Are you an entrepreneur or a small business owner in the United Arab Emirates (UAE) looking for a banking solution that won't tie up your funds in minimum balance requirements? Look no further! In this blog post, we'll explore the concept of zero-balance business accounts in the UAE and how they can benefit your business. Every business owner needs a secure location to store their money. Banks in the United Arab Emirates provide the most significant business account alternatives for established companies and new business owners.

Opening a business account is the best way to handle your finances professionally. It helps you keep your personal and business finances distinct while monitoring your inflow and outflow. Whether in Dubai, Abu Dhabi or anywhere else in the UAE, this guide will help you navigate the business banking world without the hassle of maintaining a minimum balance.

Understanding Zero Balance Business Accounts

Zero-balance business accounts, also known as business accounts with no minimum balance, are a game-changer for businesses of all sizes. These accounts offer the flexibility and financial freedom many entrepreneurs and small business owners crave. Unlike traditional business accounts that require maintaining a minimum balance to avoid fees and penalties, zero-balance business accounts allow you to operate without worrying about these constraints.

Here are some key points to explain zero-balance business accounts:

-

No Minimum Balance Requirement: Zero-balanced business accounts do not require the account holder to maintain a minimum balance. This is particularly advantageous for small businesses and startups with limited funds.

-

Low or No Monthly Fees: Many zero-balance business accounts have minimal or no monthly maintenance fees. This helps businesses save on account maintenance costs.

-

Basic Banking Services: Despite the lack of a minimum balance requirement, these accounts typically offer essential banking services such as chequebooks, debit cards, online banking, and mobile banking apps.

-

Transaction Limits: Some zero balance accounts may have transaction limits, such as a maximum number of free withdrawals or a cap on the total monthly transactions allowed. Be aware of these limits when choosing an account.

-

No Interest Earnings: Since these accounts do not require a minimum balance, they usually do not offer interest earnings on the account balance. If earning interest is a priority, businesses may need to consider other types of business accounts.

-

Easy Account Opening: Opening a zero-balance business account is often straightforward, with minimal documentation requirements, making it accessible for small businesses and startups.

-

No Overdraft Facility: Zero balance accounts typically do not provide overdraft facilities. If the account balance goes negative, the bank will not cover the shortfall, and overdraft fees will not apply.

-

Limited Additional Services: These accounts may come with something other than business loans, credit lines, or merchant services. Businesses looking for such services may need to upgrade to a different type of business account.

-

Ideal for Small Businesses: Zero-balance business accounts are well-suited for businesses with fluctuating cash flows, low transaction volumes, or those just starting and not wanting to maintain a minimum balance.

-

Regular Account Monitoring: Business owners should closely monitor their account activity to stay within zero balance or exceed transaction limits, which can lead to additional fees or account restrictions.

-

Business Size Considerations: Larger businesses with higher transaction volumes may find that traditional business accounts with higher balance requirements are more cost-effective in the long run.

Why Choose a Zero Balance Business Account in the UAE?

Some key points to choosing a zero-balance business account in the UAE are as follows:

-

Financial Freedom: With a zero-balance business account, you won't need to lock away significant money to maintain your account. This means you can allocate your funds where needed most–to grow your business.

-

Cost-Effective: Traditional business accounts often incur maintenance fees and penalties for exceeding the minimum balance. Zero-balance business accounts eliminate these charges, helping you save money over time.

-

Accessibility: These accounts are accessible to businesses of all sizes, from startups to established companies. They are designed to cater to the diverse needs of the UAE's dynamic business landscape.

-

Convenience: Managing your finances becomes more convenient with a zero-balance business account. You can focus on your business operations without constantly monitoring your account balance.

