The Foreign Account Tax Compliance Act (FATCA) is a part of the HIRE’s Act which was passed in 2010. It is a United States federal law that ) mandates that foreign financial institutions and some other non-financial foreign entities report on the foreign assets held by their U.S. account holders or be subject to withholding on withholdable payments. Furthermore, the HIRE Act also included legislation requiring U.S. citizens to register their foreign financial accounts and assets, depending on their value. In our study further, we will discuss in detail the understanding of FATCA in the UAE.

Overview of FATCA

The Foreign Account Tax Compliance Act ("FATCA") is a federal law enacted by the United States ("US") to combat offshore tax evasion by US citizens. The law has a global reach and it draws its roots from Chapter 4 of the US Internal Revenue Code and is enacted by the Hiring Incentives to Restore Employment Act of 2010. Further, the legislation aims to obtain information about offshore accounts and investments directly or beneficially owned by US persons, either through voluntary account disclosure by such persons or through disclosure to the Internal Revenue Service ("IRS") by the foreign financial institutions ("FFIs") holding such accounts/investments.

If FFIs fail to disclose or comply with the FATCA reporting obligations, the IRS may levy a 30% withholding charge on the FFIs' source investment income and proceeds from sales generated in the United States. The IRS may levy a withholding tax on any financial instrument/asset originating in the United States, including bank accounts, money market institution trading, bills, certificates of deposit, derivatives, transferable securities, commodity futures trading, individual and collective portfolio management, and other financial assets, interest, dividends, and rents.

Furthermore, the UAE signed an Intergovernmental Agreement with the United States of America on 17 June 2015 with an effective date of 1 July 2014 (“UAE-US IGA”). The UAE-US IGA is a Model 1B IGA and accordingly does not provide for reciprocal information sharing by the US.

The UAE-US IGA was ratified pursuant to Federal Law No. 9 of 2016 and establishes the framework for the exchange of information between reporting UAE financial institutions authorized to the IRS. The UAE Ministry of Finance issued guidance on the UAE-US IGA on 6 July 2015.

FATCA in the UAE

Given below are the key highlights which will be focused on in our study:

How the FATCA was applied in the UAE?

According to IRS Announcement, 2014-17 and the US Treasury Department website, the United Arab Emirates ("UAE") was added to Treasury's IGA list as having substantively agreed to a Model 1 IGA as of May 21, 2014. As a result, the UAE was recognized as having a Model 1B IGA in effect, and will continue to be treated as such provided it continues to show "strong resolve" to sign the IGA as soon as practicable, allowing UAE Financial Institutions to register on the FATCA registration website in accordance with that status. The UAE, on the other hand, could be removed from the list of countries that are treated as having an IGA in place, in which case financial institutions will be unable to comply with FATCA under a Model 1 IGA. FFIs in countries where an IGA is considered in effect should have registered by December 31, 2014.

Effects of FATCA

FATCA was applied to banking entities, insurance companies, financial

services companies and asset managers. Financial Institutions are first classified as either "Reporting Financial Institutions" or "Non-Reporting Financial Institutions" under the UAE IGA. Financial Institutions that are Deemed-Compliant or Exempt Beneficial Owners under the FATCA Regulations or Non-Reporting Financial Institutions under the UAE IGA's Annex II are Non-Reporting Financial Institutions. Non-Reporting Financial Institutions are not required to submit information to the UAE; but, in order to avoid FATCA withholding on US source payments to them, they must provide properly completed US tax forms or self-certifications to withholding agents. Article 4 of the UAE IGA required Reporting Financial Institutions to comply with the UAE IGA, which includes reporting to the UAE the information specified in Article 2 of the UAE IGA with respect to US Reportable Accounts, reporting to the UAE information on payments made to Nonparticipating Financial Institutions, and properly registering on the IRS FATCA registration website by December 31, 2014. After December 31, 2014, entities that became Reporting Financial Institutions must likewise comply and register on the IRS FATCA website.

Further, in the case of the unregulated entities that are not egulated by the Central Bank, Insurance Authority, Securities and Commodities Authority, the Dubai Financial Services Authority or Abu Dhabi Global Market Authority should understand their FATCA compliance needs, they should use the Guidance Notes in conjunction with the US-UAE IGA. In general, such entities must first identify whether they are a Financial Institution or a Non-Financial Foreign Entity and then comply with the US-UAE IGA's standards.

Non-Compliance

If an entity or account holder does not comply with the UAE IGA there are separate provisions for minor administrative errors and significant non-compliance. In the case of minor administrative errors the IRS shall notify the UAE Ministry of Finance if it believes that there has been a minor or administrative error that has resulted in erroneous or incomplete information have been reported or other violations of the UAE IGA. On the contrary, in cases of significant non-compliance, the IRS must alert the UAE Ministry of Finance, which will address the non-compliance using UAE local legislation. The UAE Ministry of Finance will also meet with Reporting Financial Institutions to examine areas of non-compliance, strategies to prevent further non-compliance, and a schedule for resolving substantial non-compliance.

Guidance Notes

The purpose of the Guidance Notes is to explain how FATCA and the UAE IGA would affect UAE Financial Institutions, UAE entities that must certify their FATCA status, and businesses that carry out FATCA obligations on behalf of Financial Institutions. Each of the Central Bank, Insurance Authority, and Securities and Commodities Authority has issued its own Guidance Note, which is essentially consistent and focuses on issues related to the firms it regulates as well as other regulator-specific concerns. With regard to this guidance, a Financial Institution shall comply with the regulations in effect at the time. Certain topics may not be addressed in these Guidance Notes if the law and regulations are deemed clear enough.

