When it comes to buying flats or villas in Dubai, potential homeowners look for 'home loans in Dubai' very frequently. Similarly, 'home loan for NRI in Dubai' is a popular search keyword. This is not surprising, given the enormous expat community in Dubai. When expats move to Dubai, they want to buy a home that satisfies their preferences and falls within their budget. Our study further focuses on the best mortgage loan interest rates in Dubai.

What is a Mortgage Loan?

A mortgage loan is a type of loan that is used by real estate buyers to raise cash for a purchase or by current property owners to produce funds for any purpose while establishing a lien on the property being mortgaged. The technique by which the loan is "secured" on the borrower's property is known as mortgage origination. This means that if the borrower defaults on the loan or otherwise fails to meet its terms, a legal process is initiated that allows the lender to seize and sell the secured property in order to repay the loan. Property in Dubai can be purchased in one of two ways: cash or with a mortgage.

Property in Dubai can be purchased in one of two ways: cash or with a mortgage. While a cash investment may be more cost-effective over time, a mortgage gives you more control over your finances. If you want to get a mortgage to buy a home in Dubai, you'll need to know how the emirate's home loans work and what you'll need to do to get one.

Mortgage loans are the handiest financial option for purchasing real estate. The process entails a bank, financial institution, or service provider covering a significant portion of the purchase price on behalf of the buyer and collecting payment over time. Along with the principal, the buyer must pay interest or financing costs.

Mortgage financing is a common method for purchasing real estate around the world, with banks offering a variety of attractive alternatives and services.

What are the Different Types of Mortgage Available in Dubai?

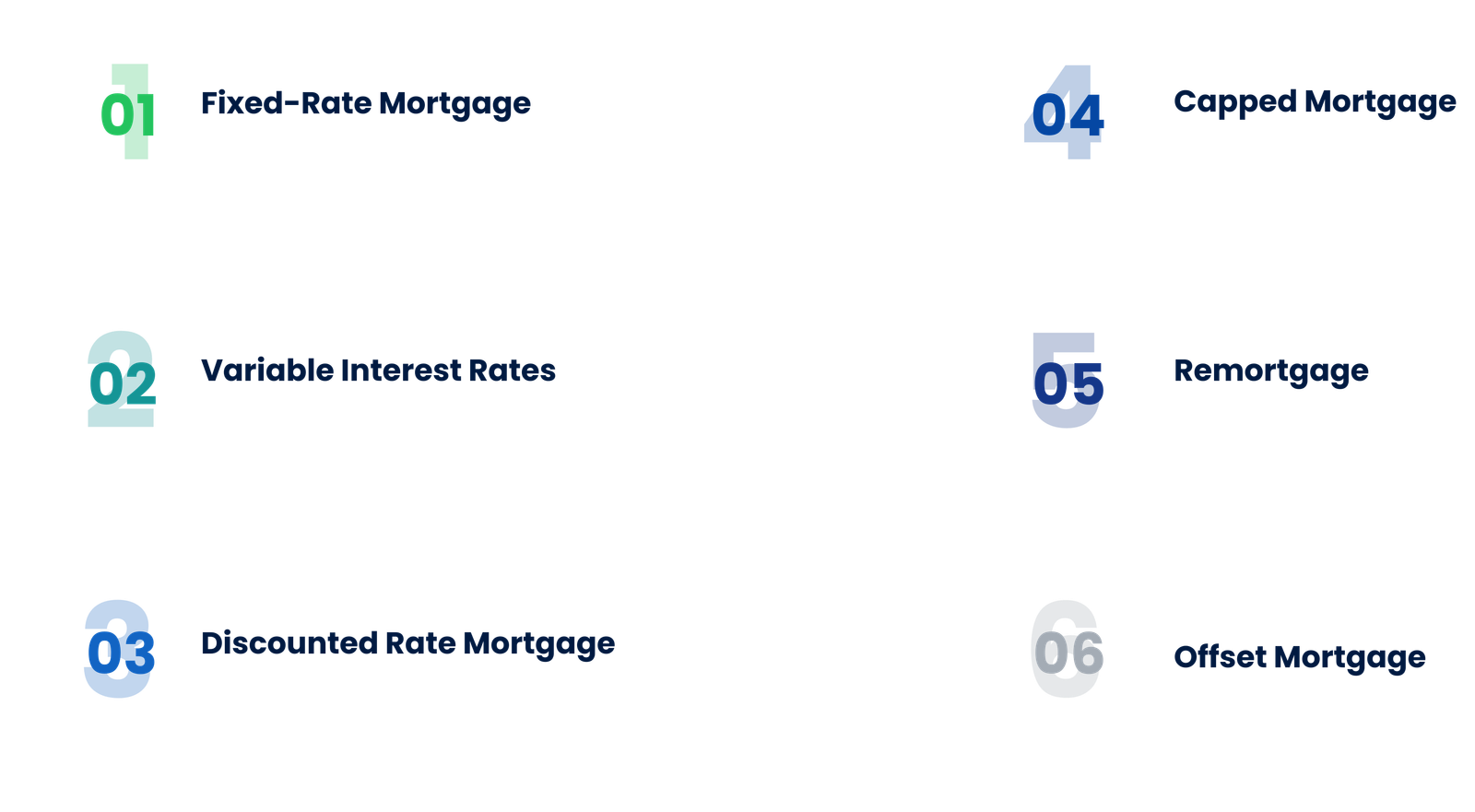

There are several sorts of mortgage loans, which differ mostly in terms of interest rates and computations. Each type has its own set of advantages that suit various people depending on their financial situation and needs. Let's take a quick look at each category to get a sense of how they work and what benefits they provide.

