- Company Formation

- Banking Services

- Other Services

- Compliance

- Office Solutions

-

About Us

- Company Formation

- Banking Services

- Other Services

- Compliance

- Office Solutions

-

About Us

The Banking, Financial Services & Insurance (BFSI) sector in the UAE operates in an intensely regulated environment. With evolving laws around Anti-Money Laundering (AML), Counter-Terrorism Financing (CTF), customer data protection, Shariah governance (for Islamic finance), and global standards like FATF and Basel, understanding what is compliance in banking is essential. Strong bfsi compliance is not optional, it’s foundational for trust, stability, and operational legitimacy.

When institutions rely on manual systems or fragmented compliance processes, the risk of error, regulatory fines, reputational damage, and operational disruptions increases dramatically. To stay ahead, financial institutions must build robust compliance frameworks that can adapt to changing regulations and ensure transparency across all operations.

Compliance in banking refers to the set of policies, procedures, internal controls, and practices banks and financial institutions put in place to ensure that all their operations adhere to applicable laws, regulations, standards, and ethical norms.

It includes everything from KYC (Know Your Customer), Customer Due Diligence (CDD), AML/CTF obligations, reporting, licensing, governance, risk management, employee training, sanctions screening, to data privacy and consumer protection.

In the UAE context, compliance also covers alignment with guidelines and circulars issued by the Central Bank of UAE (CBUAE), financial crime risk frameworks, and—where applicable—Shariah compliance for Islamic financial institutions.

Here are the main areas institutions must address under bfsi compliance:

Financial Crime Controls: AML, CTF, sanctions compliance, and monitoring/reporting suspicious activity. The UAE Central Bank’s Financial Crime Compliance Programme sets strict requirements.

Governance & Internal Policy: Clear oversight by boards; defined compliance functions; policies and procedures ensuring operational and ethical behaviour.

Shariah Compliance (for Islamic Banking): For institutions offering Islamic financial products, ensuring all activities are compliant with Shariah standards and establishing a Shariah Compliance Function (SCF) as per UAE Central Bank guidelines.

Data Protection & Privacy: Safeguarding customer information and complying with laws around personal data.

Risk Assessment & Monitoring: Proactively identifying compliance risks—legal, financial, operational—and putting in place monitoring, controls, audits.

Employee Training & Awareness: Keeping staff updated about regulations, internal policies, and emerging compliance risks.

Institutions often face:

