in UAE and Dubai with a 99% success rate

- VAT & Corporate Tax Compliance

- Accounting, Bookkeeping, and Auditing Services

- Trade License Renewal

- Golden Visa Assistance

Let DhanGuard make your journey of Business Setup in Dubai seamless and hassle-free!