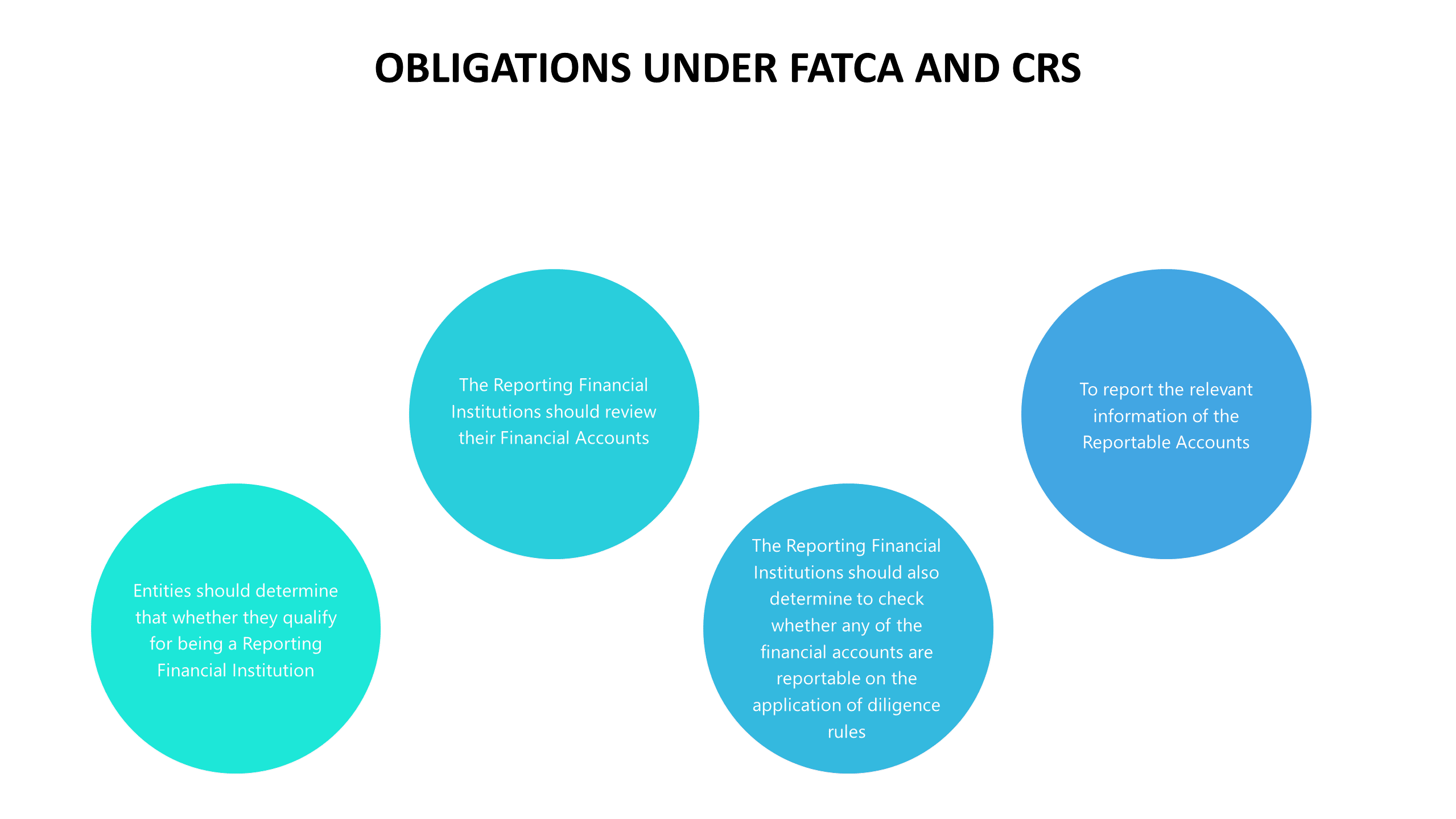

Obligations of Financial Institutions under FATCA and IRS

Financial Institutions must be aware of their FATCA/CRS duties in order to ensure effective compliance with the FATCA/CRS laws. Given below are the obligations of the institutions under FATCA and IRS:

Impact of FATCA in the UAE

FATCA compliance is vital for both UAE financial institutions and US people and companies holding accounts with such institutions, given the huge number of US tax obligors living in or otherwise having financial accounts in the UAE. Customers of FFIs in the UAE should be informed that they will very certainly be questioned if they have any US indicia and will be required to declare the presence of such indicia. When it comes to creating accounts, US citizens should expect more stringent due diligence requirements from FFIs, as well as a more rigorous onboarding procedure. FFIs bear the brunt of the burden of determining if FATCA applies to them and then ensuring that their systems are capable of collecting the required data. FFIs must also be aware of their counterparties' FATCA compliance and ensure that their terms and conditions do not prevent FATCA compliance.

Conclusion

To comply with FATCA, mechanisms for monitoring account balances and changes in account and account holder status must be in place. Finally, FFIs in the UAE must be aware of the applicable time frames in order to avoid falling foul of FATCA rules and facing any type of withholding charge. Get in touch with Dhanguard for more information.

DhanGuard: All-in-One Solution for Business Setup in Dubai, UAE

DhanGuard is your ultimate one-stop solution for all your business needs. Whether you’re planning to set up a new company or expand your existing business in the UAE, we’ve got you covered with our comprehensive range of services. From Business Setup in UAE and Company Formation in Dubai to managing your financial and legal compliance, we provide everything you need under one roof.

Our services include:

- Company Formation in UAE and Dubai

- Opening a Business Bank Account in UAE and Dubai with a 99% success rate

- VAT & Corporate Tax Compliance

- Accounting, Bookkeeping, and Auditing Services

- Trade License Renewal

- Golden Visa Assistance

Let DhanGuard make your journey of Business Setup in Dubai seamless and hassle-free!