The United Arab Emirates is well-known for its renowned banking business and the high level of client privacy that banks give. Its financial system is known for its consistency. Local banks are well-known over the world for their high levels of security, dependability, and great customer service. As a result, an increasing number of businesspeople from various nations want to create a bank account and conduct business in the UAE. It's important to keep in mind that each financial institution has different requirements for opening a business bank account. The high level of secrecy is another major factor for the growing demand for UAE bank account opening services. One of the most important reasons for the success of the UAE banking business, which is dependable and secure for your assets, is its confidentiality. Given this, as an investor, you can rest confident that your privacy will be fully maintained.

- Every firm must have a system in place to manage its finances. The business account is used to keep track of the money owed to creditors, the cash balance, and the monies owed to the company, as well as the payroll owed to the employees.

- Because they are specifically for businesses, business accounts differ from personal or private bank accounts. This bank account assists the business owner in keeping business transactions distinct from personal money. This account usually comes with particular terms for their company. When choosing a proper business bank account for a company, it is recommended that the business owner chooses one that offers good interest/profit rates and low fees.

- Thus in today’s blog we will focus on all the intrinsic details that one should keep a note of, while looking for a perfect Business Bank Account in UAE. Also we will focus on how one can open it, without any hassle. So without any further ado, let’s learn!

Before opening a Business Bank Account in the UAE, there are a few things to keep in mind.

PRIVACY

The high level of anonymity is one of the main reasons for the increasing demand for UAE banks. This confidentiality is one of the most important aspects in the UAE banking industry's success, as it makes it efficient and secure for your assets. As a result, as an investor, you can be assured that your privacy will be fully maintained. It's worth noting that various agreements have been reached in recent years between the UAE and other nations in an attempt to combat tax evasion. These agreements mean that, despite jealously preserving privacy, banks must collaborate with foreign authorities in some cases.

EASE

If you have a UAE firm (LLC, Free Zone, or Offshore), a registered branch, or a subsidiary company in the UAE, you can always apply for a Business Account with one of the local banks. Furthermore, you can apply for international banks such as HSBC, Standard Chartered Bank, and Citibank; however, a local bank account is preferable in terms of flexibility for SME and beginning businesses.

PRESENCE

So, once you've decided which bank to apply to, the next question you could have is if you need to be present to complete the application. As previously stated, local banks are more suggested and suited for you if you have a startup or SME company registered in the UAE. To be more explicit, your presence as a bank signatory is only required for one day or 1 to 5 hours in order to submit the application and validate the passport in the presence of the banker. In terms of documents, you must evaluate the company operations, the number of shareholders, the management's business background, and the new entity's business plan in the UAE.