The various types of mortgage loans that are available in Dubai are further elaborated below:

Fixed-Rate Mortgage

In a fixed-rate mortgage, the interest rate is determined before the loan term begins, as the name implies. Furthermore, this rate does not fluctuate during the course of the pre-agreed time, which is usually less than five years. However, you might be fortunate enough to locate a lender who will offer a fixed-rate loan for the entire term. This system provides apparent benefits to the borrower. Budgeting and planning your money outflow for at least a few years is easy. You will, however, be locked with the original rate if the market scenario changes and rates fall. Alternatively, if interest rates rise, you'll benefit from your fixed-lower rate.

Variable Interest Rates

The interest rate on a variable interest rate mortgage might fluctuate over the repayment period, depending on market conditions. Borrowers may be able to receive a good deal if market conditions allow, or they may have to pay a higher rate of return. If you choose this form of loan, be sure you have enough cash on hand to cover any repayment increases.

Discounted Rate Mortgage

Obtaining a discounted rate mortgage may be the best option among the several types of mortgages available in Dubai in some instances. Because financial assistance is offered on the borrower's variable interest rate, the borrower pays a reduced amount. This cut, however, is just temporary. You'll be paying a variable rate in the long run.

Capped Mortgage

Capped mortgages, in which the borrower has some advantage, are also available in Dubai. Payments will be flexible, but a maximum cap will be determined before the loan term begins. Often, the capped period is just for a short amount of time. Interest rates do rise in response to market conditions, but there is a limit beyond which the rate will not rise.

Remortgage

This is one of the useful forms of mortgages in Dubai to assist you to reset if you make a pricey mistake with your initial mortgage plan. You can receive a new loan on an existing mortgage or even a transfer of the existing mortgage using a remortgage option. This new loan may be given by the same lender or you may need to find a new one. Even when the first loan's interest rate is low, consumers may choose to refinance if they require extra funds.

Offset Mortgage

A borrower can link their current, savings, credit card, and loan accounts with an offset mortgage. Whenever money is deposited in one of the aforementioned accounts, it is used to repay the loan. As a result, by balancing your payments on a regular basis, you will pay less interest in the long term.

Best Mortgage Loan Interest Rates in Dubai

When you decide to buy a house or other piece of real estate, you will have a wide range of options. Each financial institution offers a unique set of benefits that may appeal to various people, so you'll have to weigh your alternatives and choose the best option for you. The mortgage rate, which is effectively the cost of obtaining a loan, has to be a primary comparative aspect.

Given below is the table with mortgage loan rates in the UAE offered by some of the major financial institutions across the nation:

Bank Name

Mortgage

Flat Rate

Reducing Rate

FAB

Islamic Mortgage Loan

Profit Rate-2.75%

Profit Rate-3.50%

FAB

Mortgage Loan

2.75%

3.50%

FAB

Mortgage Loan for Small Buildings

6.75%

-

Emirates NBD

Home Loans for UAE Nationals

3.04%

5.75%

Emirates NBD

Home Loans for Expats

3.04%

5.75%

CBD

Mortgage Loan for Salaried

Profit Rate-2.18%

Profit Rate-3.54%

CBD

Mortgage Loan for Self-Employed

Profit Rate-2.18%

Profit Rate-3.54%

Standard Chartered Bank

MortgageOne

1.95%

3.53%

HSBC

New Home Loan

1.96%

3.59%

HSBC

Fixed Interest Rate Home Loan

3.59%

-

Conclusion

The term Home Loan refers to a loan used to purchase or maintain a home, land, or other types of real estate. The borrower agrees to pay the lender over time, typically in a series of regular payments that are divided into principal and interest. If you’re planning to buy a home in UAE connect to us at Dhanguard for the best services. We help our clients to get home loans at Best Rates.

DhanGuard: All-in-One Solution for Business Setup in Dubai, UAE

DhanGuard is your ultimate one-stop solution for all your business needs. Whether you’re planning to set up a new company or expand your existing business in the UAE, we’ve got you covered with our comprehensive range of services. From Company Formation in UAE and Business Bank Account in UAE services to managing your financial and legal compliance, we provide everything you need under one roof.

Our services include:

- Company Formation in UAE and Dubai

- Opening a Business Bank Account in UAE and Dubai with a 99% success rate

- VAT & Corporate Tax Compliance

- Accounting, Bookkeeping, and Auditing Services

- Trade License Renewal

- Golden Visa Assistance

Let DhanGuard make your journey of Business Setup in Dubai seamless and hassle-free!