When you apply for a Business Loan, your lender will ask for a variety of financial papers, including your bank statements. But, aside from how much you spend each month, what does your bank statement tell your lender? Continue reading to find out what your lender might deduce from the data on your bank statement. So without any further ado, lets learn!

What are Business Loans based on Bank Statements?

Lenders will go over several months of your company's bank paperwork to gain an understanding of your typical daily balance, cash flow, and income using bank statement business loans. This informs lenders about your ability to repay the loan you've requested, as well as alerting them to potential dangers in lending.

Consider creating a business bank account if you need a business loan but don't have one. You'll have a hard time finding a business loan that doesn't demand a bank statement. In some situations, you may be able to apply for an account online. You may start developing the financial history you'll need to apply for a business loan with a company bank account.

DEPOSITS

Money that has been deposited into your account is referred to as a deposit. The majority of your deposits may be made up of direct deposits, checks cashed, and wire transfers. As you earn interest, your bank will deposit funds into your account.

WITHDRAWALS

Any money that has been transferred out of your account is shown by withdrawals. Your bank, for example, registers a withdrawal on your account whenever you make a purchase, use an ATM, or send a transfer.

Why do Bank Statements matter to Lenders?

If you work for a corporation, you'll most likely need to produce current pay stubs and W-2s to your lender. If you're self-employed, you'll need to provide your tax returns, as well as any other documentation requested by the lender.

- Why do lenders need to look at your bank activity if they already have all of that information? In general, your lender will want to make sure you have enough income to meet your monthly payments and enough money in your account to provide a down payment. Your lender will also want to see that you have enough money to cover at least a few months of timely payments.

- Your bank statements will also be scrutinized by your lender to ensure that your assets are "sourced and seasoned." The term "sourced" indicates that the lender is aware of the source of your funds. “Seasoned” indicates that all your funds have been in your account for some time and were not recently deposited there. Both sourcing and seasoning aid in the prevention of fraud and money laundering, as well as assuring your lender that you are not using a loan to make your down payment.

- Finally, your lender will examine your bank statements to see whether you have the funds to fulfil closing costs. Closing expenses typically vary from 2% to 5% of the entire loan amount. Your lending firm will also examine your liquid funds to ensure that you haven't forgotten to set money aside to close your loan.

Is it necessary for me to provide multiple Bank Statements?

At least two bank statements are typically required. Lenders need multiple statements to ensure you haven't taken out a loan or borrowed money from someone in order to qualify for your Business Loan. Because any loans taken out for more than two months would have previously appeared on your credit report, two is usually the ideal number.

Where can you look for your Bank Statements?

Your bank statements are easily accessible on your banking institution's website. Here are a few basic procedures, though the webpage for each financial institution will differ slightly.

Sign into your account.

Log in to your bank or credit union's website and access your account. If you forget your login information, you can contact your bank's customer service department for assistance.

Locate your Financial Statements

On the home screen of your bank, look for a tab titled "Documents" or "Statements." Before you view the documents tab, you may have to navigate via a tab labelled "Account Details."

Obtain a copy of your statements

You should notice a number of links to PDF files labelled "Statement" and the dates from this tab. Find the appropriate statement and save it. Save the files in a location where you'll have easy access to them. If the filename is a jumble of numbers and letters, rename it to something you and your lender will recognize. Follow these steps until you have at least two statements from each of your accounts, which you may then present to your lender.

What do underwriters look for when approving a loan?

To verify your income, lenders utilize a technique known as "underwriting." Before a lender will absorb your loan, underwriters perform research and assess the level of risk you pose. Your lender will notify you whether or not you qualify for a business loan when underwriting is completed. When underwriters examine your bank statements, they seek for a few warning signals.