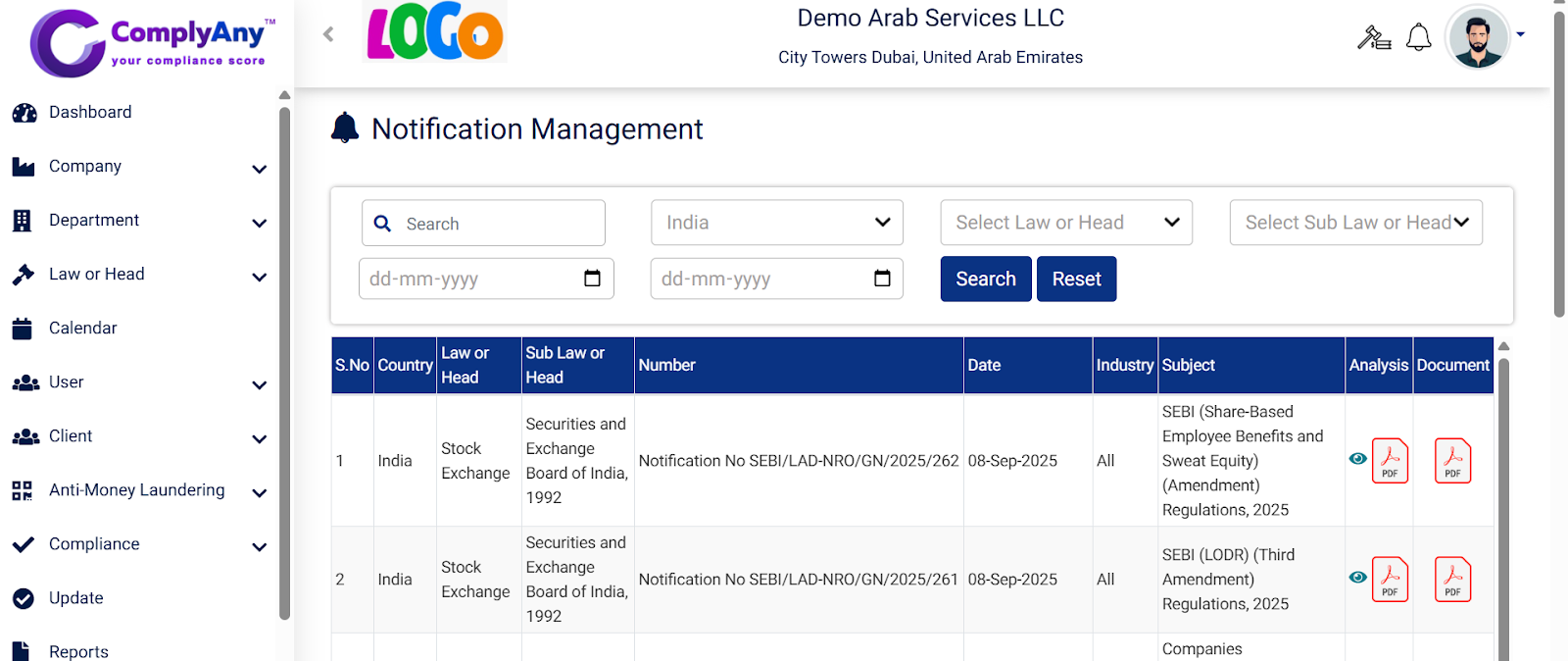

Rapid regulatory changes, especially in AML, sanctions, Shariah standards and global financial crime expectations.

High costs of compliance both in implementing systems (technology, staff) and maintaining them.

Reputation risk: even small non-compliance can lead to public scrutiny and loss of trust.

Complexity of dealing with cross-border transactions, different regulatory regimes, sanctions etc.

Balancing compliance with customer experience (e.g. too much friction in onboarding vs risk management).

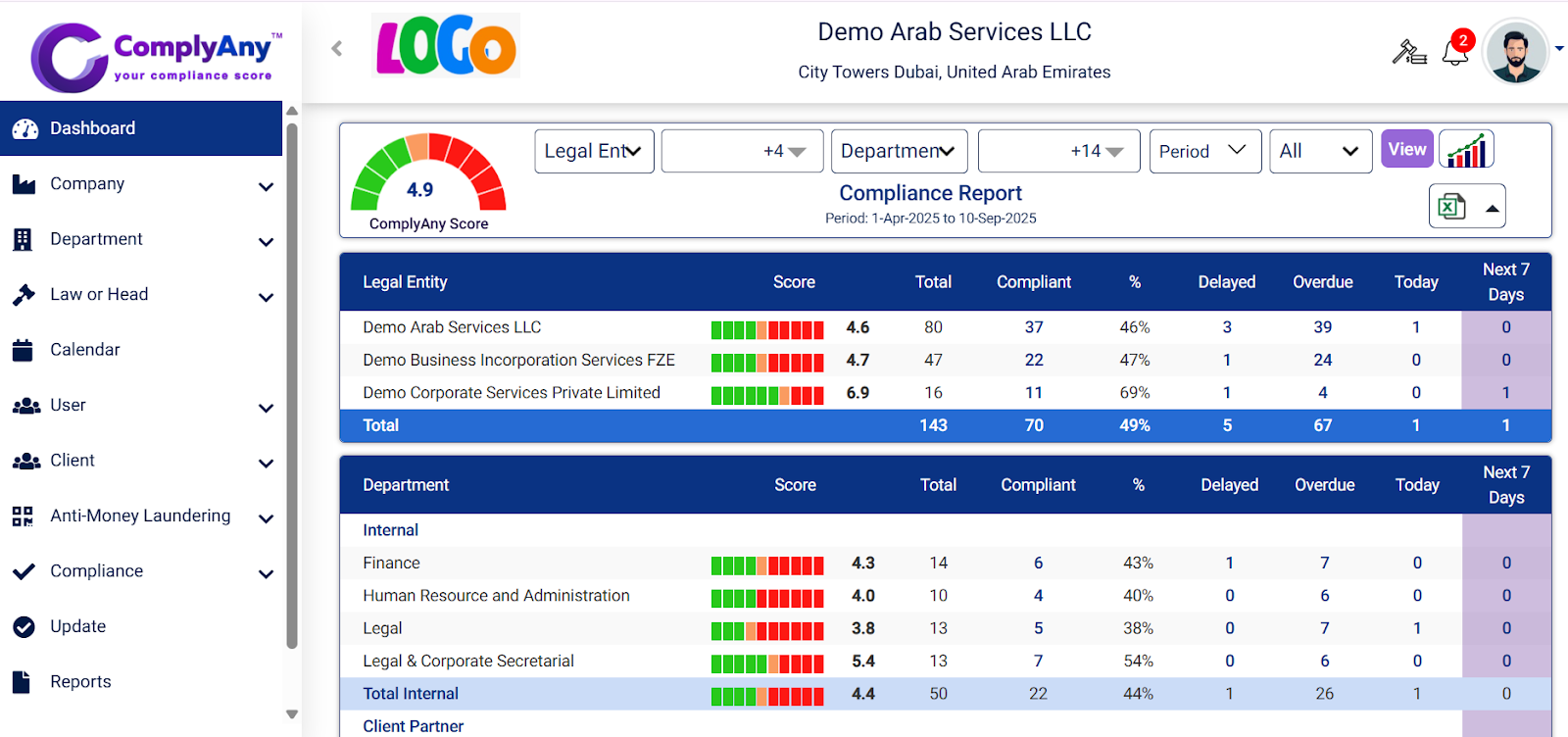

DhanGuard’s compliance platform is tailored for the BFSI sector in the UAE to simplify, automate, and strengthen compliance programs. Key features include:

Centralized compliance dashboard tracking regulatory obligations, licenses, AML/CTF, sanctions.