How to Open a Business Bank Account in the United Arab Emirates

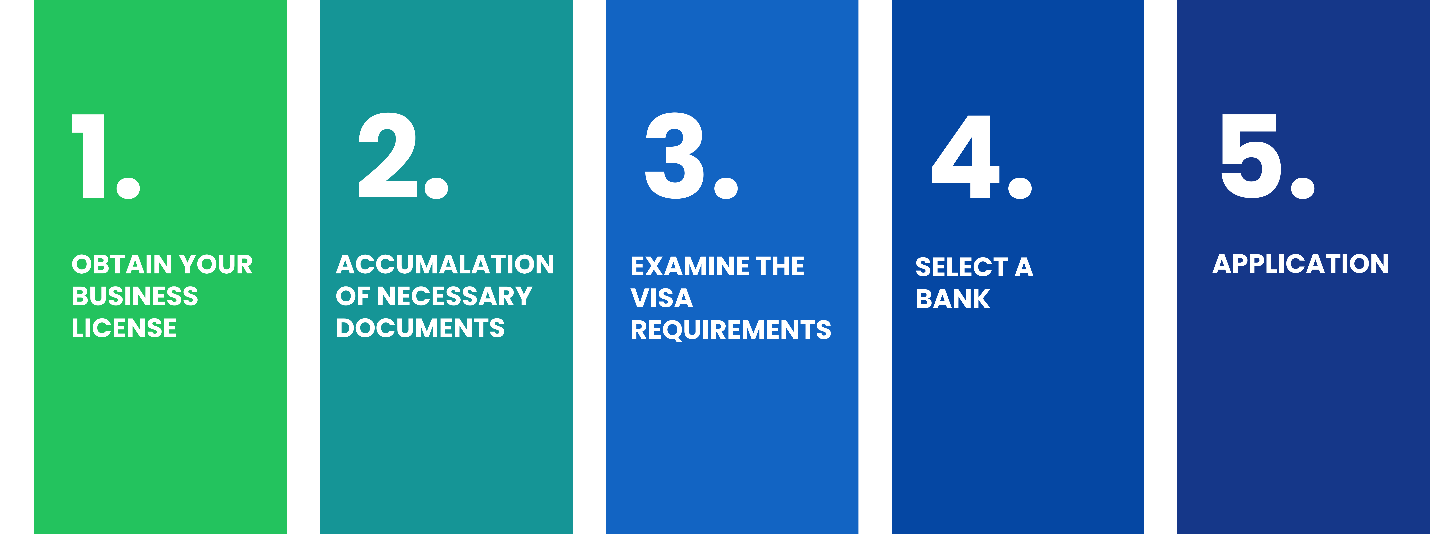

The requirements for opening a corporate bank account in the UAE differ from bank to bank, although most banks demand the presence of a significant shareholder or director. The first step in opening a bank account is to fill out an account opening application, which must be accompanied by complete firm data. Proof of business, such as contact and invoice information, as well as information about the company's clients and suppliers, might be included. To open a Business Bank Account in the UAE, follow these steps:

OBTAIN YOUR BUSINESS LICENSE

One of the most important steps in starting a business is obtaining a legal license. You won't be able to create a corporate bank account if you don't have a license since the bank won't recognize you as a corporation.

ACCUMALATION OF NECESSARY DOCUMENTS

The next critical step is to double-check that all of your legal and business paperwork are up to date.

EXAMINE THE VISA REQUIREMENTS

The next step in opening a business bank account is to find out if any of your company's stockholders need a residency visa. Only a few banks need verification of this from at least one shareholder, while others do not. As a result, the issue of whether or not your stakeholders have resident visas may influence which banks you apply to.

SELECT A BANK

Once you have all of your documentation in order, you may start looking for a bank that meets your needs. There are various national and international banks to pick from, as noted above. When choosing a bank, keep the qualifying conditions and income in mind.

APPLICATION

It's time to start the formal account-opening procedure. It is usually a good idea to go to a bank branch and speak with an advisor who can address any questions you may have. You can continue with the process once our experts at Dhanguard tell you what to do.

Documents Required for Opening a Business Bank Account in the United Arab Emirates

We'll present you with a basic list of the documents you'll need to apply for an account on your own, based on our significant experience. It's important to note that this varies depending on the extent of each client's business and the bank's criteria.

-

Curriculum Vitae

This must include the last 5-7 years of your professional and business experience. Also, make sure that the company's commercial activity fits your personal professional experience in a certain area before opening a corporate bank account.

-

Bills

As proof of residence (provided within the last three months)

-

Necessary Corporate Documents

-

Corporate Bank Statement

For the previous 6 months for the shareholder's existing company (if relevant)

-

Proof of ownership in the form of a Corporate Document

For your current business, for which a statement is issued It could be a Certificate of Incumbency or any other document issued by the Authority within the last six months.

-

Business Plan

This should include all information about the company's business activities, financial strategy, brief business development plan, possible clients, suppliers (for a trading company), and partners, as well as the management team's background.

-

Personal Bank Statement

For each shareholder for the past 6 months

What does it cost to open a Business Bank Account in UAE?

As an investor looking to open a business bank account, you may be wondering what the fees are for doing so. The good news is that, like other banks in other countries, UAE local banks do not charge any fees for creating bank accounts. Every local bank is required to keep a minimum monthly average balance, and each bank has its own set of minimum monthly average balance categories.

- This balance ranges from AED 50,000 to AED 500,000 for local UAE banks, depending on which bank you apply to. For Emirates NBD, for example, it starts at 50,000 AED. If you do not maintain a minimum monthly average balance, you will be charged a penalty of 250 AED every month.

- We'll also emphasize that if you open a corporate bank account with a set minimum maintenance amount with any local bank, we strongly advise you to keep this balance. Because you must maintain a positive relationship with your bank from the start.

Conclusion

Thus we can conclude with the fact that opening a Business Bank Account in United Arab Emirates has loads of advantages for you or your organization as a whole. Moreover the process of opening one is menial and you would not face any hardship. For more details you can contact our teams of Experts at Dhanguard, who would precisely guide you in opening a Business Bank Account in UAE. We hope this blog provided you with incite full information. For more information on other related aspects, feel free to check out our Website as well.

DhanGuard: All-in-One Solution for Business Setup in Dubai, UAE

DhanGuard is your ultimate one-stop solution for all your business needs. Whether you’re planning to set up a new company or expand your existing business in the UAE, we’ve got you covered with our comprehensive range of services. From Business Setup in UAE and Company Formation in Dubai to managing your financial and legal compliance, we provide everything you need under one roof.

Our services include:

- Company Formation in UAE and Dubai

- Opening a Business Bank Account in UAE and Dubai with a 99% success rate

- VAT & Corporate Tax Compliance

- Accounting, Bookkeeping, and Auditing Services

- Trade License Renewal

- Golden Visa Assistance

Let DhanGuard make your journey of Business Setup in Dubai seamless and hassle-free!