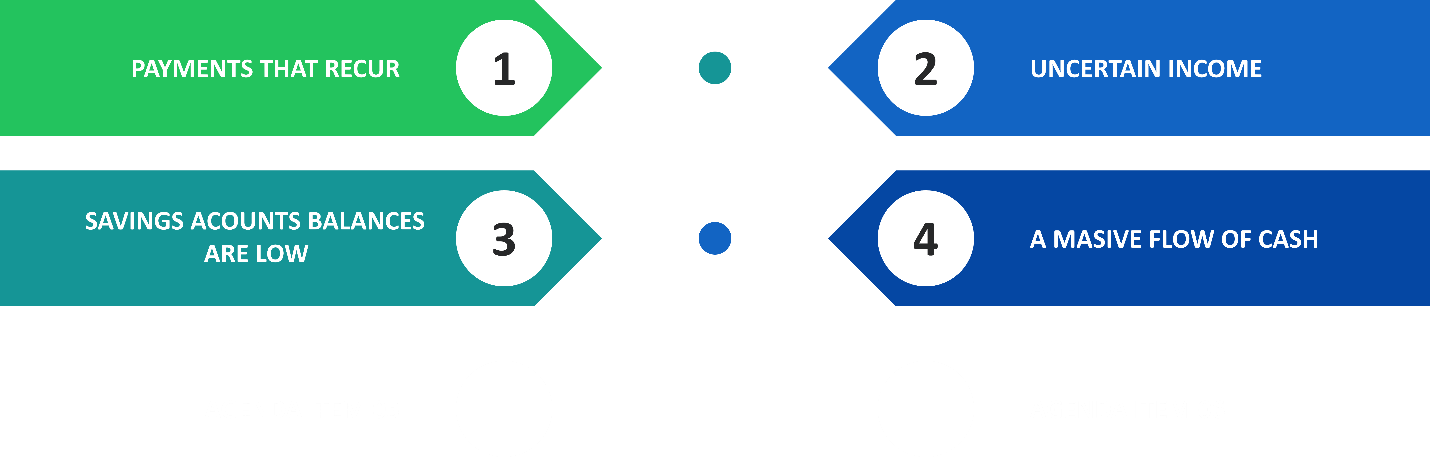

Payments that recur

- Your bank statements will also be reviewed by lenders for any recurrent withdrawals. This determines if your company has already paid off a loan owed to another lender.

- Because there is a higher chance of loss, some lenders will avoid being referred to as a "second position" lender. If a business defaults, the second lender is legally required to wait until the original lender is repaid before receiving reimbursement for their loss.

- If your company is repaying previous debt, it doesn't imply you won't get approved–but your lender will want to know about any outstanding obligations.

Uncertain Income

Lenders require proof that you will be able to make your payments on schedule. Paychecks, royalties, and court-ordered payments like alimony are all examples of regular sources of income that underwriters look for.

Your lender will want to know why your income has changed dramatically in the recent two months. It's a good idea to have a written explanation on hand in case they call you. An offer letter from a new job, for example, that includes your start date qualifies. If you're self-employed, your lender may need more than two months' worth of bank statements to prove your earnings.

Savings Account Balances are Low

Will you be able to make your payments receive an unexpected medical bill? Lenders want to know that you have enough money in your savings account to cover your payment. Each lender has its own requirements for how much money you should have in savings, but most want at least a few months' worth of payments. They also want to see that you can afford to pay the down payment and closing charges on your own.

A Massive Flow Of Cash

For lenders, a significant, abrupt deposit of cash into your account is a major red signal. It could indicate to a lender that you took out a down payment loan that isn't showing up on your credit report. The purpose of a down payment is to demonstrate that you're a responsible borrower who set aside money from your regular paycheck to cover the cost of your transaction. Using a loan to make a down payment negates the objective of the payment and indicates that you're a high-risk borrower.

- There are occasions when a rapid increase in savings is justified. You may have received a monetary present from a family member or started a new job with a sign-on bonus. Before you submit your statements, be sure you have evidence that proves where the money originated from.

- Perhaps your parents handed you a lump sum of money for your down payment as a present. As proof, you may need to obtain a copy of the transfer slip or a bank account statement from your parents, as well as a gift letter confirming that the money does not need to be repaid.

The Bigger Picture of Business Bank Statement Loans

At the end of the day, all the bank statements that lenders examine should show that your company is stable and profitable. While the definition of a "healthy business" differs by lender, if your company makes enough money to run comfortably while paying expenses, staff, and debt, lenders are likely to see you as a good candidate. Although each lender's minimum time in business criteria differ, if your company has consistently turned a profit for one to two years, you've proved consistency.

Conclusion

This is extremely crucial for lenders to observe since they want to ensure that your firm is viable before extending financing to you. Even if you're concerned that your bank statements aren't impressive, don't be scared to discuss them with your lenders. Your firm will have a much higher chance of being selected for funding if you are honest with your lender from the start. Thus, we hope this blog provided you incite full information. For more information on other related aspects, feel free to check out our website as well.

DhanGuard: All-in-One Solution for Business Setup in Dubai, UAE

DhanGuard is your ultimate one-stop solution for all your business needs. Whether you’re planning to set up a new company or expand your existing business in the UAE, we’ve got you covered with our comprehensive range of services. From Business Setup in UAE and Company Formation in Dubai to managing your financial and legal compliance, we provide everything you need under one roof.

Our services include:

- Company Formation in UAE and Dubai

- Opening a Business Bank Account in UAE and Dubai with a 99% success rate

- VAT & Corporate Tax Compliance

- Accounting, Bookkeeping, and Auditing Services

- Trade License Renewal

- Golden Visa Assistance

Let DhanGuard make your journey of Business Setup in Dubai seamless and hassle-free!