Real-time monitoring and alerts for changes in regulation, deadlines for filings, suspicious transaction detection.

Workflow automation for compliance tasks and employee training modules.

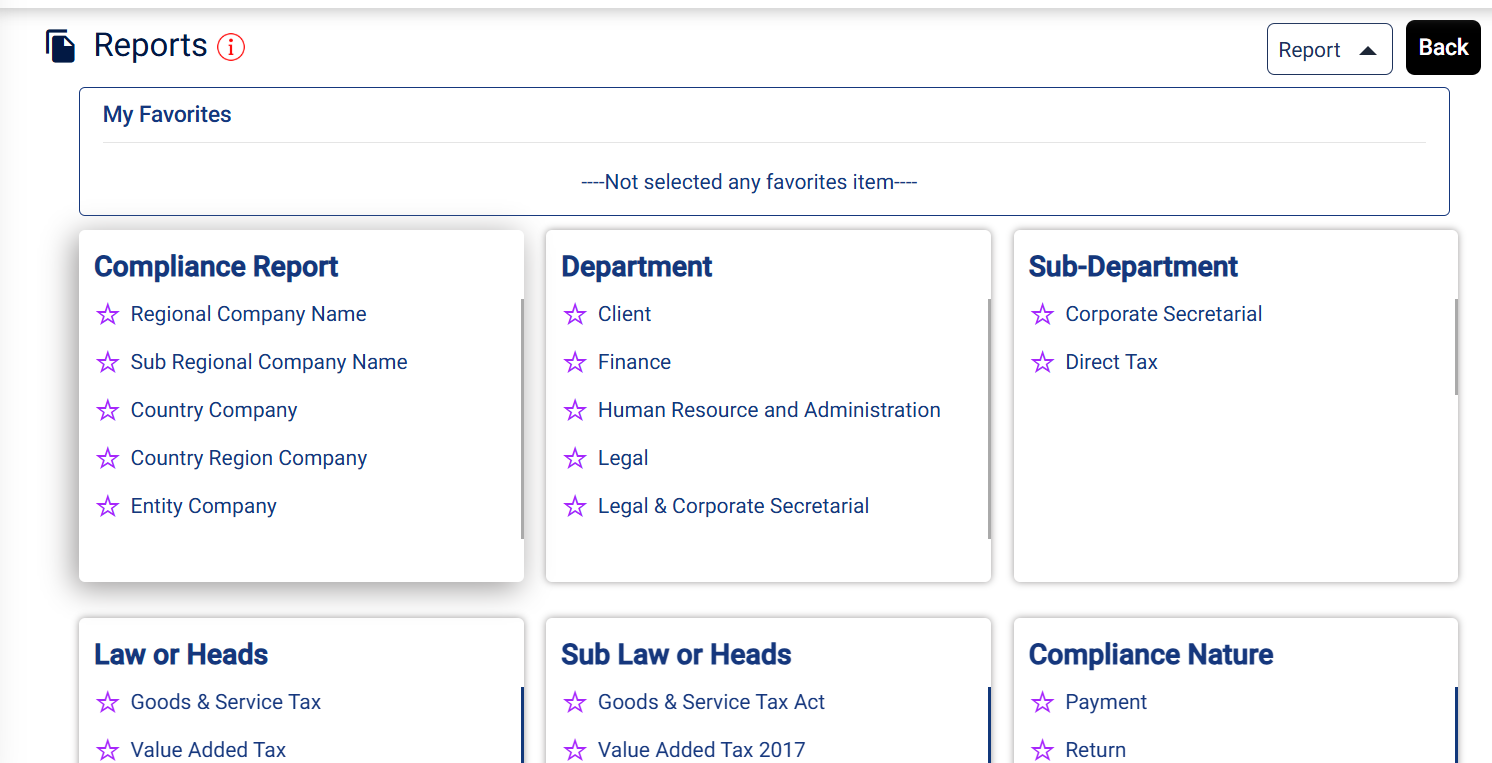

Reporting tools for internal audit, risk functions, board reporting, and external regulators.

Shariah compliance function support for Islamic financial institutions to align governance, audit, and operational practices with SCF standards.

Reduced risk of financial penalties, license revocation, or legal sanctions.