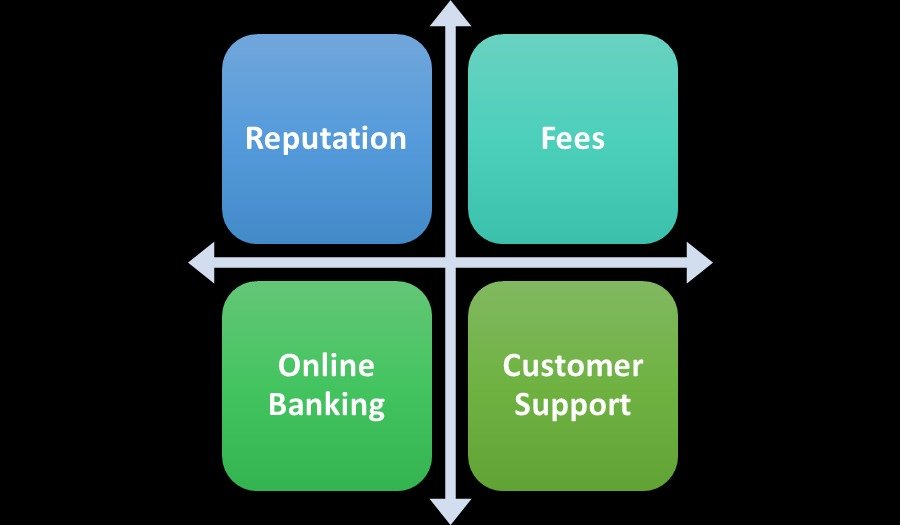

Selecting the Right Bank for Your Zero Balance Business Account

Now that you're convinced about the benefits of zero-balance business accounts, the next step is choosing the right bank in the UAE to open your account.

Here are a few factors to consider:

-

Reputation: Look for a bank with a strong reputation for business banking services. Read reviews and ask for recommendations from fellow entrepreneurs.

-

Fees: While zero balance accounts eliminate minimum balance requirements, it's essential to understand any other fees or charges associated with the account, such as transaction fees or annual fees.

-

Online Banking Services: Ensure the bank offers robust online banking services, including mobile apps and internet banking platforms. This will make managing your account more convenient.

-

Customer Support: Good customer support is crucial if you encounter any issues with your account. Check the bank's responsiveness and availability.

Opening Your Zero Balance Business Account in the UAE

Once you've selected the right bank, the process of opening a zero-balance business account is relatively straightforward. To open a business bank account, follow these simple steps:

Obtain a Current Trade License

When trying to open a business account, an applicant must first obtain a valid trade license. The bank will only examine an application for a business account if the applicant submits a trade license.

Obtain the Required Documents

After obtaining a working trade license, the applicant must collect the necessary paperwork to register a company account in the UAE. Having all the required documentation prepared and organized can assist candidates in streamlining the application process and obtaining immediate approval.

Consult the Visa Requirements

UAE nationals do not require a residency visa to open a business account. If they want to open a joint business account and one of their partners is a non-resident, they must get a residency visa.

Select the Business Account option

Once the documents are in order, the applicant can search for a bank with the finest features and perks for business accounts. They can either go to the websites of various banks to see what they offer, or they can go to our website to see what they have to give. Calling our customer service number is one of the most convenient ways to reach our helpline. Our financial professionals assess the customers' financial needs and assist them in opening the bank account of their choice.

Request a Business Account

For consumers who want to open a business account, each bank in the UAE has a different application process. Filling out the application form with all of the fundamental facts about the firm, attaching all necessary papers, and presenting it in the presence of one of the bank's representatives is the standard procedure. This ensures that candidates do not make any errors when completing their application.

Documents Needed to Open an Account for a Business

The required documentation differs from bank to bank. The essential paperwork needed to open a business account with any bank in the United Arab Emirates is listed below:

-

For each shareholder, a copy of their Emirates ID card

-

Holders of shareholder visas

-

A copy of each shareholder's current business license and the director of the company's valid passport

-

Shareholder Registry Articles and Memorandum of the Company

-

business strategy

-

a certificate of incorporation

-

Reference letter from the business partners

-

a copy of the current contracts

-

Fund disclosure sources

-

duplicate stock certificates

-

valid standing document

-

Company extract (according to the company's official registry)

-

Statements of all stockholders' personal bank accounts for the last six months

Top Business Accounts in the UAE with Zero Balance

The top-performing zero-balance business accounts to open in the UAE are shown below:

HSBC BSP Premium Account

One of the current business accounts that the bank provides is the HSBC BSP Premium Account. The main characteristics and advantages of the HSBC business account are listed below:

-

Available in various currencies, such as AED, USD, JPY, EUR, GBP, etc.

-

competitive forex transaction rates

-

Use the bank's ATMs or check and cash deposit devices for free checks and money transactions.

-

Services for free phone banking

-

Even during extended hours, there is free access to HSBC Business Customer Service Centers.

