In the dynamic landscape of business transactions, using post-dated cheques remains a prevalent practice in the United Arab Emirates (UAE). A cheque is the most common payment method issued by banks in the United Arab Emirates. In the digital age, it is still a helpful payment option. A check is issued from the account holder to the bearer, who can cash it or deposit it in a bank to have the funds credited to their account. The process is straightforward. Check-related idioms that are frequently used include "cancelling checks," "paycheck validity," "bouncing checks," "post-dated cheques," and others.

Dhanguard will thus go into great detail about the idea of Post Dated Cheques in the UAE in today's blog. So, let's start learning right away!

What is a Post Dated Cheque?

A cheque has a few fields: Name, Amount, Date, and Signature. Every field on a check is significant and needs to be filled in with attention. A cheque is a post-dated cheque if the Date is in the future (PDC Cheque). This indicates that the cheque could only be cashed as of the Date shown on the cheque.

Let us explain with the help of the following example: if the Date on the cheque is 26.05.2023 and the current Date is 01.03.2023, the cheque can only be paid on or after that Date. These kinds of Cheques are referred to as post-dated cheques.

What are the Benefits of a Post Dated Cheque?

The benefits of a post-dated cheque are enumerated below-

-

The payer is not compelled to make a single lump sum payment or payment within the predetermined time frame; instead, it operates as an instalment payment system.

-

The payer can postpone future payments, which helps him make up for his financial shortfall.

-

Even if the owner cannot pay suppliers because of a lack of funds, it makes it possible for a business to continue operating normally.

-

The guarantee that the transaction will happen at some point in the future benefits both parties.

-

Cheques that have been post-dated can be your best friend or worst adversary. Establishing strong and lasting business ties is one possible advantage of this payment method.

-

A solid financial future can be ensured when a supplier can be relied upon and post-dated cheques can be used to pay with complete assurance that the transaction will be honoured.

Can You Deposit a Post-Dated Cheque Before the Date?

-

In the UAE, depositing post-dated cheques before the indicated Date is permissible.

-

Unlike certain countries where banks may decline to process post-dated cheques before the due Date, UAE banks typically accept them without any timing restrictions on deposits.

Is Issuing a Post-Dated Cheque Secure in the UAE?

The following key points states that issuing a Post-Dated Cheque is Secure in the UAE:

-

Post-dated cheques are given to banks or other financial institutions in addition to the usual payments as a requirement of the loan agreement.

-

Banks deposit the cheques to encash them when a borrower misses loan payments over an extended period.

-

If there are funds in the account, the bank or financial institution will cash it; otherwise, the account holder will be charged with a cheque-bounced case.

-

It is up to the account holder to keep Post-Dated cheques secure.

-

The account must have money available at the moment of withdrawal, regardless of whether the cheque is payable to a person or a financial institution.

-

Otherwise, the account holder will be subject to legal cheque-bouncing penalties in the UAE.

