Around the world, the International Bank Account Number, or IBAN, is used in both international and domestic payments. When manually entered by consumers and operators alike, the IBAN, which is a very long series of numbers and digits, is often a point of weakness.

A late payment almost often results in further delays and expenses for the business.

Your company will efficiently eliminate missed transactions and streamline the payment procedures by validating payment data at the point of entry.

The IBAN Suite programme is developed to help businesses around the world and in UAE to handle domestic and foreign payments more efficiently.

What Is an International Bank Account Number (IBAN)?

An IBAN, or international bank account number, is a common international numbering scheme for identifying an account held in a foreign country. The number begins with a two-digit country code, followed by two numbers and a string of alphanumeric characters. It's important to note that an IBAN isn't intended to override a bank's own account numbering; rather, it's intended to include additional detail that aids in the identification of international payments.

Why is an IBAN code needed in United Arab Emirates?

As now we know IBAN is an International Bank Account Number. IBANs are used to help guide international payments to the correct bank accounts.

Using a standard, internationally agreed format, an IBAN contains information about the country the payment is headed to, as well as the full basic bank account number for the specific account. This removes processing errors and helps cross-border transfers to move from one account to another easily and efficiently.

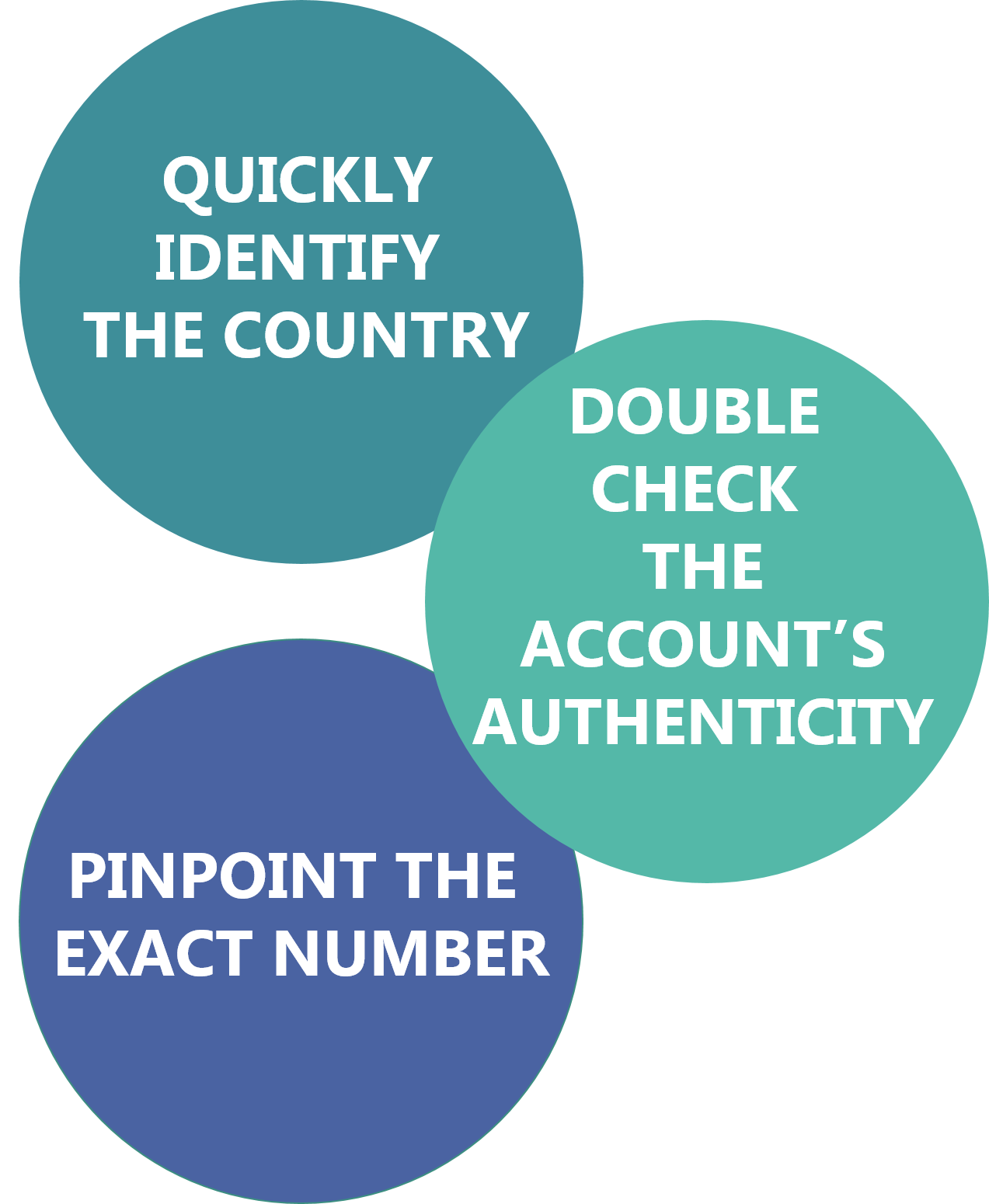

When a person makes or receives some kind of foreign payment between banks, it serves three critical functions:

Quickly Identify the Country

Financial institutions should use an IBAN to conveniently and efficiently note the country of the bank to which a transfer is being sent.

