In the dynamic business landscape of the United Arab Emirates, financial transactions play a pivotal role. Among these transactions, using bank cheques remains a fundamental and widely accepted method for conducting various economic activities. One should be clear about many facets when deciding to start their business in the UAE, like Company Formation Regulations, Licensing and Documentation, etc. Similarly, they should be well-versed with all the necessary Banking requisites concerning account opening, account management, cheques, and international transfers. Knowing how Bank Cheques operate in the UAE can save you time and headaches.

In this blog, Dhanguard will extensively discuss everything about Bank Cheques in the UAE. So, without any further ado, let's learn!

What are Bank Cheques?

A bank cheque in the United Arab Emirates (UAE) is issued by a financial institution that allows the person holding it to take money out of their account. If the beneficiary’s bank rejects the cheque, the issuing bank guarantees the total amount.

To make the payment, the payer must deposit the cheque, entitling the payee to receive a certain amount. Cheques are frequently used by businesses in the UAE to pay for goods or services, office rent, or the purchase of office supplies. Cheques are often regarded as the general form of payment all over the United Arab Emirates.

Bank Cheque Essentials for Business Owners

Some crucial factor for Business Owners to be aware of regarding Bank Cheques in the UAE are as follows:

-

You can write a post-dated check for a specific amount without having the money available immediately. You must verify that you own it before the person or organization to whom you contributed it hands it over to his bank.

-

If you do not have adequate funds before that time, the bank will return your cheque and issue you a notice declaring there are "insufficient funds," any unclear checks will be viewed as a criminal offence.

-

This means the payee can contact the UAE Police if the person you sent the check to presented it to his bank and there wasn't enough money. You must thus proceed with the utmost prudence and take cheques very seriously.

Along with the information required on the cheque, we also included the reasons why a cheque can be returned:

-

Incorrect payee's name

-

Discrepancy in the amounts

-

Wrong signature

-

Lack of funds

Furthermore, your bank will charge you a fee for cheque processing if you write a cheque as payment to someone and the cheque is returned for one of the mentioned reasons. Different banks impose different fees.

What is a Cash Cheque?

A Cash Cheque, also known as an Open Cheque, is a check that can be cashed over the counter without the need for a bank account. An open cheque usually has a top and bottom signature. The term "Cash Cheque" will also be used frequently. This conventional cheque is similar to the one we just examined, but instead of the payee's name, it states "Cash". As an illustration, let's say your business debit card has a limit of AED 10,000, and you urgently need to buy AED 15,600 worth of office supplies. This money cannot be withdrawn at an ATM, and it will take time for the bank to receive instructions to pay in cash. Instead, write "Cash" in the payee name field, complete the rest of the check as usual, and deliver it to your bank. You will receive AED 15,600 in cash, which will instantly be debited from your account.

Several banks have started to establish policies declaring that they will stop accepting such checks after a specific date, which we've noticed simultaneously. However, many banks still offer the service. You should only use the service when it is necessary, as we strongly suggest

Cash Cheque Withdrawal in UAE

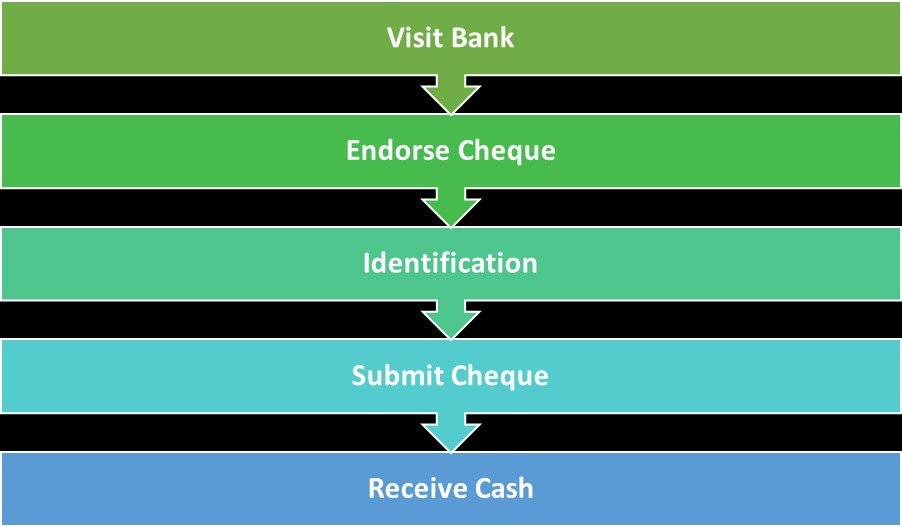

Cash cheque withdrawal in the UAE is a fundamental aspect of the banking system in the UAE. A cash cheque is a form of payment that allows the recipient to encash it at a bank or financial institution. To withdraw cash using a cheque, follow these steps:

-

Visit Your Bank: Head to your bank's branch where you have an account.