-

There is no required average minimum balance per current account.

-

AED 1,500 in maintenance costs each month

RAKstarter SME ACCOUNT from RAKBANK

To assist startup firms in maximizing their financial efficiency, RAKBANK has introduced this business account with low minimum balance requirements. The main characteristics and advantages of the business account are listed below.

-

No minimum balance is necessary.

-

unlimited access to cheque books, attractive interest rates on the balance of the account

-

No fee will apply if the business account balance is zero.

-

Multiple currencies are offered, including AED, USD, EUR, and GBP.

-

competitive rates for trade finance, enticing interest rates for fixed deposits

-

Phone banking services are available 24/7

-

Relationship manager who is committed

ADCB Business Choice Current Account - Silver

Customers can choose between three different Business Choice Current Account types from ADCB. It includes the Silver Business Choice Current Account. The advantages and characteristics of the bank account are listed below.

-

attractive interest rates on the account's remaining balance

-

A low minimum balance is necessary

-

yearly gift of four free cheque books

-

Business Choice debit card, free of charge

-

E-statements available without charge

-

15 free transactions per month at the teller

-

ADCB financial products are easily accessible.

ADCB Business Choice Current Account - Gold

Gold Business Choice ADCB Another business account with zero balance that provides substantial benefits at low minimum balance requirements is the current account. The bank account's characteristics and advantages are shown below.

-

Every month, the first cheque book is free.

-

30 free teller transactions each month

-

No-cost debit card

-

Delivered chequebook at the specified location

-

Low remittance transaction fees

-

Quick access to further financial goods from ADCB

ADCB Business Choice Current Account - Platinum

Platinum Business Choice by ADCB Its competitive interest rates on the sum kept in the bank account make the current version a well-known product. Here are a few other attributes and advantages of the bank account.

-

Free commercial insurance

-

Unlimited transactions at no additional cost

-

Debit card of your choice without cost

-

Free monthly checks for three books

-

One free monthly remittance is delivered in a chequebook to the desired address.

-

Rapid access to other financial products from ADCB

How to Open a Business Account in the UAE Quickly

Here are a few straightforward procedures for opening a business account in the UAE.

Online banking

To make it simple for its customers to access all their banking products and services, banks in the UAE provide online banking portals. Existing bank customers can apply for their desired business account by logging into their online banking portal using their login information. The applicants must complete and submit the application form with any necessary supporting documentation.

Mobile Banking

Existing bank customers can also sign in to their bank's mobile banking app and quickly apply for the business account they want. All they have to do is complete the online application and submit it with all the required paperwork.

Bank's Website

To open their preferred business account, applicants who need access to the desired bank's online or mobile banking portal can go to the bank's website and complete the online application. They must upload the necessary documentation online or ask a bank representative to complete their required paperwork. Not all banks in the United Arab Emirates offer this option for collecting documents from home.

Branch of a bank

Those who want to open a business account but do not have access to the internet can alternatively apply in person at the branch of their preferred bank. They must bring the necessary documentation and exhibit it before a bank agent.

Conclusion

Zero-balance business accounts in the UAE are a game-changer for entrepreneurs and small business owners. They offer financial freedom, cost-effectiveness, and convenience, enabling you to focus on growing your business without worrying about minimum balance requirements. When selecting a bank, consider factors like reputation, fees, online banking services, and customer support. With the right bank and a zero-balance business account, you can take your business to new heights in the vibrant business landscape of the UAE. Say goodbye to minimum balance constraints and hello to financial flexibility! Please do not hesitate to contact Dhanguard if you require any support throughout the application process. We will gladly assist you.

DhanGuard: All-in-One Solution for Business Setup in Dubai, UAE

DhanGuard is your ultimate one-stop solution for all your business needs. Whether you’re planning to set up a new company or expand your existing business in the UAE, we’ve got you covered with our comprehensive range of services. From Business Setup in UAE and Company Formation in Dubai to managing your financial and legal compliance, we provide everything you need under one roof.

Our services include:

- Company Formation in UAE and Dubai

- Opening a Business Bank Account in UAE and Dubai with a 99% success rate

- VAT & Corporate Tax Compliance

- Accounting, Bookkeeping, and Auditing Services

- Trade License Renewal

- Golden Visa Assistance

Let DhanGuard make your journey of Business Setup in Dubai seamless and hassle-free!