Pinpoint the Specific Account Number

An IBAN is used to identify the specific account number to which funds will be transferred within a region. Clearly, if one of these elements were absent, completing an international money transfer becomes a nightmare at best and difficult at worst.

Double Check the Account’s Authenticity

Finally, an IBAN provides financial institutions with a quick and convenient way to double-check the authenticity of an account's records and ensure that a satisfactory transfer can be made before proceeding.

How International Bank Account Numbers Work?

A two-letter country code is followed by two check digits and up to 35 alphanumeric characters in the IBAN sequence. The simple bank account number is made up of these alphanumeric characters (BBAN). It is up to each country's banking association to decide which BBAN will be used as the norm for that country's bank accounts. However, IBAN is still used by European banks, though it is gaining popularity in other countries.

When sending interbank transactions or wiring money from one bank to another, particularly across foreign borders, an IBAN number would be used. In the list of countries that use the IBAN scheme right now.

How to get your IBAN in UAE?

When sending money, it's critical to use the correct IBAN. If you make a mistake, your bank can send your money to the incorrect location or charge you for an invalid payment.

You will normally find your IBAN by checking your bank statement or logging into your online banking and if you are facing trouble to find your IBAN number then our experienced experts at Dhanguard will help you find your IBAN number in UAE.

It's important to note that just because an IBAN is in the correct format doesn't mean it exists. Alternatively, it may be the correct IBAN for a specific account. Before sending or accepting a payment, double-check with your receiver or bank or make payment after consulting our experts who will guide you at every step from obtaining your I BAN number and in the process of making a payment.

Who uses IBAN?

The IBAN was designed to make electronic transfers between banks in the Eurozone easier. Since then, it has spread around the world, but not all banks and regions have adopted the norm, and you may still need to focus on an alternative method like SWIFT. The IBAN is not used for domestic money transactions in North America, Australia, or Asia, and is only used when making a payment to a country that has adopted the IBAN.

What does an IBAN look like in UAE?

An IBAN number is made up of a sequence of alphanumeric characters that all play a role in the money transfer process. Every country uses the same IBAN format, though the number of digits can differ. Norway, for example, employs 15 characters, while Liechtenstein employs 21, while in UAE an IBAN has 23 characters. Any nation will use a limit of 34 numbers. An IBAN example in the United Arab Emirates- AE07033098765432109876.

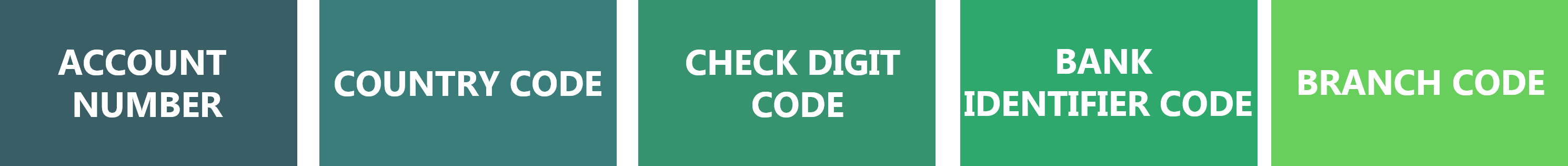

In general, an IBAN number is divided into the following codes (which may or may not be in the order listed, depending on the country):

Country code

The ISO country code is the first two letters. The country code identifies the country where the transaction is to be made.

Check digit code

The check digits are the two digits after the country code. They aid in the verification of the account number as well as the routing destination.

Bank identifier code

The bank code is in the next line. This, of course, specifies the bank that owns the account.

Branch code

The branch code is the fourth string of characters which signifies the bank branch and in which city or state the branch is located.

Account number

Finally, we arrive at the account number, which is the last string of characters. It will still be 16 characters long in Cyprus.

The Basic Bank Account Number is made up of the last three (bank, branch, and account numbers) (BBAN).

In the UAE, what kinds of money transfers need an IBAN?

- Transfers between your deposit and the deposits of your beneficiaries of other UAE banks.

- Transfers between your deposit and the accounts of your beneficiaries when transferring money to banks in countries that have adopted the IBAN system.

- IBAN can be used for both inbound and outbound remittances.

DhanGuard: All-in-One Solution for Business Setup in Dubai, UAE

DhanGuard is your ultimate one-stop solution for all your business needs. Whether you’re planning to set up a new company or expand your existing business in the UAE, we’ve got you covered with our comprehensive range of services. From Company Formation in UAE and Business Bank Account in UAE services to managing your financial and legal compliance, we provide everything you need under one roof.

Our services include:

- Company Formation in UAE and Dubai

- Opening a Business Bank Account in UAE and Dubai with a 99% success rate

- VAT & Corporate Tax Compliance

- Accounting, Bookkeeping, and Auditing Services

- Trade License Renewal

- Golden Visa Assistance

Let DhanGuard make your journey of Business Setup in Dubai seamless and hassle-free!