-

Endorse the Cheque: Sign the back of the cheque. This endorsement is necessary to prove that you are the intended recipient.

-

Provide Identification: Show your identification, usually a valid Emirates ID or passport, to the bank.

-

Submit the Cheque: Hand over the endorsed cheque to the bank teller.

-

Receive Cash: After verification, the bank will provide you with the cash equivalent of the cheque amount.

How to Encash a Cheque in UAE

Encashing a cheque is a straightforward process but requires adherence to specific rules and procedures. Here's how to do it:

-

Endorse the Cheque: Sign the back of the cheque as the payee. This step is essential to prove your entitlement to the funds.

-

Visit the Bank: Go to your bank's branch where you hold an account.

-

Present Identification: Bring valid identification, such as your Emirates ID or passport.

-

Hand Over the Cheque: Submit the endorsed cheque to the bank teller.

-

Wait for Verification: The bank will verify the cheque and your identification.

-

Receive the Funds: Once verified, the bank will credit the cheque amount into your account or provide you with cash.

How to Write a Cheque in UAE

Writing a cheque in the UAE is a formal process that requires attention to detail. Follow these steps:

-

Date: Write the current date on the cheque. It's advisable to use the Gregorian calendar.

-

Payee's Name: Write the recipient's name or organization on the "Pay" line.

-

Amount in Words: Write the cheque amount, specifying the currency.

-

Amount in Numbers: In the box provided, write the numerical amount.

-

Signature: Sign the cheque in the designated space.

-

Memo Line (Optional): Include a memo to specify the purpose of the payment.

-

Cross the Cheque (Optional): Cross the cheque by drawing two diagonal lines across the top left corner to make it non-negotiable.

How to Cash a Cheque in Dubai

Dubai, being a global hub, attracts expatriates from around the world. Here's how expatriates can cash a cheque in Dubai:

-

Bank Account: Ensure you have a bank account in Dubai to deposit the cheque.

-

Endorsement: Follow the standard procedure for endorsing the cheque.

-

Visit Your Bank: Visit the branch of your bank in Dubai.

-

Identification: Present your title, such as a passport with a valid residence visa.

-

Deposit the Cheque: Hand over the cheque to the bank teller for deposit.

-

Wait for Clearance: The bank will verify and clear the cheque.

-

Access Funds: Once cleared, you can access the funds through your bank account.

Why Choose Us?

Navigating the financial landscape of Dubai and the UAE can be intricate. That's where Dhanguard, your trusted business consultancy firm, comes into play. A Bank Cheque can be a valuable tool to help you achieve your financial goals in the UAE. By understanding the eligibility criteria, key features, application process, and important considerations, you'll be better equipped to navigate the world of Cheques and make informed decisions that align with your financial aspirations. If you require personalized guidance on Bank Cheques or any financial matters, our expert team at Dhanguard is here to assist you at every step.

Conclusion

Cheques can be helpful as a significant tool to make your hefty business transactions, which are otherwise tricky when done through Cash or Credit or Debit Card. We have mentioned every helpful information you would require to use Cheques for your Payments in the UAE. Thus, we hope this blog provides you with insightful information. For more information on other related aspects, check out our website or visit our head office.

DhanGuard: All-in-One Solution for Business Setup in Dubai, UAE

DhanGuard is your ultimate one-stop solution for all your business needs. Whether you’re planning to set up a new company or expand your existing business in the UAE, we’ve got you covered with our comprehensive range of services. From Company Formation in UAE and Business Bank Account in UAE services to managing your financial and legal compliance, we provide everything you need under one roof.

Our services include:

- Company Formation in UAE and Dubai

- Opening a Business Bank Account in UAE and Dubai with a 99% success rate

- VAT & Corporate Tax Compliance

- Accounting, Bookkeeping, and Auditing Services

- Trade License Renewal

- Golden Visa Assistance

Let DhanGuard make your journey of Business Setup in Dubai seamless and hassle-free!