Post-Dated Cheque Rules in the UAE

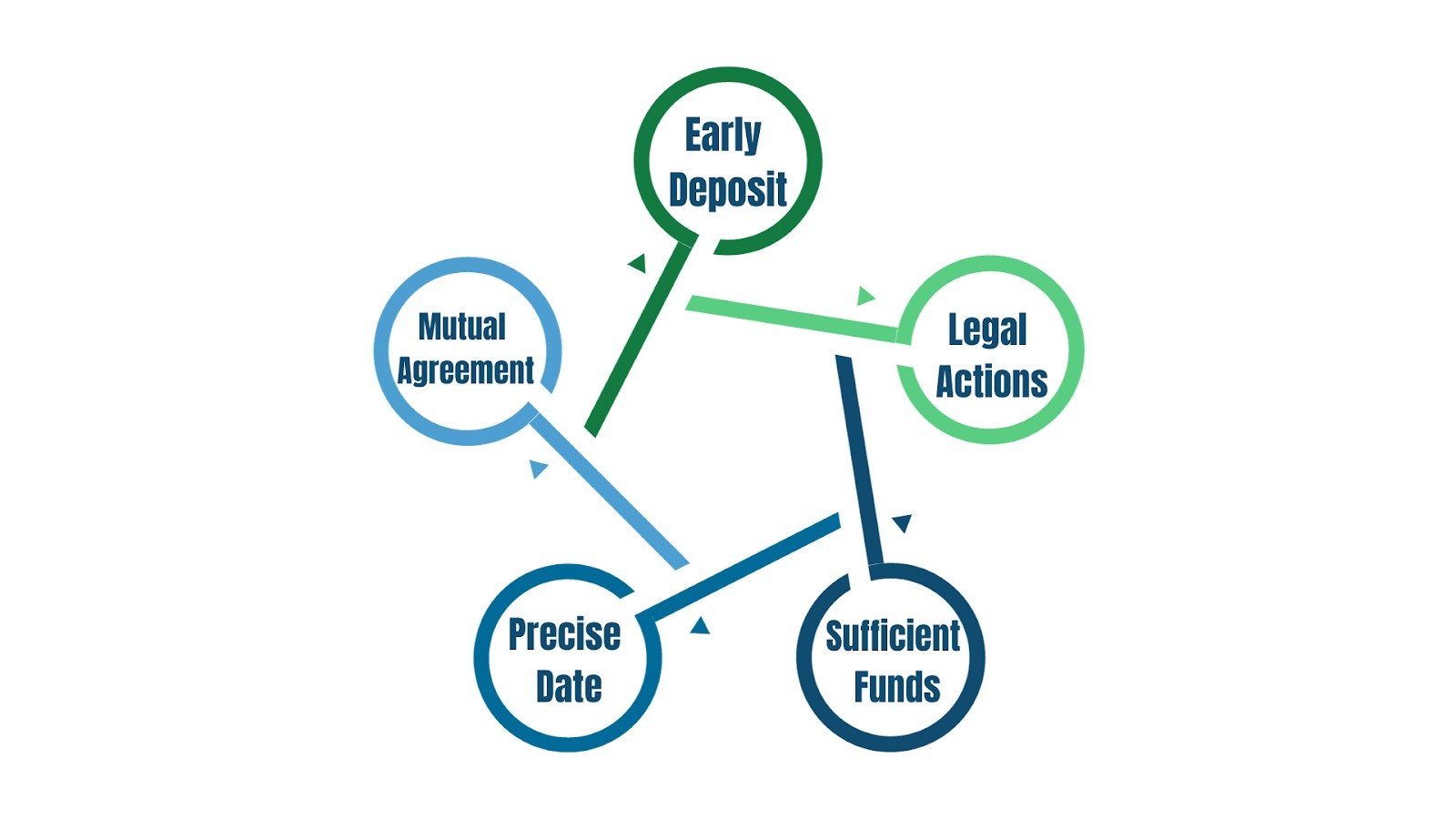

To ensure smooth transactions and maintain financial integrity, the UAE has established specific rules governing post-dated cheques:

-

Mutual Agreement: Post-dated cheques must be issued based on a joint agreement between the parties involved. This agreement can be formalized through a written contract or a verbal understanding, but it's advisable to have written documentation for legal purposes.

-

Precise Date: The Date on the cheque should be explicitly mentioned and cannot be ambiguous. This Date signifies when the cheque can be presented for payment.

-

Sufficient Funds: The issuer is responsible for ensuring adequate funds are in the account on the Date mentioned on the cheque. Bouncing a post-dated cheque can lead to legal consequences.

-

Early Deposit: As previously mentioned, UAE banks generally accept post-dated cheques without restrictions on deposit timing. However, depositing a post-dated cheque before the indicated Date could lead to potential issues if insufficient funds are in the issuer's account.

-

Legal Actions: In case of a bounced post-dated cheque, the payee has the right to take legal action against the issuer, which may result in penalties or imprisonment.