Enhanced trust and credibility with customers, investors, regulators.

More efficient operations: fewer wasted resources on remediation or firefighting.

Volatility mitigation: better prepared for regulatory changes or investigations.

Competitive advantage: institutions seen as compliant, robust, and trustworthy tend to attract more business.

In the fast-evolving financial landscape of the UAE, bfsi compliance is more than a regulatory checkbox—it is an essential foundation for sustainable success. What is compliance in banking today encompasses ethical conduct, regulatory alignment, risk management, and operational excellence. Institutions that embed compliance deeply into their culture, systems, and decision-making not only protect themselves from legal and financial risks but also build lasting trust with stakeholders and the wider market. DhanGuard’s solutions empower BFSI players to navigate this complexity seamlessly turning compliance from a burden into a strategic asset.

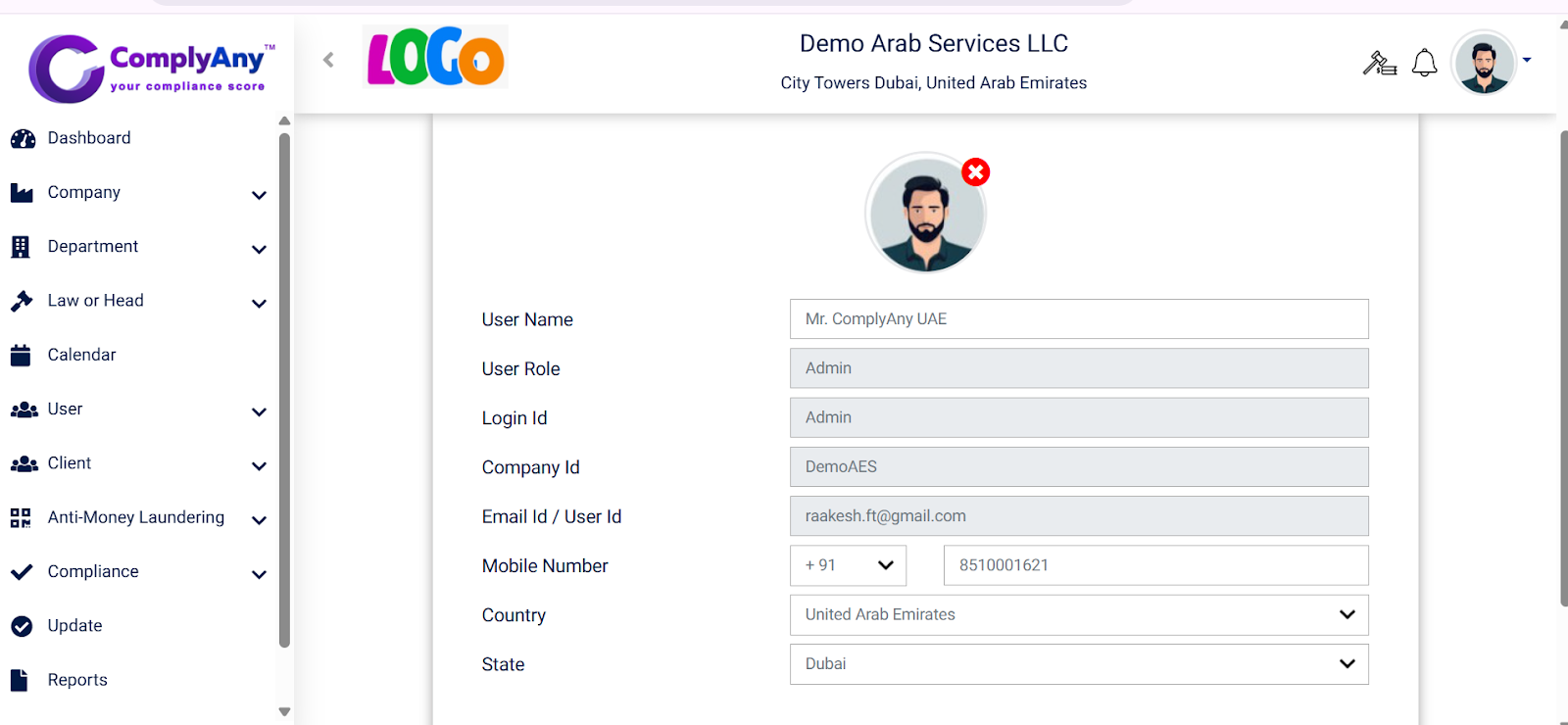

Compliance doesn’t have to feel complicated. With ComplyAny, everything is designed to be clear, visual, and easy to manage. The platform brings together your VAT filings, corporate tax returns, ESR & UBO reports, AML obligations, and more—into a single, intelligent interface.

From the moment you log in, you’ll experience :

A modern, intuitive compliance platform—built for UAE businesses.