Validity of Post-Dated Cheques in the UAE

Here's a brief explanation of the validity of post-dated cheques in the UAE:

-

Fixed Validity: UAE has validity of six months for post-dated cheques.

-

Agreement Matters: Validity depends on the agreement between the issuer and the payee.

-

Bank Discretion: Banks typically accept post-dated cheques but may verify the Date before processing.

-

Early Deposit Allowed: Depositing post-dated cheques before the indicated Date is expected.

-

Legal Protections: Legal recourse is available if a cheque is deposited without authorization.

-

Issuer's Responsibility: Issuers must ensure funds are available on the specified Date.

-

Bank Policies: Check with your bank for specific policies regarding post-dated cheques.

How to write Post-Dated Cheques in the United Arab Emirates?

Writing a post-dated cheque is the same as writing a standard cheque:

-

You must include the bearer's name (the person to whom the cheque is given), the cheque's amount, and AC Payee in the upper left corner if the money is to be credited to the bearer's account.

-

The Date is the most significant and unique element on a Post Dated Cheque.

-

Mention a future date on which your cheque can be cashed.

-

Finally, double-check the information provided before signing the cheque to avoid it from becoming a bounced cheque, dishonoured cheque, etc.

Required Instructions for Post-Dated Cheques in the UAE

Below are the essential directives regarding the Post Dated Cheques in the UAE, which you should be aware of-

-

No written contract exists: The payee may present the cheque at any time until the payer notifies the bank that the checks cannot be cashed before the specified Date. The payee may deliver the cheque at any time, and if the payer has yet to give the bank any instructions, the bank is compelled to honor the cheque. This implies the bank can pay the payee in cash before the scheduled Date.

-

Fraud is not accepted: Although there is no law against using post-dated cheques, it is unlawful to issue a check if the payer does not have enough money to cover the cheque's declared amount.

-

Ensure by checking with your bank: A cheque with an upcoming date is not guaranteed. If they receive written instructions, the bank will give us instructions on how to accomplish this in writing. The user must pay a fee for this monitoring, and different banks have varied regulations for how long they will track to avoid early payments.

Implications of Depositing a Post-Dated Cheque Early in the UAE

While UAE banks generally accept post-dated cheques without restrictions on deposit timing, depositing a post-dated cheque before the indicated Date should be done cautiously. If the issuer's account lacks sufficient funds to cover the cheque amount on the Date of Deposit, it may lead to the following consequences:

-

Bouncing of the Cheque: If there are insufficient funds, the cheque will bounce, and the payee will not receive the intended payment.

-

Legal Recourse: The payee has the right to take legal action against the issuer for issuing a bounced cheque, which may result in penalties or imprisonment for the issuer.

Conclusion

In the UAE's business landscape, post-dated cheques are a standard instrument to facilitate transactions and financial agreements. Understanding the rules, validity, and implications of post-dated cheques is vital for anyone involved in financial transactions in Dubai and the UAE. While depositing a post-dated cheque before the Date is generally acceptable, issuers and payees should exercise caution and adhere to the established guidelines to ensure smooth and lawful transactions. We therefore hope that this blog gives you proper knowledge. Please visit our website for further details on other related topics.

DhanGuard: All-in-One Solution for Business Setup in Dubai, UAE

DhanGuard is your ultimate one-stop solution for all your business needs. Whether you’re planning to set up a new company or expand your existing business in the UAE, we’ve got you covered with our comprehensive range of services. From Company Formation in UAE and Business Bank Account in UAE services to managing your financial and legal compliance, we provide everything you need under one roof.

Our services include:

- Company Formation in UAE and Dubai

- Opening a Business Bank Account in UAE and Dubai with a 99% success rate

- VAT & Corporate Tax Compliance

- Accounting, Bookkeeping, and Auditing Services

- Trade License Renewal

- Golden Visa Assistance

Let DhanGuard make your journey of Business Setup in Dubai seamless and hassle-free!